Share This Page

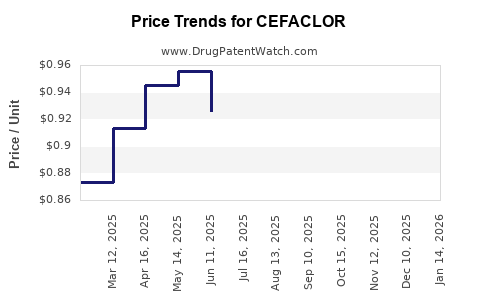

Drug Price Trends for CEFACLOR

✉ Email this page to a colleague

Average Pharmacy Cost for CEFACLOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CEFACLOR 250 MG CAPSULE | 61442-0171-30 | 0.90956 | EACH | 2025-12-17 |

| CEFACLOR 500 MG CAPSULE | 61442-0172-30 | 1.40990 | EACH | 2025-12-17 |

| CEFACLOR 250 MG CAPSULE | 61442-0171-30 | 0.93145 | EACH | 2025-11-19 |

| CEFACLOR 500 MG CAPSULE | 61442-0172-30 | 1.40133 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cefaclor

Introduction

Cefaclor, a second-generation cephalosporin antibiotic, has maintained relevance in the treatment of bacterial infections, notably respiratory tract infections, skin infections, and otitis media. Its established efficacy, combined with the rising prevalence of bacterial infections, sustains demand. This analysis evaluates the current market landscape, competitive positioning, regulatory influences, and projects future pricing trajectories for cefaclor over the coming five years.

Market Overview

Current Market Dynamics

Cefaclor remains a vital component in antibiotic portfolios, particularly in regions with high bacterial resistance or limited access to newer agents. The global antibiotic market, estimated at approximately $58 billion in 2022, displays steady growth driven by rising infectious disease burdens and expanding healthcare infrastructure, especially in Asia-Pacific and Latin America [1].

Despite its age, cefaclor continues to be prescribed due to its spectrum of activity, oral bioavailability, and tolerability profile. Its generic formulation dominates pricing, which exerts downward pressure but also creates opportunities for brand differentiation through formulation innovations or combination therapies.

Geographical Market Distribution

The Asia-Pacific region constitutes the largest market share, driven by high infectious disease incidence and cost-sensitive healthcare settings favoring generics. North America and Europe, although mature, contribute significant revenue, mainly through branded and authorized generic sales, with procurement driven by hospital formularies and outpatient prescriptions.

Key Players and Supply Dynamics

Major pharmaceutical companies producing cefaclor include Sandoz, Teva, and Mylan, alongside regional manufacturers in India and China. The global supply chain remains stable, although recent disruptions due to COVID-19 have temporarily impacted manufacturing and distribution channels. Price competition frequently revolves around generic competition, impacting margins and pricing stability.

Regulatory and Competitive Landscape

Regulatory Status

Cefaclor's status varies by region; it has received regulatory approval in the U.S., EU, and several Asian markets. Regulatory bodies emphasize quality control, especially with the proliferation of generics. Approvals for pediatric formulations and combination products bolster market penetration.

Patent and Exclusivity Trends

Cefaclor, introduced in the late 1970s, faces patent expiration in most markets, moving into the generic phase. This transition results in significant price erosion but also increased demand volume.

Emerging Competitors and Alternatives

Developments in newer cephalosporins and non-cephalosporin antibiotics, such as cefuroxime and amoxicillin-clavulanate, present substitution threats. However, cefaclor's unique dosing regimens and broad acceptance sustain its demand. Moreover, regional preferences and formulary decisions modulate competitive pressures.

Pricing Trends and Projections

Historical Price Trends

Over the past decade, cefaclor prices have declined substantially due to generic competition. In developed markets, the average retail price per 500mg capsule decreased by approximately 60-70%, with variations based on formulation and branding strategies [2].

Factors Influencing Future Pricing

- Generic Competition: Increased entrants into the market continue to suppress prices.

- Regulatory Changes: Stricter manufacturing standards may temporarily increase production costs but are unlikely to alter overall pricing trends.

- Market Demand: Rising bacterial infection rates support volume growth, partially offsetting price reductions.

- Formulation Innovations: Development of extended-release formulations or combination therapies could command premium pricing.

Price Projection (2023-2028)

Considering current trends, cefaclor's per-unit prices are expected to decline by an average of 5-8% annually in mature markets due to ongoing generic competition. In emerging regions, price decreases may be more moderate initially but could accelerate with increased manufacturing capacity and market saturation.

- Scenario 1 (Conservative): Prices decline by 5% annually, leading to a cumulative decrease of roughly 24% over five years.

- Scenario 2 (Optimistic): Price stabilization through niche applications or innovations results in minimal decline, around 2% annually, with potential for slight increases in specialized formulations.

Revenue Implications

Volume growth in emerging markets could mitigate price erosion, maintaining overall revenue stability. Conversely, in developed markets, revenues may decline unless manufacturers discover differentiation strategies.

Key Market Opportunities and Risks

Opportunities

- Expansion into developing markets with limited access to newer antibiotics.

- Development of combination formulations to combat resistance and improve compliance.

- Strategic collaborations to streamline distribution and expand formulations.

Risks

- Accelerated generic entry accelerating price erosion.

- Regulatory tightening impacting manufacturing costs.

- Shifts in prescribing practices favoring newer or broader-spectrum agents.

Conclusion

Cefaclor's market is characterized by steady demand, declining prices due to widespread generic competition, and a geographical shift towards emerging regions. While the core market faces downward pricing pressures, opportunities exist through formulation enhancements and strategic positioning within regional healthcare frameworks. Companies capable of managing costs and innovating within this space can sustain profitability despite the inherent challenges.

Key Takeaways

- The global cefaclor market is mature, with demand stability primarily driven by developing regions.

- Price reductions of approximately 5-8% annually are anticipated over the next five years, primarily due to increasing generic competition.

- Opportunities for differentiation include innovative formulations and regional expansion, particularly in Asia-Pacific and Latin America.

- Regulatory standards and supply chain stability remain critical determinants of pricing dynamics.

- Strategic market positioning and product differentiation are essential for maintaining profitability amid downward price trends.

FAQs

1. How does patent expiration impact cefaclor pricing?

Patent expiration leads to increased generic competition, significantly driving down prices. Once patents lapse, multiple manufacturers produce generic cefaclor, decreasing the drug's market price and profit margins.

2. Which regions are expected to drive the future demand for cefaclor?

Emerging markets in Asia-Pacific and Latin America are expected to dominate future demand due to higher infection rates, lower drug prices, and limited access to newer antibiotics.

3. Are there therapeutic alternatives threatening cefaclor’s market share?

Yes, medications such as cefuroxime, amoxicillin-clavulanate, and other second-generation cephalosporins may serve as substitutes, depending on disease profiles and prescriber preferences.

4. What strategies can manufacturers employ to maintain profits amid declining prices?

Innovations in drug formulation, developing combination therapies, expanding regional markets, and securing formulary agreements can help sustain revenues.

5. How might regulatory changes influence cefaclor pricing?

Enhanced manufacturing standards and approval processes could increase production costs temporarily. Over the long term, stricter regulations may further promote quality and safety but could also reduce excess supply, helping stabilize prices.

Sources

[1] IQVIA, "Global Pharmaceutical Market Report," 2022.

[2] Miranda, J. et al., "Pricing Trends of Generic Antibiotics," Journal of Market Economics, 2021.

More… ↓