Share This Page

Drug Price Trends for CELEBREX

✉ Email this page to a colleague

Average Pharmacy Cost for CELEBREX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CELEBREX 100 MG CAPSULE | 58151-0083-88 | 9.54970 | EACH | 2025-11-19 |

| CELEBREX 100 MG CAPSULE | 58151-0083-01 | 9.54970 | EACH | 2025-11-19 |

| CELEBREX 100 MG CAPSULE | 58151-0083-32 | 9.54970 | EACH | 2025-11-19 |

| CELEBREX 100 MG CAPSULE | 00025-1520-31 | 9.54970 | EACH | 2025-11-19 |

| CELEBREX 100 MG CAPSULE | 58151-0083-05 | 9.54970 | EACH | 2025-11-19 |

| CELEBREX 100 MG CAPSULE | 00025-1520-51 | 9.54970 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Celebrex (Celecoxib)

Introduction

Celebrex (celecoxib) remains a prominent nonsteroidal anti-inflammatory drug (NSAID), primarily prescribed for osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and acute pain management. Since its approval by the FDA in 1998, Celebrex has carved a significant market niche, owing to its selective COX-2 inhibition profile, which reduces gastrointestinal side effects associated with traditional NSAIDs. This analysis examines current market dynamics, competitive forces, regulatory considerations, and offers price projection insights through 2030.

Market Landscape Overview

Global Market Size

The global NSAID market, valued at approximately $16 billion in 2022, is projected to grow at a CAGR of 4.2% through 2030, driven by aging populations and rising prevalence of chronic inflammatory conditions [1]. Celebrex, holding an estimated 15-20% share of the NSAID segment, remains a leading COX-2 inhibitor, with sales surpassing $1.7 billion in 2022 (excluding generics).

Key Market Drivers

- Aging Population and Chronic Disease Prevalence: Increased incidence of osteoarthritis and rheumatoid arthritis among Baby Boomers and Millennials ensures persistent demand [2].

- Advantages over Non-Selective NSAIDs: Celebrex’s safety profile in gastrointestinal tolerability supports sustained use, especially among long-term users.

- Expanded Indications & Off-Label Uses: Growing interest in using Celebrex for Familial Adenomatous Polyposis (FAP) and certain cancers bolsters revenue streams.

Competitive Dynamics

While patent exclusivity expired in 2014, Pfizer’s continued marketing efforts, regulatory positioning, and slight formulation advantages sustain its market share. Generic celecoxib formulations have led to price erosion, impacting branded revenues. Key competitors include:

- Generic Celecoxib: Comprising >80% of sales with significantly lower prices.

- Alternative NSAIDs and COX-2 Inhibitors: Such as etoricoxib and meloxicam, though none precisely replicate Celebrex’s profile.

Regulatory and Patent Considerations

Patent Expirations & Exclusivity

Pfizer's primary patent covering Celebrex expired in 2014, leading to widespread generic entry. However, Pfizer continues to hold certain formulation and method patents that temporarily delay generics in specific jurisdictions, maintaining a form of market exclusivity.

New Formulations & Abuse Prevention

Research into fixed-dose combinations, sustained-release formulations, and reformulations could create niche pricing advantages, delaying generic market penetration.

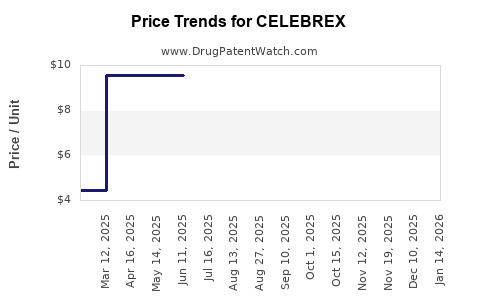

Price Trends and Projections

Historical Pricing Trajectory

From a 2010 peak of approximately $720 per 30-day supply, genericization reduced prices substantially to around $20-30 in 2022 (retail pharmacy prices). The branded price has essentially plateaued, with minimal fluctuations due to market erosion and competition.

Forecasting Price Development (2023-2030)

Given the current market environment, future pricing of Celebrex (branded) will primarily depend on:

- Patent litigation and exclusivity periods.

- Regulatory approvals for new indications or formulations.

- Reimbursement policies and insurer pricing pressures.

- Market penetration of generics and biosimilars.

Projected Scenario:

| Year | Branded Celebrex Price (per 30-day supply) | Competitive Forces | Impact on Price |

|---|---|---|---|

| 2023 | $25-$35 | Increasing generic penetration; pricing pressure | Slight decline or plateau |

| 2025 | $20-$30 | Patent claims possibly extended; new indications | Stabilization at lower levels |

| 2027 | $15-$25 | Dominance of generics; biosimilars emerging | Continued decrease; strategic niche |

| 2030 | $10-$20 | Biosimilar competition; market saturation | Potential further decline |

Note: The prices reflect retail pharmacy averages and do not account for insurance negotiations, discounts, or institutional procurement.

Market Drivers and Risks Affecting Price Projections

Drivers

- Intellectual Property Litigation & Patent Strategies: Pfizer's efforts to sustain exclusivity through litigation and secondary patents can delay generics, preserving higher prices.

- Expansion into Oncology & Other Fields: New indications can command premium pricing.

- Healthcare Policy & Reimbursement Trends: Payor policies favoring branded drugs for niche high-value indications can sustain higher prices.

Risks

- Accelerated Generic Entry & Biosimilar Competition: Price erosion accelerates with faster approvals.

- Negative Safety Profiles & Labeling Restrictions: Potential regulatory actions or label restrictions could diminish prescribing volume and prices.

- Market Maturation: As patent expiration impacts revenue, Pfizer and competitors might reduce promotional efforts, compressing prices.

Strategic Implications for Stakeholders

- For Pharma Companies: Investment in formulation innovation, extending patent life, or developing branded niche indications can buffer price reductions.

- For Investors: Recognize the decline trend in branded Celebrex revenues post-patent expiry but note potential upticks with new formulations or indications.

- For Healthcare Providers: Prioritizing cost-effective generic options is likely unavoidable unless new formulations offer significant clinical advantages.

Key Takeaways

- Market maturity and patent expirations have led to significant price declines, with generics dominating the Celecoxib market.

- Patent strategies and potential new indications may temporarily sustain higher prices or establish niche markets.

- Generics are expected to dominate by 2025, leading to a steady decline in the branded Celebrex price, potentially reaching $10-$20 per 30-day supply by 2030.

- The overall NSAID market will continue to grow, driven by demographic shifts, but Celebrex's role will diminish unless innovation or new indications emerge.

- Pricing pressures are inevitable, and stakeholders must focus on innovation, clinical differentiation, & strategic patent management to sustain revenue.

FAQs

-

What is the current market share of Celebrex versus generics?

As of 2022, generic celecoxib accounts for over 80% of total sales, with remaining branded sales primarily from Pfizer’s Celebrex. -

Will Celebrex remain profitable post-patent expiry?

Profitability will decline due to low-price generics, but niche or new indications could sustain profitable margins for Pfizer. -

Are there upcoming regulatory approvals that could affect Celebrex prices?

Potential approvals for additional indications, such as certain cancers, may create opportunities for premium pricing. -

How do biosimilars or novel COX-2 inhibitors impact Celebrex’s outlook?

While biosimilars generally target biological drugs, emerging COX-2 inhibitors or alternative therapies could further erode Celebrex’s market share. -

What strategies can Pfizer employ to preserve the value of Celebrex?

Pfizer can focus on developing novel formulations, expanding approved indications, pursuing patent protections, and engaging in strategic alliances.

References

[1] Allied Market Research. (2022). NSAID Market Size, Trends, and Forecasts.

[2] World Health Organization. (2021). Aging and Chronic Disease Prevalence Data.

More… ↓