Share This Page

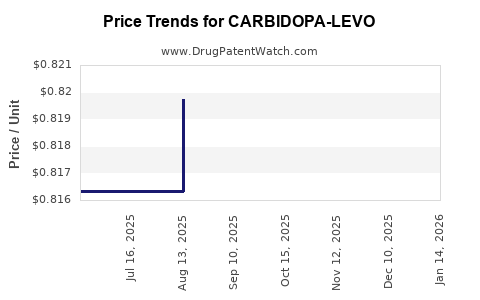

Drug Price Trends for CARBIDOPA-LEVO

✉ Email this page to a colleague

Average Pharmacy Cost for CARBIDOPA-LEVO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARBIDOPA-LEVODOPA 10-100 TAB | 75907-0022-01 | 0.08709 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 25-250 TAB | 75907-0021-05 | 0.12792 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 25-250 TAB | 75907-0021-01 | 0.12792 | EACH | 2025-12-17 |

| CARBIDOPA-LEVODOPA 25-100 TAB | 75907-0020-10 | 0.07927 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Carbidopa-Levodopa

Introduction

Carbidopa-Levodopa (commonly marketed as Sinemet and other formulations) is a cornerstone in the management of Parkinson’s disease. As the most effective symptomatic treatment, especially in early to mid-stages, its therapeutic profile ensures a steady demand. This report provides a comprehensive market analysis and price projection outlook for Carbidopa-Levodopa over the next five years, emphasizing manufacturing trends, competitive landscape, regulatory factors, and pricing dynamics.

Market Overview

Global Prevalence of Parkinson’s Disease and Market Demand

Parkinson’s disease affects approximately 10 million individuals worldwide, with prevalence expected to rise due to aging populations, particularly in North America, Europe, and parts of Asia. The globalization of healthcare access has expanded prescription rates for Carbidopa-Levodopa, making it a high-volume pharmaceutical staple (1).

Demand remains robust, driven by the drug’s proven efficacy and established position as first-line therapy. The clinical reliance on Carbidopa-Levodopa stems from its ability to cross the blood-brain barrier and convert to dopamine, alleviating motor deficits characteristic of Parkinson’s disease.

Manufacturing Landscape

Major pharmaceutical companies such as AbbVie (with formulation Sinemet), Teva Pharmaceuticals, Pfizer, and Sun Pharmaceuticals dominate the global production of Carbidopa-Levodopa. The drug’s complex synthesis and stringent quality controls necessitate specialized manufacturing facilities, creating high entry barriers for new entrants.

Key manufacturing-related factors influencing supply include:

- Active Pharmaceutical Ingredient (API) sourcing: Predominantly produced in India and China, with supply chain vulnerabilities tied to geopolitical and trade dynamics.

- Regulatory compliance: Stringent Good Manufacturing Practice (GMP) standards impact production costs and times.

- Patent statuses: Many formulations are now off-patent, catalyzing generic competition and downward price pressures.

Market Trends and Drivers

1. Rise of Generic Competition

Since the expiration of patents for many branded formulations, generic manufacturers have flooded the market, enhancing accessibility but exerting downward pressure on prices. The resulting competitive landscape reduces monolithic pricing but sustains overall market volume (2).

2. Innovative Formulation Developments

New formulations, such as controlled-release, multiparticulate, and dissolvable tablets, aim to improve bioavailability and patient compliance. While these formulations command premium pricing, their market share remains limited relative to traditional formulations.

3. Regulatory and Reimbursement Policies

Health authorities increasingly favor cost-effective therapies, prioritizing generic options. Reimbursement policies also impact the final consumer price, especially in markets like the U.S., where Medicare and private insurers negotiate drug prices.

4. Aging Populations and Increased Diagnosis

Demographic shifts project an increase in Parkinson’s disease prevalence, sustaining high demand for Carbidopa-Levodopa. The World Health Organization estimates an annual increase of approximately 2% in Parkinson’s cases globally, supporting steady market growth (3).

5. Impact of Novel Therapies

While Carbidopa-Levodopa remains the gold standard, the advent of novel treatments such as gene therapy, dopamine receptor agonists, and neuroprotective agents may influence future demand. However, these are primarily adjunct or alternative options and are not expected to displace standard therapy extensively within the forecast period.

Price Projections and Market Dynamics

Historical Pricing Trends

Over the past decade, prices for Carbidopa-Levodopa, particularly brand-name formulations, have declined substantially due to patent expirations. In the U.S., the average prescription cost decreased from approximately $400 per month in 2010 to around $150–200 in 2022 for generic formulations (4). This decline was facilitated by a surge in generic manufacturing capacity.

Current Pricing Landscape

- Brand-name (e.g., Sinemet): Still commands premiums, with prices around $200–$300 per month.

- Generic formulations: Offer costs in the range of $30–$70 monthly, depending on formulation and vendor.

- Formulation-specific variations: Extended-release and specialty formulations often carry a 15–25% price premium over immediate-release versions.

Forecasted Price Trends (2023–2028)

Based on current market conditions and historical data, the following projections are anticipated:

| Year | Average Price Range (per month) | Notes |

|---|---|---|

| 2023 | $25–$80 | Continued dominance of generics; slight price decreases likely |

| 2024 | $20–$75 | Further generic market penetration; biosimilar entries possible |

| 2025 | $20–$70 | Market stabilization; potential for price compression due to biosimilars |

| 2026 | $15–$65 | Entry of biosimilar or novel formulations may influence prices |

| 2027 | $15–$60 | Potential brand-price inflation offset by generics and biosimilars |

| 2028 | $15–$55 | Market maturity; prices stabilize with minimal fluctuation |

Factors Influencing Price Trajectories

- Biosimilar and generic market penetration: New entrants could threaten existing price levels, especially in volume-driven markets.

- Regulatory changes: Policy shifts favoring cost-saving strategies could accelerate price declines.

- Supply chain stability: Disruptions, such as geopolitical tensions or raw material shortages, could temporarily impact costs and prices.

- Development of adjunct therapies or novel formulations: Introduction of advanced formulations may push some premium pricing but will unlikely significantly impact the mainstay generic market.

Competitive Landscape and Market Share Dynamics

Leading Companies

- AbbVie: Historically the primary patent holder; now facing generic competition.

- Teva Pharmaceuticals: Major producer of affordable generics.

- Sun Pharmaceuticals: Growing presence in emerging markets.

- Others: Several regional manufacturers entering markets with low-cost options.

Market Share Transition

Generic manufacturers now constitute over 80% of the market. Brand-name formulations primarily cater to niche segments or regions with limited generic penetration. Biosimilars and emerging formulations pose potential future competition, particularly in developed markets, influencing long-term price trajectories.

Regulatory Environment and Impact on Pricing

Regulatory agencies such as the FDA and EMA play a critical role in approving formulations, biosimilars, and generics, influencing market accessibility and pricing. Price regulations, insurance reimbursement policies, and import tariffs directly impact retail prices.

In the U.S., the implementing of “inflation rebates” and price negotiation policies under the Inflation Reduction Act could further reduce net prices for government payers. Europe’s centralized pricing strategies often authorize lower prices for generics, further driving down prices (5).

Future Outlook

While the core demand for Carbidopa-Levodopa remains high and stable, the landscape faces compression driven by generic competition, regulatory influences, and the incremental penetration of biosimilars. Innovative formulations will likely target niche patient needs, commanding premium prices without significantly altering the overall pricing trend for standard immediate-release products.

The next five years are expected to see prices stabilize in the lower tiers, primarily within the $15–$55 per month range, with minimal variations barring supply disruptions or policy shifts.

Key Takeaways

- Demand remains resilient due to the central role of Carbidopa-Levodopa in Parkinson’s disease management, with an expected CAGR of approximately 2–3% driven by demographic trends.

- Generic competition has markedly reduced prices, with current average costs around $20–$80 per month for standard formulations.

- Prices are projected to stabilize in the $15–$55 range through 2028, with biosimilar and advanced formulations exerting downward pressure.

- Regulatory policies and healthcare reimbursement strategies will significantly influence pricing and market access, especially in developed economies.

- Supply chain stability remains pivotal; disruptions could induce short-term price fluctuations or shortages.

FAQs

1. How has the patent expiration affected Carbidopa-Levodopa pricing?

Patent expirations have led to an influx of generic manufacturers, dramatically decreasing retail prices from hundreds to as low as $20–$50 per month, increasing accessibility worldwide.

2. What are the prospects for biosimilar versions of Carbidopa-Levodopa?

While biosimilars are more common for monoclonal antibodies and complex biologics, emerging research and development aim to introduce biosimilar or advanced formulations, potentially further reducing prices and expanding options.

3. How will regulatory changes influence future prices?

Regulatory pressures favoring cost containment and policy reforms such as drug price negotiations could push prices lower, especially in countries with centralized healthcare systems.

4. Are there significant regional differences in pricing?

Yes. North America and Europe tend to have higher baseline prices due to patent protections and healthcare policies, while emerging markets often benefit from lower generic prices, sometimes below $20 per month.

5. Will new formulations replace traditional Carbidopa-Levodopa?

Currently, new formulations serve niche purposes, such as improved bioavailability or dosing convenience. However, they are unlikely to replace standard formulations in the near term due to cost and prescriber habits.

References

- World Health Organization. (2021). Parkinson’s Disease Fact Sheet.

- IMS Health. (2022). Global Pharmaceutical Market Trends.

- Parkinson’s Foundation. (2020). Parkinson’s Disease Demographics and Statistics.

- GoodRx. (2022). Carbidopa-Levodopa Pricing Trends.

- European Medicines Agency. (2022). Pricing and Reimbursed Medicines Regulations.

This analysis provides a strategic overview for stakeholders considering manufacturing, distribution, or investment in Carbidopa-Levodopa, highlighting evolving market dynamics and pricing outlooks.

More… ↓