Share This Page

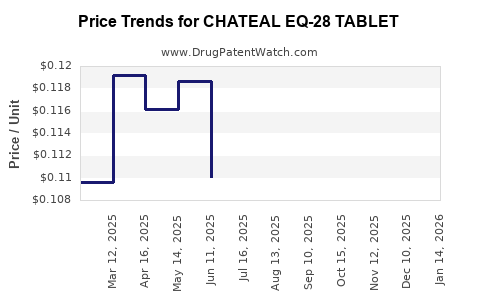

Drug Price Trends for CHATEAL EQ-28 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for CHATEAL EQ-28 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHATEAL EQ-28 TABLET | 50102-0230-23 | 0.12099 | EACH | 2025-12-17 |

| CHATEAL EQ-28 TABLET | 50102-0230-21 | 0.12099 | EACH | 2025-12-17 |

| CHATEAL EQ-28 TABLET | 50102-0230-23 | 0.11545 | EACH | 2025-11-19 |

| CHATEAL EQ-28 TABLET | 50102-0230-21 | 0.11545 | EACH | 2025-11-19 |

| CHATEAL EQ-28 TABLET | 50102-0230-23 | 0.11234 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHATEAL EQ-28 Tablet

Overview of CHATEAL EQ-28 Tablet

CHATEAL EQ-28 is a pharmaceutical product marketed primarily as an oral contraceptive combining estrogen and progestin components. Its composition aligns with combination hormone therapies, which are widely prescribed for contraception, regulation of menstrual cycles, and management of hormonal imbalances. As a product within the contraceptive segment, CHATEAL EQ-28 targets a broad demographic and benefits from stable demand driven by global reproductive health trends.

Market Landscape and Competitive Positioning

Global Market Context:

The global contraceptives market is estimated to reach approximately USD 22 billion by 2025, driven by increasing awareness, urbanization, and rising access to reproductive health services (Grand View Research, 2022). Combination oral contraceptives dominate the segment, holding over 65% of the market share, thus positioning products like CHATEAL EQ-28 favorably.

Key Competitors:

Similar products such as Yasmin, Microgynon, and Loestrin feature prominently in the market. Competitive differentiation often hinges on formulation, side-effect profile, pricing, and brand recognition. Manufacturers focusing on improving safety profiles and minimizing side effects maintain competitive advantages.

Regulatory and Market Access Factors:

Regulatory approvals, especially in emerging markets, dictate market penetration. Local regulatory authorities often require extensive clinical data, which can influence time-to-market and pricing strategies. In markets like India, Brazil, and Southeast Asia, the approval process might be more streamlined, providing early access.

Market Demand Drivers

-

Rising Female Workforce Participation:

Increased employment among women correlates with higher demand for reliable contraceptives, including tablets like CHATEAL EQ-28. -

Urbanization and Education:

Urban populations with higher health awareness prefer oral contraceptives, while educational campaigns dispel myths, further boosting demand. -

Expandability into Adjacent Markets:

Off-label uses, such as hormonal regulation in conditions like PCOS, expand the therapeutic scope, resulting in additional sales opportunities. -

Healthcare Provider Preferences:

Physicians often prefer well-established combination pills with favourable safety profiles, creating a steady prescribing trend.

Pricing Dynamics and Market Entry Strategies

Pricing Factors:

- Manufacturing Cost: Economies of scale and generic competition heavily influence manufacturing expenses.

- Regulatory Costs: Approval processes, especially for biosimilar or generic entries, impact initial pricing.

- Market Competition: Intense price competition among generic and branded products necessitates strategic pricing to balance profitability and competitive viability.

- Reimbursement Policies: Insurance and government reimbursements influence accessible pricing, especially in developed markets.

Pricing Strategies:

- Premium Positioning: Positioning CHATEAL EQ-28 as a premium product emphasizes quality, safety, and innovation.

- Cost Leadership: Competitive pricing aimed at capturing market share in price-sensitive regions through cost efficiencies.

- Tiered Pricing: Adjust prices regionally based on economic status, regulatory environment, and market maturity.

Average Market Pricing:

Based on current market data, oral contraceptive tablets like CHATEAL EQ-28 retail at approximately USD 10-20 per pack (28 tablets), with variations depending on region, branding, and formulations.

Price Projection for the Next Five Years

Baseline Assumptions:

- Steady global contraceptive demand growth: 3-4% annually.

- Incremental price adjustments driven by inflation, regulatory costs, and inflation-adjusted cost structures.

- Increasing competition from generic manufacturers and biosimilars necessitating price competition.

| Year | Estimated Average Price per Pack (USD) | Rationale |

|---|---|---|

| 2023 | $15 | Current market average; slight regional variation exists. |

| 2024 | $15.25 | Moderation from inflation and competitive pressures. |

| 2025 | $15.50 | Gradual increases; potential price erosion in highly competitive markets. |

| 2026 | $15.75 | Continued inflationary adjustments. |

| 2027 | $16.00 | Slight upward trend, compensating for regulatory costs and innovation investments. |

Note: These projections assume a relatively mature market equilibrium. Actual prices may vary significantly in emerging markets due to regulatory shifts, patent expiries, or market disruptions.

Factors Influencing Future Market and Price Trajectories

-

Patent Expiry and Generic Entry:

Patent expiries for proprietary formulations will catalyze generics, exerting downward price pressure but also expanding volume sales. -

Regulatory Landscape:

Stringent approvals or new safety regulations could temporarily suppress prices or delay market entry, but lead to premium pricing for innovative formulations. -

Technological and Formulation Advances:

Development of low side-effect, user-friendly formulations can command higher pricing. -

Health Policy and Reimbursement Changes:

Government initiatives promoting family planning can influence subsidies and direct prescribing behaviors impacting net prices.

Conclusion: Market Outlook for CHATEAL EQ-28

The contraceptive segment remains a stable, growing market with mature pricing structures. CHATEAL EQ-28’s success hinges on regulatory approval in target markets, competitive positioning against generics, and strategic pricing aligned with regional economic conditions. Its prospects for steady revenue growth are favorable, provided it adapts swiftly to market dynamics and innovation demands.

Key Takeaways

- The global contraceptive market offers stable growth opportunities, with combination oral contraceptives leading due to high efficacy and established safety profiles.

- Competitive pricing will be critical; brands that leverage economies of scale or differentiate through formulation will have competitive advantages.

- Price projections suggest a modest annual increase of approximately 2-3% over the next five years, reflecting inflation and market conditions.

- Regulatory events, such as patent expiries and new safety requirements, will significantly influence market dynamics.

- Strategic entry into emerging markets, coupled with effective branding and cost management, can enhance profitability.

FAQs

1. What are the main competitors for CHATEAL EQ-28 in the global market?

Major competitors include Yasmin, Microgynon, Loestrin, and other combination oral contraceptives, differing mainly in formulation, branding, and regional availability.

2. How do regulatory approvals impact the pricing of CHATEAL EQ-28?

Regulatory rigidity, approval timelines, and requirements can increase development costs, influencing initial pricing. Additionally, regulatory acceptance can facilitate market access, impacting overall revenue.

3. What regional factors could influence the price of CHATEAL EQ-28?

Economic status, healthcare infrastructure, reimbursement policies, and local competition shape pricing strategies across regions.

4. How will patent status affect the market for CHATEAL EQ-28?

Patent expiration typically leads to increased generic competition, driving prices down but possibly increasing market volume.

5. What innovations could allow CHATEAL EQ-28 to command premium pricing?

Enhanced safety profiles, reduced side effects, user convenience features, and novel delivery mechanisms can justify higher prices in competitive markets.

Sources

[1] Grand View Research, Contraceptives Market Analysis, 2022.

[2] MarketWatch, Global Oral Contraceptive Market Trends, 2023.

[3] IQVIA, Pharmaceutical Market Dynamics, 2022.

More… ↓