Share This Page

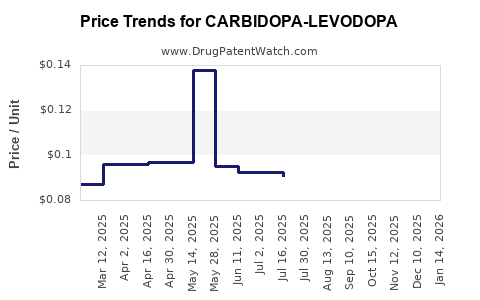

Drug Price Trends for CARBIDOPA-LEVODOPA

✉ Email this page to a colleague

Average Pharmacy Cost for CARBIDOPA-LEVODOPA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARBIDOPA-LEVODOPA 10-100 TAB | 31722-0381-05 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 10-100 TAB | 50228-0457-01 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 10-100 TAB | 31722-0381-01 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 10-100 TAB | 50228-0457-05 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 10-100 TAB | 00093-9701-01 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA-ENTACAPONE 50-200-200 MG TAB | 16571-0694-01 | 0.76936 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Carbidopa-Levodopa

Introduction

Carbidopa-Levodopa remains the cornerstone therapy for Parkinson’s disease management, consistently forming a significant segment of the neurological drug market. As a combination medication, it addresses dopamine deficiency — a hallmark of Parkinsonian pathology. This analysis examines current market dynamics, competitive landscape, patent protections, and future price trajectories for Carbidopa-Levodopa, providing a comprehensive view for stakeholders aiming to navigate this critical pharmaceutical domain.

Market Overview

Current Market Size and Demand Drivers

The global Parkinson's disease market was valued at approximately $4.9 billion in 2022, with Carbidopa-Levodopa accounting for a dominant share due to widespread clinical use. The rising prevalence of Parkinson's across aging populations underpins ongoing demand. The Parkinson's population is projected to double by 2040, growing at a CAGR of roughly 4%, further fueling the demand for effective treatments like Carbidopa-Levodopa.

Key Market Players and Product Portfolio

Leading pharmaceutical companies hold substantial market shares, with AbbVie (controlling Leg Parkinson's and Duodopa formulations), Sun Pharmaceutical, and Mitsubishi Tanabe Pharma as prominent competitors. Generic manufacturers, including Teva and Mylan, also contribute significantly, particularly post-patent expiry, intensifying pricing competition.

Regulatory and Patent Landscape

While some formulations remain under patent protections— notably AbbVie's extended-release formulations— the expiration of several key patents has precipitated a wave of generic entries, exerting downward pressure on prices. The U.S. FDA approved multiple generics in recent years, contributing to market commoditization.

Market Dynamics

Pricing Trends and Factors

- Brand vs. Generic Pricing: Brand-name products typically command premium prices, but patent expirations induce substantial price reductions as generics enter the market.

- Formulation Complexity: Extended-release formulations or combination variants with novel delivery mechanisms often command higher prices initially but face erosion over time.

- Reimbursement Policies: In many countries, insurance coverage and reimbursement policies influence access and price elasticity.

- Global Market Variations: Prices are generally higher in North America and Europe due to regulatory costs and reimbursement policies, whereas emerging markets see significantly lower prices influenced by localized pricing controls.

Clinical Practice and Therapeutic Trends

Optimal dosing regimens evolve with ongoing research, sometimes leading to modifications in standard formulations and influencing market offerings. Additionally, the emergence of adjunct therapies, such as dopamine agonists and MAO-B inhibitors, could shape future demand.

Price Projections (2023–2030)

Near-term Outlook (2023–2025)

Post-patent expiry, the average wholesale price (AWP) of generic Carbidopa-Levodopa has declined by approximately 30-50%. The proliferation of generics is expected to sustain low price levels, with campaign-led price stabilization efforts limiting market volatility. The introduction of bioequivalent formulations could further compress prices by 10–15% annually.

Medium to Long-term Outlook (2026–2030)

Price erosion will likely slow as the market matures, but residual brand premiums may persist for proprietary extended-release versions. Innovations such as controlled-release formulations, implantable pumps, and transdermal systems could command premium pricing, maintaining a tiered price structure within the market.

Predicted average prices for generic Carbidopa-Levodopa tablets could stabilize around $0.10–$0.15 per tablet by 2030, down from about $0.25–$0.30 per tablet in 2022. Brand-name formulations may retain prices 2–3 times higher, contingent on patent statuses and formulations marketed.

Impact of Market Factors on Price

- Patent Expiration: Accelerates price reduction due to generic competition.

- Regulatory Approvals: Facilitate entry of biosimilars and improved formulations, influencing price levels.

- Supply Chain Dynamics: Raw material costs and manufacturing expansions impact pricing flexibility.

- Market Penetration in Emerging Markets: Lower prices in these regions could push global prices downward.

- R&D and Innovation: New delivery methods could sustain higher prices for advanced formulations.

Strategic Implications for Stakeholders

- Manufacturers: Need to innovate beyond commoditized formulations, focusing on differentiated delivery systems.

- Investors: Market stability suggests moderate growth, but patent protections could offer lucrative opportunities temporarily.

- Healthcare Providers: Cost-effective prescribing favors generic access, influencing formulary decisions.

- Regulators: Pricing policies and patent laws directly impact market evolution and drug affordability.

Conclusion

The Carbidopa-Levodopa market is characterized by significant generics-driven price declines following patent expiries, with future pricing primarily influenced by innovation, regulatory landscapes, and global market expansion. While current trends predict continued price compression in the short term, lifetime extension strategies and formulation advancements present opportunities for premium pricing segments in the long run. Stakeholders must remain vigilant of patent statuses, technological innovations, and reimbursement frameworks to optimize positioning in this mature yet evolving market.

Key Takeaways

- The global market for Carbidopa-Levodopa is sizable and growing, driven by aging populations and increasing Parkinson’s prevalence.

- Patent expirations have generally resulted in considerable price reductions for generic formulations, with prices expected to stabilize between $0.10–$0.15 per tablet by 2030.

- Innovation in formulations and delivery systems could sustain higher pricing tiers, especially for proprietary extended-release products.

- Competitive dynamics are heavily influenced by regulatory approvals, patent statuses, and pricing policies across different regions.

- Stakeholders should focus on innovation, market diversification, and regulatory intelligence to maximize value in a commoditized landscape.

FAQs

1. How will patent expirations affect Carbidopa-Levodopa prices?

Patent expirations facilitate entry of generics, leading to significant price declines—often 30–50%—and increased market competition. Future expiries could bring additional downward pressure.

2. Are there any upcoming formulations that could command higher prices?

Yes, innovations such as extended-release formulations, transdermal patches, and implantable delivery systems may justify premium pricing due to improved patient adherence and efficacy.

3. What regions are expected to experience the most price declines?

Emerging markets, where price regulation and generic penetration are high, will witness sharper price reductions compared to developed markets with established brand preferences and regulatory protections.

4. How do regulatory policies influence Carbidopa-Levodopa prices?

Regulations affecting patent durations, approval pathways for generics/biosimilars, and reimbursement policies directly impact market competition and pricing strategies.

5. Will new therapies replace Carbidopa-Levodopa in the future?

While emerging treatments (e.g., gene therapy, neurostimulation) are under investigation, Carbidopa-Levodopa remains the gold standard for symptomatic management, unlikely to be replaced entirely in the near term.

Sources:

- Market Research Future. “Parkinson’s Disease Market Analysis.” 2022.

- IQVIA. “Global Pharmaceutical Price Trends.” 2022.

- U.S. Food and Drug Administration. Approved Drug Products. 2023.

- Parkinson’s Foundation. “Statistics & Research.” 2022.

- EvaluatePharma. “2019 Global Market Outlook for Parkinson’s Disease Drugs.”

- Statista. “Global Parkinson’s Disease Market Revenue Forecast.” 2023.

More… ↓