Last updated: July 28, 2025

Introduction

CEQUA (cyclosporine ophthalmic emulsion 0.09%) stands as a pivotal treatment in the management of dry eye disease (DED), a chronic condition affecting millions globally. Approved by the U.S. Food and Drug Administration (FDA) in 2018, CEQUA is marketed by Novartis and offers a novel formulation aimed at improving patient adherence and therapeutic efficacy. Its market dynamics, competitive landscape, and potential pricing strategies are integral to stakeholders' decision-making processes. This analysis synthesizes current market data, projections, and strategic considerations to elucidate CEQUA's future trajectory.

Market Landscape

Prevalence of Dry Eye Disease

Dry eye disease affects roughly 16 million Americans and up to 30% of individuals over age 50 worldwide, with increasing prevalence driven by aging populations, digital device usage, and environmental factors (1). The symptomatic burden and impact on quality of life propel continued demand for effective therapies.

Existing Therapeutic Options

Prior to CEQUA, the market primarily comprised over-the-counter artificial tears and off-label uses of immunomodulators like cyclosporine (Restasis). Restasis, FDA-approved in 2002, dominated the niche for cyclosporine-based DED treatment but faced competition from newer agents and generics, affecting market share and pricing.

Introduction of CEQUA

CEQUA was developed to address limitations associated with Restasis, including formulation stability and preservative content. Its approval marked a significant shift, offering an alternative with potentially improved tolerability and efficacy. Novartis’s strategic positioning emphasizes differentiation through enhanced patient experience and marketing.

Market Penetration and Growth Drivers

Current Market Penetration

Despite its relatively recent entry, CEQUA has gained traction through targeted marketing and physician adoption, especially among patients intolerant to preservatives. The drug's precise targeting in the ophthalmic niche and patent protections serve as leverage points.

Growth Drivers

-

Rising Prevalence of DED: As global aging populations expand, the demand for effective DED treatments grows, creating fertile ground for CEQUA expansion.

-

Intolerance to Existing Therapies: Patients inadequately managed with artificial tears or experiencing side effects from formulations like Restasis may switch to CEQUA.

-

Physician Preference: Ophthalmologists favor innovations that improve compliance and comfort, positioning CEQUA favorably.

-

Market Expansion: Increasing penetration in international markets with high unmet needs will fuel growth.

Competitive Landscape

Key Competitors

-

Restasis (cyclosporine ophthalmic emulsion 0.05%)

Competitor with significant market share, though facing patent expirations and generic competition in some regions.

-

Xiidra (lifitegrast ophthalmic solution 5%)

Approved in 2016, offering a different mechanism of action, capturing a substantial portion of the dry eye market.

-

Other Emerging Therapies:

Continuation of innovation in anti-inflammatory agents and biologics targeting dry eye.

Market Differentiation

CEQUA's higher cyclosporine concentration (0.09%) allows for potentially quicker onset of action, a key differentiator. Formulation advantages, such as preservative-free design, enhance compliance and tolerability.

Price Analysis and Projections

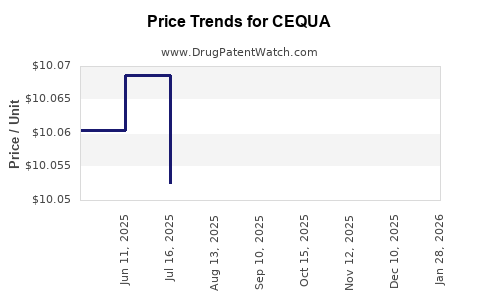

Current Pricing Snapshot

As of 2023, CEQUA’s wholesale acquisition cost (WAC) per bottle hovers around $1,100–$1,200, consistent with premium-positioned ophthalmic drugs. Pricing strategies reflect formulation benefits and market positioning, with payor mix and discounting impacting net prices.

Price Drivers

-

Market Positioning: Premium pricing enabled by clinical advantages and patent exclusivity.

-

Reimbursement Landscape: Insurance coverage, including Medicare and commercial payors, influences patient out-of-pocket costs, potentially limiting uptake among cost-sensitive populations.

-

Competitive Pressures: Entry of generics or biosimilars could exert downward pricing pressure.

Projected Price Trends (2023–2033)

-

Short-Term (1–3 years): Stable prices with modest increases (~2-3%) driven by inflation and rebate management.

-

Mid to Long-Term (4–10 years): Possible price erosion due to patent expiry, increased generic competition, and biosimilar development, potentially reducing prices by 30-50% over the decade.

-

Strategic Pricing: Novartis may employ value-based pricing, especially if real-world evidence demonstrates superior efficacy or safety, to sustain premium pricing longer.

Market Size and Revenue Outlook

Revenue Projections

- 2023: Estimated global sales of approximately $200 million.

- 2025: Projected to reach $300–$400 million with increased penetration and expanded indications.

- 2030: Potential surpassing $600 million, contingent upon market acceptance, new formulations, and expanded indications.

Geographical Expansion

- United States: Largest market, given high prevalence and established reimbursement pathways.

- Europe & Asia: Growing markets with increasing ophthalmic care infrastructure and unmet needs.

Impact of Regulatory and Patent Developments

- Patent protections, expected to last until 2027–2029, shield pricing strategies temporarily.

- Post-patent expiry, generics are anticipated to significantly alter market dynamics and pricing.

Strategic Considerations for Stakeholders

- Pharmaceutical Innovators: Focus on early market entry, leveraging differentiation and evidence generation.

- Payers: Negotiating value-based agreements to manage costs.

- Physicians: Emphasizing clinical benefits to justify premium pricing.

- Investors: Monitoring patent status and competitive threats to forecast revenue sustainability.

Key Takeaways

- The CEQUA market exhibits strong growth prospects driven by rising DED prevalence and physician preference for effective, tolerable treatments.

- Current pricing strategies fully capitalize on its differentiated formulation, but patent expiration and generic entry threaten to erode prices over time.

- Strategic expansion into international markets and evidence-based differentiation are crucial to maintaining premium pricing.

- Stakeholders must consider reimbursement landscapes, competitive pressures, and technological innovations in shaping future market positionings.

FAQs

1. What factors support CEQUA’s premium pricing compared to competitors?

CEQUA offers a higher cyclosporine concentration (0.09% vs. 0.05%), preservative-free formulation, and potential for faster onset, which improve tolerability and efficacy, justifying its premium price.

2. How will patent expiry impact CEQUA’s market share and price?

Post-patent expiration, generic versions are expected to enter the market, leading to reduced prices—potentially by 30–50%—and increased competition, which could diminish market share if not offset by differentiation and expanded indications.

3. What growth opportunities exist for CEQUA outside the U.S.?

International markets with high DED prevalence, improving ophthalmic care infrastructure, and unmet medical needs present significant expansion opportunities, especially if regulatory pathways are navigated efficiently.

4. How do payor dynamics influence CEQUA’s pricing strategy?

Insurance coverage, formulary inclusion, and negotiation power significantly impact net prices. Cost-effectiveness evidence can support premium pricing and favorable formulary placement.

5. What emerging therapies could challenge CEQUA’s market dominance?

New therapeutics with different mechanisms of action, biologics, or biosimilars, particularly those offering improved efficacy, safety, or convenience, could threaten CEQUA’s position and influence future pricing.

References

[1] Schaumberg DA, et al. Prevalence of Dry Eye Disease Among US Men and Women. Am J Ophthalmol, 2009.