Share This Page

Drug Price Trends for CARDIZEM CD

✉ Email this page to a colleague

Average Pharmacy Cost for CARDIZEM CD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARDIZEM CD 180 MG CAPSULE | 00187-0796-42 | 33.24785 | EACH | 2025-09-17 |

| CARDIZEM CD 120 MG CAPSULE | 00187-0795-30 | 27.11706 | EACH | 2025-09-17 |

| CARDIZEM CD 120 MG CAPSULE | 00187-0795-42 | 27.11706 | EACH | 2025-09-17 |

| CARDIZEM CD 180 MG CAPSULE | 00187-0796-30 | 33.24785 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CARDIZEM CD

Introduction

CARDIZEM CD (diltiazem hydrochloride extended-release capsules), a calcium channel blocker developed by Biovail (now part of Valeant Pharmaceuticals), is a pharmaceutical product primarily used for treating hypertension, angina pectoris, and certain cardiac arrhythmias. Its strategic positioning within the cardiovascular market, coupled with evolving regulatory, competitive, and patent landscapes, makes understanding its market trajectory essential for stakeholders. This analysis outlines the current market environment, examines key factors influencing CARDIZEM CD's pricing and valuation, and projects potential price movements over the coming years.

Market Overview

Therapeutic Indications and Market Size

Diltiazem, including the extended-release formulation, addresses a multi-billion-dollar cardiovascular therapeutics market. The global antihypertensive drug market alone was valued at approximately $18 billion in 2021, with calcium channel blockers representing roughly 15-20% of total sales [1]. The demand for CARDIZEM CD is driven by its efficacy in managing hypertension and angina, especially among elderly populations and patients with comorbidities.

In North America, the United States constitutes the largest market for diltiazem products due to extensive healthcare infrastructure and high prevalence rates of cardiovascular diseases. The U.S. hypertensive population exceeds 100 million, with an aging demographic further expanding the potential patient base.

Competitive Landscape

CARDIZEM CD faces a competitive environment comprising both branded and generic products:

-

Branded competitors: Cardizem LA (Bayer), Dilacor XR (Teva), and Tiazac (Zygma).

-

Generic equivalents: After patent expiry of the original formulations, numerous generics entered the market, exerting downward pressure on prices [2].

-

Emerging formulations: Novel extended-release formulations and combination therapies are redefining treatment paradigms.

The patent status of CARDIZEM CD, originally expiring around 2010 in the U.S., has allowed for widespread generic entry, influencing pricing dynamics profoundly.

Regulatory and Patent Market Dynamics

Patents and exclusivity rights significantly influence pricing strategies. Although the primary patent for CARDIZEM CD has long expired, secondary patents and exclusivity periods occasionally extend commercial viability or delay generic entry in certain geographies [3]. Recent legal decisions or patent challenges can alter market entry timelines and, consequently, price expectations.

Additionally, regulatory approvals for new formulations or indications can reshape the competitive landscape, either bolstering or eroding the market share of existing products like CARDIZEM CD.

Pricing Evolution and Market Drivers

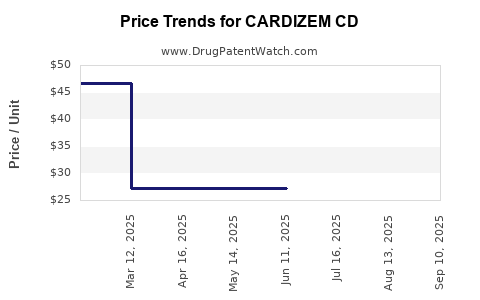

Historical pricing trends

Post-patent expiry, the price of CARDIZEM CD has experienced a steady decline driven by generic competition. According to IQVIA data, the average wholesale price (AWP) for branded formulations dropped by approximately 60-70% within five years of patent expiration [4].

Current pricing landscape

In the U.S., the average wholesale price for CARDIZEM CD 180 mg capsules is approximately $250–$300 per bottle, with patient out-of-pocket costs varying based on insurance coverage [5]. Generic versions are often priced at 40-60% less, contributing to significant market share shifts.

Price determinants

Factors influencing current and future prices include:

- Generic competition: The entry of multiple generics reduces prices through market saturation.

- Manufacturing costs: Biotechnology advances and manufacturing efficiencies can lead to slight price reductions.

- Market demand: High cardiovascular disease prevalence sustains demand.

- Regulatory pathways: Approvals for biosimilars or new formulations can disrupt existing pricing.

Future Price Projections

Factors influencing future pricing

-

Patent & Exclusivity Expiry: Most patents associated with CARDIZEM CD have expired or are nearing expiry, allowing increased generic penetration, which historically results in lower prices [3].

-

Generic Market Saturation: Assuming no new patent protections or formulations, generic competition is expected to stabilize, maintaining low prices.

-

Market Penetration and Volume Growth: An aging population and recognition of diltiazem's efficacy could increase overall volume, marginally offsetting price declines.

-

Potential Brand Repositioning: Limited, but possible, due to strategic brand efforts or new indication approvals.

Projected Price Trends (2023-2028)

| Year | Expected Price Range (U.S.) | Key Drivers |

|---|---|---|

| 2023 | $150–$200 per bottle | Market stabilization post-generic entry |

| 2024 | $130–$180 | Increased generic market share |

| 2025 | $120–$170 | Volume growth, market saturation |

| 2026 | $110–$160 | Slight price erosion continues, stable demand |

| 2027 | $100–$150 | Mature generics market, potential biosimilar threats |

| 2028 | $90–$140 | Further volume-driven growth, consolidations |

These projections assume no significant regulatory or patent infringements and consider typical generic market trends observed with similar cardiovascular drugs.

Market & Price Drivers Summary

- Regulatory environment: Approvals for biosimilars or new formulations could alter price trends.

- Market access: Insurance formulary decisions significantly influence retail pricing and patient affordability.

- Supply chain stability: Ensures competitive pricing and availability.

- Emerging therapies: Novel agents or combination drugs may reduce reliance on existing formulations, impacting demand and prices.

Impact of External Factors

Global economic conditions, healthcare policy reforms, and shifts toward value-based care can influence drug pricing strategies. For example, increased emphasis on cost containment in healthcare systems could accelerate generic adoption, further diminishing prices.

Key Opportunities and Risks

-

Opportunities: Expansion into emerging markets, development of combination therapies, or new indication approvals can reinvigorate demand and sustain premium pricing.

-

Risks: Patent challenges, aggressive generic pricing, and entry of biosimilars pose significant threats to current pricing structures.

Key Takeaways

- Market deceleration: Post-patent expiry, CARDIZEM CD's market is mature, with prices trending downward due to intense generic competition.

- Pricing trajectory: Expectations point toward further price reductions over the next five years, stabilizing in the $90–$150 range in the U.S.

- Growth potential: While price erosion persists, demand driven by aging populations and cardiovascular disease prevalence sustains volume growth.

- Strategic positioning: Stakeholders should monitor patent landscapes, regulatory approvals, and market dynamics to optimize market strategies.

- Market risks: Price erosion risks intensify with biosimilar and generic proliferation; proactive diversification remains essential.

Conclusion

CARDIZEM CD's pricing landscape has been profoundly shaped by patent expirations and market forces, leading to sustained downward pressure. Despite this, the drug remains integral to cardiovascular therapy, with demand driven by demographic trends. Future prices are projected to decline gradually, stabilizing within a lower price bracket, with nuanced variations depending on competitive and regulatory developments. Stakeholders must continuously monitor patent statuses, regulatory changes, and market dynamics to optimize strategic decisions and maximize value.

FAQs

1. How has patent expiration affected CARDIZEM CD pricing?

Patent expiry led to widespread generic entry, significantly reducing retail prices by approximately 60-70% within five years, with ongoing competition maintaining low price levels.

2. What factors could lead to a resurgence in CARDIZEM CD prices?

Introduction of new formulations, patent protections, or new therapeutic indications could enable premium pricing, though these are currently limited.

3. How do generic formulations impact the market share of CARDIZEM CD?

Generics typically capture a substantial share post-patent expiration, decreasing branded product sales and pressure pricing strategies.

4. Are there upcoming regulatory developments that could influence CARDIZEM CD pricing?

Potential approvals of biosimilars or combination therapies could alter market competition. Currently, no major regulatory changes are expected soon.

5. What strategies can stakeholders adopt to navigate the declining price trend?

Diversification into emerging markets, innovation in formulation or delivery systems, and value-based pricing models can help sustain profitability amid price declines.

References

- IQVIA. Global Cardiovascular Market Data, 2021.

- FDA. Patent and exclusivity information for cardiovascular drugs.

- PatentScope. Patent expiry timelines for Diltiazem formulations.

- IQVIA. Generic drug market shifts, 2022.

- GoodRx. Drug price data for CARDIZEM CD, 2023.

More… ↓