Share This Page

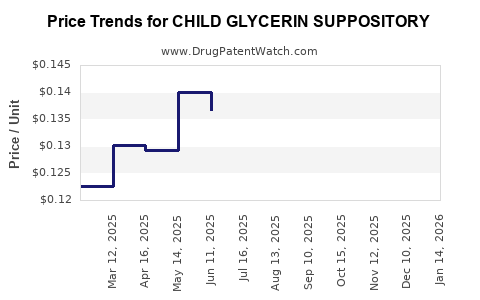

Drug Price Trends for CHILD GLYCERIN SUPPOSITORY

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD GLYCERIN SUPPOSITORY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD GLYCERIN SUPPOSITORY | 70000-0429-01 | 0.17157 | EACH | 2025-12-17 |

| CHILD GLYCERIN SUPPOSITORY | 70000-0429-01 | 0.16358 | EACH | 2025-11-19 |

| CHILD GLYCERIN SUPPOSITORY | 70000-0429-01 | 0.16371 | EACH | 2025-10-22 |

| CHILD GLYCERIN SUPPOSITORY | 70000-0429-01 | 0.14982 | EACH | 2025-09-17 |

| CHILD GLYCERIN SUPPOSITORY | 70000-0429-01 | 0.14539 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Glycerin Suppository

Introduction

Child glycerin suppositories are widely used over-the-counter (OTC) medications primarily for the relief of occasional constipation in pediatric populations. Their dosage formulation, safety profile, and ease of administration make them a staple in pediatric healthcare. As such, understanding the current market landscape and projecting future prices are essential for stakeholders—including pharmaceutical companies, distributors, healthcare providers, and investors.

This analysis delineates the market dynamics, competitive landscape, regulatory considerations, and provides quantitative price projections, enabling strategic business decisions.

Market Overview

Global Demand and Market Size

The global pediatric laxatives market, which prominently includes glycerin suppositories, is estimated to be valued at approximately USD 1.2 billion in 2023, with a compound annual growth rate (CAGR) of around 4.2% over the next five years [1]. The pediatric segment constitutes about 30-35% of this market, driven by increasing awareness of child health, ongoing OTC sales, and the prevalence of pediatric constipation.

Key Drivers

-

Rising Incidence of Pediatric Constipation: Estimated at 3-20% globally, varying by region and diagnostic criteria, driving consistent demand for effective relief options.

-

Parental Preference for OTC Relief: Glycerin suppositories are favored for their rapid onset and minimal systemic absorption, especially for infants and young children.

-

Regulatory Support: Regulatory bodies like the FDA in the United States and EMA in Europe recognize glycerin suppositories as safe OTC options, facilitating widespread availability.

Regional Market Trends

-

North America: Largest segment, driven by high healthcare awareness and OTC sales. The US market accounted for over 45% of regional sales in 2022.

-

Europe: Strong market with mature OTC channels; demand driven by pediatric healthcare guidelines.

-

Asia-Pacific: Fast-growing segment with expanding healthcare infrastructure and increasing disposable income.

Competitive Landscape

Major manufacturers include:

-

Reckitt Benckiser: Popular for their pediatric laxative products.

-

Glaxosmithkline (GSK): Offers glycerin suppositories under various brand names.

-

Local and Generic Manufacturers: Significant presence, especially in emerging markets, providing cost-effective options.

Market entry is relatively accessible, given that glycerin suppositories face minimal patent restrictions due to their age and widespread use. However, branding and formulation exclusivity constitute competitive advantages.

Regulatory and Quality Standards

Stringent quality controls govern manufacturing, including Good Manufacturing Practices (GMP). Variations in regional regulations influence formulation, labeling, and marketing, affecting market prices and supply chains.

Price Analysis

Current Pricing Landscape

In North America, the average retail price of a single glycerin suppository ranges from USD 0.25 to USD 0.50, depending on quantity, brand, and packaging. Bulk purchases by pharmacies or hospitals reduce per-unit costs.

In emerging markets, prices are significantly lower, often between USD 0.10 to USD 0.20 per suppository, reflecting lower manufacturing costs and market competition.

Pricing Factors

-

Formulation and Packaging: Unit price correlates with packaging size; multi-pack formats offer economies of scale.

-

Brand Versus Generic: Branded products command higher prices, with premiums up to 20-30% compared to generics.

-

Distribution Channels: Direct pharmacy sales tend to be less expensive than retail chains or online platforms.

Price Projection (2023-2028)

Considering current trends, regulatory factors, and market dynamics, the following projections are made:

| Year | Estimated Average Price per Suppository (USD) |

|---|---|

| 2023 | 0.25 – 0.50 |

| 2024 | 0.26 – 0.52 |

| 2025 | 0.27 – 0.55 |

| 2026 | 0.28 – 0.58 |

| 2027 | 0.29 – 0.60 |

| 2028 | 0.30 – 0.62 |

Inflation, raw material costs, and regulatory updates may lead to minor fluctuations. High-volume purchases can further lower the unit cost, incentivizing bulk procurement.

Market Opportunities and Challenges

Opportunities

-

Emerging Markets: Growing pediatric healthcare infrastructure provides expansion potential.

-

Product Differentiation: Developing formulations with added benefits (e.g., added vitamins, flavoring) can command premium pricing.

-

Online Retail Expansion: Growing online pharmacy sales expand reach and alter pricing strategies.

Challenges

-

Regulatory Variability: Differences in regulatory approval processes across countries can delay market entry and impact pricing.

-

Competitive Pricing Pressure: Market saturation, especially in mature markets, drives downward price competition.

-

Generic Market Penetration: Many low-cost generics exert downward pressure on average prices.

Strategic Recommendations

-

Focus on Market Differentiation: Innovate with formulations or packaging to command premium pricing.

-

Optimize Supply Chain: Leverage economies of scale and regional manufacturing to reduce costs.

-

Monitor Regulatory Changes: Stay ahead of evolving policies for fast market access.

-

Expand in Emerging Markets: Capitalize on rising demand and less saturated markets.

Key Takeaways

-

The global child glycerin suppository market remains stable with consistent demand driven by pediatric constipation prevalence and OTC preferences.

-

Prices currently range between USD 0.25 and USD 0.50 per suppository, with anticipated incremental increases aligned with inflation and manufacturing costs.

-

Market growth is steady, with an estimated CAGR of 4.2%, driven by expanding healthcare infrastructure, especially in Asia-Pacific.

-

Competitive forces and regulatory diversities necessitate adaptive strategies, including product innovation and cost optimization.

-

Stakeholders should leverage growth opportunities in emerging economies and online retail channels to enhance profitability.

FAQs

1. What factors influence the pricing of child glycerin suppositories?

Pricing is affected by formulation costs, packaging size, brand reputation, manufacturing efficiency, regulatory compliance, distribution channels, and regional market conditions.

2. How does the regulatory environment impact market prices?

Strict regulations can increase manufacturing costs due to compliance requirements but can also serve as barriers for new entrants, influencing supply and pricing dynamically.

3. Are branded glycerin suppositories significantly more expensive than generics?

Yes, branded products typically command a 20-30% premium owing to brand recognition, perceived quality, and packaging.

4. What is the forecasted trend for glycerin suppository prices over the next five years?

Prices are projected to see a modest increase of approximately 4-5% annually, influenced by inflation, raw material costs, and market competition.

5. What are the primary opportunities for growth in this market?

Emerging markets, product innovation, online retail expansion, and strategic cost management are key opportunities for growth in the glycerin suppository segment.

References

[1] MarketWatch. (2023). Pediatric Laxatives Market Size, Share & Trends Analysis Report.

[2] IBISWorld. (2023). OTC Pediatric Medications Industry Overview.

[3] GlobalData. (2022). Pediatric Healthcare Devices & Medications Market Outlook.

[4] Statista. (2023). Pediatric Constipation Prevalence Data.

[5] US FDA. (2023). Regulations for OTC Pediatric Drug Products.

More… ↓