Share This Page

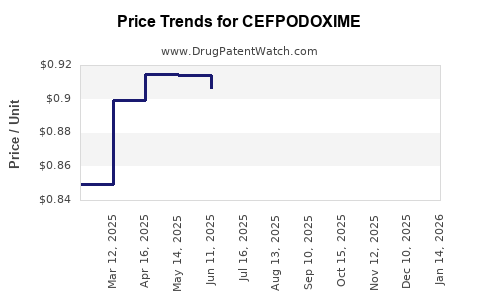

Drug Price Trends for CEFPODOXIME

✉ Email this page to a colleague

Average Pharmacy Cost for CEFPODOXIME

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFPODOXIME 100 MG TABLET | 65862-0095-20 | 1.07570 | EACH | 2025-12-17 |

| CEFPODOXIME 100 MG TABLET | 67877-0878-20 | 1.07570 | EACH | 2025-12-17 |

| CEFPODOXIME 100 MG TABLET | 65862-0095-01 | 1.07570 | EACH | 2025-12-17 |

| CEFPODOXIME 100 MG TABLET | 69292-0510-01 | 1.07570 | EACH | 2025-12-17 |

| CEFPODOXIME 100 MG TABLET | 00781-5438-20 | 1.07570 | EACH | 2025-12-17 |

| CEFPODOXIME 200 MG TABLET | 69292-0516-50 | 1.62468 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cefpodoxime

Overview of Cefpodoxime

Cefpodoxime is a third-generation cephalosporin antibiotic widely prescribed for treating bacterial infections, including respiratory tract infections, urinary tract infections, skin, and soft tissue infections. Its favorable pharmacokinetic profile, including oral bioavailability and efficacy against common bacterial pathogens, prompts consistent demand within the antimicrobial market.

Manufactured primarily by pharmaceutical firms worldwide, cefpodoxime is available under various brand names such as Vantin® (Pfizer), and generic formulations are prevalent. Its positioning within the healthcare system and resistance patterns substantially influence market dynamics and future pricing trends.

Market Landscape and Segment Dynamics

Global Market Size and Growth

The global antibiotics market, valued at approximately USD 49 billion in 2022, is projected to witness a compound annual growth rate (CAGR) of around 3-4% through 2030 (source: MarketsandMarkets). Cefpodoxime, as part of the cephalosporin subclass, constitutes a significant portion of third-generation cephalosporins, which historically account for a sizeable antibiotics segment.

Regional Market Drivers

- North America: High healthcare expenditure, robust prescribing guidelines, and antimicrobial stewardship programs moderate volume growth but support premium pricing for branded formulations.

- Europe: Growth driven by aging populations and rising antimicrobial resistance, prompting increased usage of broad-spectrum antibiotics like cefpodoxime.

- Asia-Pacific: Fastest-growing market owing to expanding healthcare infrastructure, increased access, and a rising burden of infectious diseases.

Key Market Players and Competition

Major players include Pfizer, Teva Pharmaceuticals, Sandoz (Novartis), and other regional manufacturers. While brand-name formulations command higher prices, intense generic competition puts downward pressure on prices, especially in mature markets.

Pricing Dynamics

Current Pricing Trends

In developed markets such as the U.S. and Western Europe, the wholesale acquisition cost (WAC) for branded cefpodoxime can range between USD 50–100 per course, depending on dosage and packaging. Generic formulations typically retail for approximately 50% or less of branded prices, driven by intense competition.

In emerging markets, prices are substantially lower, with formulations available for USD 10–30 per course, constrained further by local regulatory frameworks and procurement practices.

Influencing Factors

- Regulatory Policies: Price controls and reimbursement policies significantly influence pricing, especially in Europe and Asia.

- Supply Chain Dynamics: Scarcity of raw materials or manufacturing disruptions can cause price fluctuations.

- Antimicrobial Stewardship: Growing emphasis on judicious antibiotic use can impact demand and pricing strategies.

- Resistance Patterns: Rising resistance affecting the drug’s efficacy may lead to formulary restrictions impacting sales volume and price.

Future Price Projections

Short-term (1–3 years)

Overall, cefpodoxime prices are anticipated to remain relatively stable, with gradual pricing pressure from generic competition. In mature markets, branded prices may decline marginally due to increasing generic penetration. In emerging markets, expansion and demand could support steady or modestly rising prices.

Medium to Long-term (3–10 years)

- Market Contraction Risks: Escalating antimicrobial resistance might restrict use or necessitate combination therapies, potentially reducing demand and exerting downward pressure on prices.

- Innovation and Formulation Advances: Development of improved formulations or biosimilar products could influence pricing strategies.

- Policy Shifts: Implementation of global antimicrobial stewardship and drug pricing reforms may further restrain prices, especially in publicly funded health systems.

Projected Price Range (per full course):

In developed nations, expect stabilization around USD 70–120, with continued decline for generics toward USD 40–70. In developing regions, prices may range from USD 15–40, with room for slight increases due to economic growth and increased healthcare access.

Market Opportunities and Challenges

Opportunities

- Growing demand in emerging markets.

- Potential for patent expirations of branded formulations to stimulate generic competition.

- Expansion of indications due to increased resistance, prompting broader use.

Challenges

- Rising antimicrobial resistance diminishing efficacy.

- Stringent regulatory and pricing environments.

- Global push for antibiotic stewardship limiting overprescription and potential volume growth.

Strategic Recommendations

- For Manufacturers: Invest in quality assurance, develop cost-effective formulations, and adapt to local regulatory landscapes to remain competitive.

- For Investors: Monitor resistance trends and policy shifts that could impact demand and pricing; consider emerging markets for growth opportunities.

- For Healthcare Providers: Balance clinical efficacy with antimicrobial stewardship efforts to optimize therapy choices.

Key Takeaways

- Cefpodoxime remains a valuable third-generation cephalosporin with steady demand across global markets.

- Pricing is influenced by regional economic factors, competition, resistance patterns, and regulatory policies.

- The future of cefpodoxime pricing appears stable in developed markets but faces downward pressures due to increasing generic competition and antimicrobial stewardship initiatives.

- Growth opportunities exist in emerging economies, although challenges related to resistance and regulation persist.

- Strategic positioning, continuous monitoring of resistance trends, and regulatory developments are essential for stakeholders aiming to optimize profitability and access.

FAQs

1. How does antimicrobial resistance impact cefpodoxime market prices?

Resistance reduces the drug’s effectiveness, potentially limiting its use to specific cases or leading to its replacement by newer agents, thereby decreasing demand and exerting downward pressure on prices.

2. Are generic versions of cefpodoxime significantly cheaper than branded formulations?

Yes. Generic cefpodoxime products are often priced at 50–70% less than branded versions, driven by competition, especially in mature markets.

3. What regions are expected to experience the fastest growth in cefpodoxime demand?

The Asia-Pacific region is projected to have the fastest growth, fueled by expanding healthcare infrastructure and rising infectious disease prevalence.

4. How might future regulatory policies affect cefpodoxime pricing?

Tighter price controls and antimicrobial stewardship programs may limit pricing flexibility and reduce profit margins, especially in publicly funded healthcare systems.

5. What are the primary factors manufacturers should consider for maintaining market competitiveness?

Quality assurance, cost-effective manufacturing, strategic pricing, compliance with regulations, and addressing resistance patterns are critical for sustaining competitiveness.

References

[1] MarketsandMarkets. "Antibiotics Market - Global Forecast to 2030." 2022.

[2] IQVIA. "Global Antimicrobial Market Trends," 2022.

[3] World Health Organization. "Antimicrobial Resistance Strategic Framework," 2021.

More… ↓