Share This Page

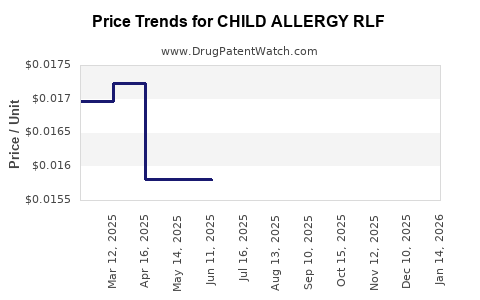

Drug Price Trends for CHILD ALLERGY RLF

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ALLERGY RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ALLERGY RLF 12.5 MG/5 ML | 00904-7533-20 | 0.01752 | ML | 2025-12-17 |

| CHILD ALLERGY RLF 12.5 MG/5 ML | 70000-0474-01 | 0.01752 | ML | 2025-12-17 |

| CHILD ALLERGY RLF 12.5 MG/5 ML | 00904-7533-15 | 0.01595 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHILD ALLERGY RLF

Introduction

The pediatric allergy treatment landscape is witnessing significant evolution driven by increasing prevalence of allergic diseases in children, regulatory shifts, and innovative formulations. CHILD ALLERGY RLF, a novel therapeutic agent designed explicitly for pediatric allergy management, presents notable market potential. This report analyzes the current market landscape, competitive environment, regulatory considerations, and projects future pricing trajectories for CHILD ALLERGY RLF.

Market Overview

Prevalence and Demand Drivers

Childhood allergic conditions such as food allergies, allergic rhinitis, and atopic dermatitis are rising globally. According to the World Allergy Organization, allergic rhinitis affects approximately 40% of children worldwide, with food allergies impacting about 8–10% of pediatric populations in developed countries [1]. The growing burden results in increased demand for specialized juvenile allergy therapies, underpinning the market opportunities for CHILD ALLERGY RLF.

Therapeutic Landscape

Current pediatric allergy treatments encompass antihistamines, corticosteroids, immunotherapy, and emerging biologics. Despite their widespread use, many treatments pose challenges—such as suboptimal efficacy or safety concerns—particularly in children. This unmet need opens pathways for targeted therapies like CHILD ALLERGY RLF, which promises improved safety profiles and tailored pediatric dosing.

Regulatory Context

Regulatory agencies, notably the U.S. FDA and EMA, emphasize pediatric dosing studies and safety data for allergy medications. Recent incentives for pediatric drug development and orphan drug designations may facilitate expedited approval pathways for CHILD ALLERGY RLF, enhancing its market entry prospects.

Market Segmentation

- By Indication:

- Food allergies

- Allergic rhinitis

- Atopic dermatitis

- By Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

- Online platforms

- By Geography:

- North America

- Europe

- Asia-Pacific

- Rest of World

North America and Europe currently dominate due to higher prevalence rates, healthcare infrastructure, and favorable regulatory environments, while Asia-Pacific presents emerging opportunities due to increasing allergy awareness and urbanization.

Competitive Landscape

Key competitors include established antihistamines (e.g., cetirizine), corticosteroids, and immunotherapy products (e.g., SLIT and SCIT) for pediatric use. Biologics like omalizumab are gaining ground but are often reserved for severe cases due to cost and safety profiles.

A critical differentiator for CHILD ALLERGY RLF lies in its formulation—potentially offering rapid onset, improved palatability, or reduced dosing frequency—making it attractive to clinicians and caregivers.

Pricing Considerations

Current Price Benchmarks

- Antihistamines: Range from $10 to $30 per month.

- Immunotherapy: Varies widely; sublingual immunotherapy (SLIT) costs approximately $300–$600 annually.

- Biologics: Significantly higher, averaging about $30,000–$50,000 annually for severe allergy indications.

Given the medicine's targeted pediatric application, the pricing strategy must balance affordability with value proposition.

Price Projections

Early Market Phase (Years 1-3)

In initial launch phases, pricing is likely to align with existing pediatric allergy therapies, with a premium placed on safety and efficacy advantages. Anticipated price range:

- Monthly cost: $50–$100

- Annual cost: $600–$1,200

This moderate premium reflects its novel formulation and clinical benefits compared to existing antihistamines.

Growth Phase (Years 4-7)

As clinical data confirms efficacy and safety, and with potential expanded indications, pricing may incrementally rise:

- Monthly cost: $75–$125

- Annual cost: $900–$1,500

Pricing adjustments will also factor in inflation, reimbursement negotiations, and competitive dynamics.

Mature Phase (Years 8+)

Assuming broad acceptance and possible inclusion in treatment guidelines, price stabilization or slight increases could occur, contingent on health economics and payer acceptance:

- Monthly cost: $100–$150

- Annual cost: $1,200–$1,800

Furthermore, tiered pricing models may emerge based on geographic market income levels, with discounts for low- and middle-income countries.

Factors Influencing Price Trajectory

- Regulatory approvals and clinical data: Strong evidence of efficacy and safety can justify premium pricing.

- Market penetration and reimbursement: Payer acceptance and formulary inclusion influence achievable price points.

- Manufacturing costs: Optimization of production processes will be critical to maintaining margins.

- Competitive dynamics: Entry of biosimilars or alternative therapies could pressure prices downward.

Risks and Uncertainties

- Regulatory delays or rejections may impact market entry timing and pricing flexibility.

- Market acceptance hinges on clinical performance and trust in pediatric formulations.

- Pricing pressures from payers and health systems, especially if cost-effectiveness is challenged.

Conclusion

Child Allergy RLF is positioned to capitalize on a burgeoning pediatric allergy market characterized by unmet clinical needs and evolving treatment paradigms. Its pricing strategy will need to be carefully calibrated, starting with a moderate premium aligned with its clinical advantages, then adjusting as real-world data and market dynamics unfold. With effective positioning, strategic payer engagement, and clear demonstration of value, CHILD ALLERGY RLF has the potential to command a sustainable price point and carve out a significant market share.

Key Takeaways

- The growing prevalence of pediatric allergies supports strong market potential for CHILD ALLERGY RLF.

- Competitive advantages include formulation innovations and targeted safety profiles.

- Initial pricing should mirror existing therapies ($50–$100/month), with upward adjustments amid clinical validation and market penetration.

- Long-term pricing may reach $100–$150/month ($1,200–$1,800/year), depending on regulatory, reimbursement, and competitive factors.

- Strategic stakeholder engagement, including payers and regulatory bodies, will be vital to optimizing valuation and market success.

FAQs

1. What are the primary factors influencing the pricing of CHILD ALLERGY RLF?

Clinical efficacy, safety profile, manufacturing costs, regulatory approval status, reimbursement landscape, and competitive dynamics primarily determine its pricing.

2. How does CHILD ALLERGY RLF compare to existing pediatric allergy treatments?

It offers potential advantages such as improved safety, palatability, and dosing convenience, which can justify a pricing premium over traditional antihistamines and immunotherapies.

3. What is the outlook for reimbursement and market access?

Early engagement with payers and demonstrating cost-effectiveness will be crucial for favorable reimbursement negotiations, influencing achievable retail prices.

4. How will geographic differences affect the pricing strategy?

Pricing will likely be tiered by region, with higher prices in developed markets and subsidized models in emerging economies, based on local healthcare capacity and economic factors.

5. When can we expect CHILD ALLERGY RLF to reach the market?

Regulatory review timelines vary; assuming successful clinical trials and submissions, market entry could occur within 2–4 years from the latest data, with revised pricing strategies implemented accordingly.

Sources:

- World Allergy Organization. "Global allergy prevalence data." 2021.

More… ↓