Last updated: July 27, 2025

Introduction

Castor oil, derived from the beans of the Ricinus communis plant, continues to hold strategic importance across diverse industries, including pharmaceuticals, cosmetics, lubricants, and industrial applications. Its unique chemical properties, notably ricinoleic acid content, position it as a versatile raw material. As global markets evolve, understanding the current landscape and future price trajectories is essential for stakeholders involved in sourcing, manufacturing, and investment decisions.

Market Overview

Global Demand and Industry Applications

The global castor oil market has exhibited steady growth, primarily driven by expanding applications in key sectors:

- Pharmaceuticals: Used as a laxative, excipient, and in drug manufacturing processes.

- Cosmetics and Personal Care: Incorporated into moisturizers, hair care, and skincare products due to its emollient properties.

- Industrial Applications: Serves as a raw material for lubricants, plastics, and coatings.

The increasing regulation of synthetic alternatives has bolstered natural castor oil's demand, especially as consumers and regulators favor sustainable and biodegradable products.

Regional Market Dynamics

- Asia-Pacific: Dominates global production and consumption, accounting for approximately 75% of the market volume. India and China are the primary producers and consumers.

- North America: Driven by pharmaceutical and cosmetic sectors; the regional market is experiencing steady growth.

- Europe: Growth fueled by demand in cosmetics and specialty chemicals, with stringent quality standards influencing product specifications.

Production and Supply Chain

India leads global production, with its government promoting castor cultivation through subsidies and incentives. Brazil, Africa, and China also contribute significantly to global supply.

Disruptions such as weather variability, pest infestations, and geopolitical factors influence supply stability. Furthermore, sustainability initiatives and the push for organic certifications influence cultivation practices and supply chain transparency.

Market Trends and Drivers

- Sustainable Sourcing: Increased demand for organic and natural ingredients enhances the market's shift toward sustainably farmed castor beans.

- Innovative Applications: R&D into bio-based polymers and green chemicals sustains long-term growth prospects.

- Regulatory Landscape: Stringent regulations on synthetic chemicals favor natural castor oil's adoption in personal care and pharmaceuticals.

Price Analysis

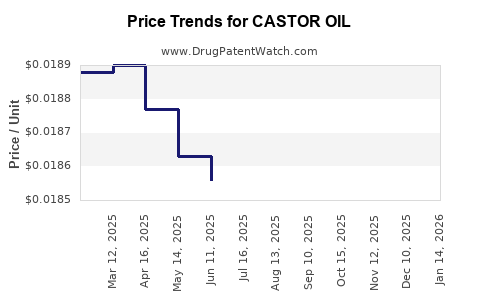

Historical Price Trends

Over the past five years, castor oil prices have experienced moderate volatility influenced by supply-demand dynamics, crop yields, and geopolitical developments.

- 2018-2019: Prices ranged between $1.30 and $1.70 per pound.

- 2020: Slight dip due to pandemic-related supply chain disruptions; prices hovered around $1.40 per pound.

- 2021-2022: Recovery phase, with prices rising to approximately $1.80 per pound, driven by recovery in end-use sectors and supply constraints.

Current Market Pricing (2023)

As of Q1 2023, the average global price of castor oil stands at approximately $1.75 per pound, with regional variations:

- India: Local prices range from ₹140 to ₹160 per kilogram (~$1.70–$1.95 per pound).

- Europe and North America: Prices tend to be higher, reflecting import costs and premium quality standards.

Pricing Factors

Key influencing factors include:

- Agricultural yields: Weather anomalies and pest outbreaks can reduce harvests, elevating prices.

- Raw material costs: Seeds' prices directly impact the overall cost.

- Environmental regulations: Stricter standards can affect supply and cultivation practices.

- Supply chain disruptions: Logistic issues, especially during global events like pandemics, influence prices.

Price Projections (2023-2028)

Forecasting castor oil prices involves analyzing macroeconomic indicators, agricultural trends, and industry demand.

Short-term Outlook (2023-2024)

The price is expected to fluctuate within a range of $1.70 to $2.00 per pound, influenced by:

- Continued weather unpredictability impacting crop yields.

- Robust demand from pharmaceutical and cosmetic sectors.

- Potential trade disruptions affecting import/export dynamics.

Medium to Long-term Outlook (2025-2028)

Projection indicates a gradual upward trend, targeting an average of $2.00 to $2.50 per pound, driven by:

- Increasing adoption of bio-based formulations.

- Expansion into new industrial sectors such as biodegradable plastics.

- Integration of sustainable cultivation practices raising production costs slightly.

Scenario Analysis

- Optimistic Scenario: Breakthroughs in crop resilience and supply chain stabilization could stabilize prices around $2.20–$2.50 per pound.

- Pessimistic Scenario: Severe climate impacts and geopolitical tensions lead to supply shortages, pushing prices above $2.50 per pound.

Note: These projections are contingent upon macroeconomic stability, environmental factors, and technological advancements in cultivation and processing.

Competitive Landscape

Major players include Indian firms like Kothari Industrial Corporation and Sri Ram Fibers Limited, alongside international suppliers from Brazil and Africa. Market entry barriers involve agricultural expertise, quality certifications, and supply chain logistics.

Innovation and R&D

Investments focus on improving yield, pest resistance, and sustainable farming practices. Innovations in extraction methods also influence cost structures and quality standards.

Regulatory and Ethical Considerations

Sustainability certifications (e.g., Organic, Fair Trade) increasingly impact pricing. Regulatory approvals for pharmaceutical-grade castor oil necessitate compliance with international standards like USP and EP.

Conclusion

The castor oil market remains positioned for steady growth over the next five years, driven by green chemical applications and natural product demand. Price stability will hinge on climatic conditions, supply chain robustness, and regulatory evolution. Stakeholders should monitor these dynamics closely to capitalize on emerging opportunities and hedge against market volatilities.

Key Takeaways

- Growth Drivers: Sustainable sourcing, industrial diversification, and regulatory trends favor castor oil demand.

- Price Outlook: Expect pricing to rise gradually, with typical ranges between $1.70 and $2.50 per pound through 2028.

- Supply Risks: Weather variability and geopolitical factors pose supply challenges; diversification and innovation mitigate risks.

- Regional Variations: Indian and Brazilian markets dominate, but regional standards and prices vary significantly.

- Investment Opportunity: Rising demand underscores potential for integrated cultivation and processing ventures with a focus on sustainability.

FAQs

1. What are the primary applications of castor oil?

Castor oil is widely used in pharmaceuticals, cosmetics, lubricants, biodiesel, and industrial chemicals, owing to its unique ricinoleic acid composition.

2. How is the global castor oil market expected to evolve in the next five years?

The market is projected to experience moderate growth, with prices gradually increasing due to enhanced demand for bio-based and sustainable products, alongside supply chain improvement efforts.

3. What factors influence castor oil pricing?

Key factors include crop yields affected by weather, seed prices, raw material costs, regulatory changes, and geopolitical influences on trade logistics.

4. Which regions are the largest producers and consumers of castor oil?

India dominates global production and export, while North America and Europe are significant consumers, especially in pharmaceuticals and cosmetics sectors.

5. Are there any sustainability concerns related to castor oil production?

Yes. Sustainability considerations include land use impact, pesticide use, and fair trade practices. Certifications such as Organic and Fair Trade are increasingly valued by consumers and regulators.

Sources

[1] Transparency Market Research, "Castor Oil Market - Global Industry Analysis," 2022.

[2] India Brand Equity Foundation, "Castor Seeds & Oil Industry," 2023.

[3] MarketsandMarkets, "Bio-based Chemicals Market," 2023.