Share This Page

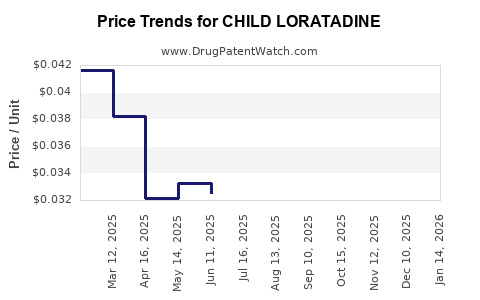

Drug Price Trends for CHILD LORATADINE

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD LORATADINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD LORATADINE 5 MG/5 ML SYR | 51672-2092-08 | 0.04238 | ML | 2025-12-17 |

| CHILD LORATADINE 5 MG/5 ML SOL | 46122-0423-26 | 0.04238 | ML | 2025-12-17 |

| CHILD LORATADINE 5 MG TAB CHEW | 51660-0754-31 | 0.49404 | EACH | 2025-12-17 |

| CHILD LORATADINE 5 MG/5 ML SOL | 00904-6767-20 | 0.04238 | ML | 2025-12-17 |

| CHILD LORATADINE 5 MG/5 ML SOL | 51672-2131-08 | 0.04238 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHILD LORATADINE

Introduction

Child Loratadine, a non-sedating antihistamine used primarily to treat allergies and hay fever in paediatric populations, remains a vital therapeutic option owing to its efficacy, safety profile, and ease of administration. This report offers a comprehensive market analysis and price projection for Child Loratadine, examining current demand, supply dynamics, competitive landscape, regulatory factors, and future pricing trends.

Market Overview

Global Demand and Usage Trends

The pediatric allergy treatment market, including Child Loratadine, is expanding due to increasing prevalence of allergic rhinitis, atopic dermatitis, and other allergic conditions among children. The World Allergy Organization reports a rising trend in allergic diseases, with prevalence estimates affecting up to 40% of children worldwide [1].

Market Segments and Geographic Distribution

North America represents the largest share owing to high awareness, robust healthcare infrastructure, and widespread OTC availability. Europe follows, with significant usage in Germany, UK, and France. Emerging markets in Asia-Pacific, especially China and India, show high growth potential driven by urbanization, increasing disposable income, and awareness campaigns.

Regulatory Status

Regulatory approvals for Child Loratadine are established in most markets, with formulations designed specifically for pediatric use, typically in syrup or dispersible tablet forms to facilitate ease of administration.

Competitive Landscape

Key Players

- Bayer Pharma AG: Market pioneer with Claritin (Loratadine) offering pediatric formulations.

- Mylan (now part of Viatris): Generic Loratadine products with pediatric versions.

- Sandoz and Glenmark: Emerging players offering affordable pediatric antihistamines.

- Local/National Brands: In numerous emerging markets, local manufacturers play a significant role, often at lower price points.

Product Differentiation

Major differentiators include formulation (liquid, dispersible tablets), taste masking, packaging size, and pricing strategies targeting various segments from premium to generic markets.

Regulatory and Patent Dynamics

Most patents for Loratadine have expired or are nearing expiry, facilitating generic manufacturing and intensifying price competition. Regulatory agencies such as the FDA and EMA have approved pediatric formulations, ensuring wider market access, but registration timelines may influence market entry timings.

Market Drivers and Restraints

Drivers

- Rising prevalence of pediatric allergies.

- Increasing awareness about allergy management.

- Adoption of OTC products for minor conditions.

- Expanding healthcare coverage in emerging markets.

Restraints

- Stringent regulatory requirements for pediatric medications.

- Price sensitivity in developing regions.

- Competition from newer antihistamines and combination drugs.

- Patent limitations for some formulations.

Price Dynamics and Projections

Current Price Landscape

In developed markets, a typical pediatric Loratadine syrup (30ml) retails at approximately $8–$12, with generics priced as low as $3–$5 per unit. In emerging markets, prices often range between $1–$3 per unit, reflecting lower manufacturing costs and greater price sensitivity.

Factors Influencing Future Pricing

- Patent expirations: Will foster generic proliferation, driving prices downward.

- Market penetration: Increased access in low-income regions may pressure prices.

- Regulatory reforms: Government price controls could limit upside potential.

- Manufacturing efficiencies: Advances in production could further lower costs.

Projection for 2025-2030

- Developed Markets: Prices for pediatric Loratadine are expected to remain relatively stable, with minor declines projected due to generic competition. Average prices could drop by 10–15% over five years, settling around $6–$10 per 30ml bottle.

- Emerging Markets: Significant downward pressure anticipated; prices may fall by 20–25%, supporting wider accessibility. Expect prices around $0.75–$2 per unit by 2030.

Volume-Driven Growth vs. Price Erosion

While the unit price may decline, overall market volume is projected to increase, particularly in Asia-Pacific, balancing revenue streams for manufacturers.

Market Opportunities and Strategic Implications

- Formulation innovation: Developing palatable, convenience-enhanced pediatric formulations can command premium pricing.

- Brand positioning: Educating caregivers enhances brand loyalty, supporting sustainable pricing.

- Region-specific pricing strategies: Adapt pricing to local income levels, regulatory environments, and competitive landscapes.

- Partnerships: Collaborations with healthcare providers can expand access and influence pricing structures.

Regulatory Outlook and Market Entry Barriers

Anticipated regulatory reforms focusing on pricing transparency and stricter safety standards could influence market dynamics. Entry barriers are lowering as patents expire, but compliance costs and local authorization processes remain significant hurdles in some markets.

Concluding Insights

The global Child Loratadine market is poised for moderate price erosion driven by generic entry, especially in emerging economies. Meanwhile, demand driven by rising allergy prevalence sustains sales volume growth. Manufacturers with innovative formulations, competitive pricing, and strategic regional positioning are likely to capitalize on these trends.

Key Takeaways

- The pediatric allergy market, featuring Child Loratadine, continues to grow globally, driven by rising allergy cases.

- Patent expirations and increased generic competition will likely reduce prices by up to 25% in developing markets by 2030.

- Price stabilization with slight declines is projected in mature markets, maintaining profitability through increased volume.

- Market opportunities exist in formulation innovation, regional pricing strategies, and expanding access in emerging economies.

- Regulatory environments and patent landscapes are pivotal factors influencing future market dynamics and pricing.

FAQs

1. How does patent expiration affect Child Loratadine prices?

Patent expiry enables generic manufacturers to enter the market, increasing competition and significantly reducing prices, especially in mature markets.

2. Which regions are expected to experience the fastest price declines?

Emerging markets such as India, China, and Southeast Asia are likely to see the most significant price reductions due to intense competition and manufacturing cost advantages.

3. What opportunities exist for pharmaceutical companies in this market?

Innovations in child-friendly formulations, branding, and strategic regional pricing can create competitive advantages amid price pressures.

4. How does regulatory approval influence pricing?

Streamlined approval processes facilitate faster market entry and can enhance competition, leading to downward pressure on prices.

5. What is the outlook for the overall market volume of Child Loratadine?

Market volume is expected to grow steadily, propelled by increasing allergy prevalence and expanding access in developing countries, offsetting some price declines.

Sources: [1] World Allergy Organization Journal, 2022. Prevalence of Allergic Diseases in Children.

More… ↓