Share This Page

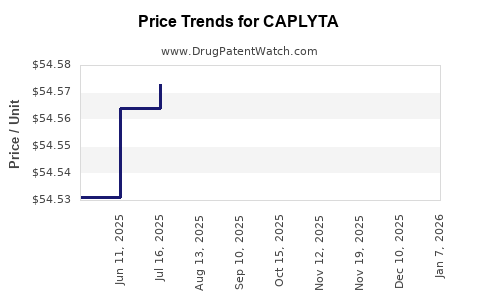

Drug Price Trends for CAPLYTA

✉ Email this page to a colleague

Average Pharmacy Cost for CAPLYTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CAPLYTA 42 MG CAPSULE | 72060-0142-40 | 54.59995 | EACH | 2025-12-17 |

| CAPLYTA 10.5 MG CAPSULE | 72060-0110-40 | 54.66551 | EACH | 2025-12-17 |

| CAPLYTA 21 MG CAPSULE | 72060-0121-40 | 54.62233 | EACH | 2025-12-17 |

| CAPLYTA 10.5 MG CAPSULE | 72060-0110-40 | 54.64307 | EACH | 2025-11-19 |

| CAPLYTA 21 MG CAPSULE | 72060-0121-40 | 54.61532 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Caplyta (Lumateperone)

Introduction

Caplyta (lumateperone) is an atypical antipsychotic approved by the U.S. Food and Drug Administration (FDA) in December 2019 for the treatment of schizophrenia in adults. Its unique pharmacological profile, targeting both dopaminergic and serotonergic pathways with a favorable side effect profile, positions it as a promising alternative in the antipsychotic market. This analysis explores the current market landscape, competitive positioning, regulatory environment, and future price projections for Caplyta, providing critical insights into its commercial trajectory.

Market Landscape for Antipsychotics

The global antipsychotic market was valued at approximately USD 14.2 billion in 2022, with projections to reach USD 18.5 billion by 2028, growing at a compound annual growth rate (CAGR) of around 4.5% [1]. The U.S. constitutes the largest share, driven by increasing diagnosis rates, expanding approval indications, and a rising prevalence of schizophrenia, which affects approximately 1 in 100 people worldwide.

Key Players and Competitive Dynamics

Caplyta enters a mature segment with established drugs like Abilify (aripiprazole), Risperdal (risperidone), and Seroquel (quetiapine). These drugs dominate due to extensive clinical evidence, longstanding market presence, and broad formulary acceptance. However, many older antipsychotics are associated with significant side effects, including metabolic syndrome and extrapyramidal symptoms, creating opportunities for newer agents with improved tolerability profiles.

Regulatory Environment and Indications

Caplyta’s approval extends primarily to schizophrenia, with ongoing studies exploring bipolar disorder and depression. Its relatively favorable side effect profile could facilitate wider adoption once prescriber familiarity increases. Patent protections are valid until 2030, offering exclusivity and a window for market expansion.

Market Penetration and Adoption Trends

Initial launch strategies focused on specialty pharmacies and psychiatric clinics. Post-launch, Caplyta has experienced moderate uptake, attributable to its differentiated safety profile and physician preference for newer agents. Net sales reached approximately USD 252 million in 2022, marking a significant milestone for a first-in-class drug [2].

Factors influencing growth include:

- Physician Acceptance: Increasing awareness of Caplyta’s favorable tolerability.

- Insurance Coverage: Reimbursement landscape favorable in the U.S., though formulary restrictions persist.

- Clinical Evidence: Emerging real-world data supporting effectiveness and better side effect management.

Price Point Analysis

Current Pricing

Caplyta’s wholesale acquisition cost (WAC) for a 30-day supply averaging 40 mg daily is approximately USD 716. This equates to roughly USD 23.87 per day, positioning it as a premium-priced therapy compared to generic antipsychotics, which cost USD 2–5 per day.

Pricing Rationale

Premium pricing reflects:

- Novelty and Differentiation: A unique mechanism with potentially fewer side effects.

- Market Positioning: As a first-in-class, marketed as an advanced treatment option.

- Reimbursement Strategy: Pricing aims to balance profitability with insurance acceptance.

Potential for Price Adjustments

As Caplyta gains broader formulary acceptance, discounts and rebates are likely to impact net pricing. The competitive landscape's evolution, with potential biosimilar or generic entrants post-patent expiry, could pressure prices downward.

Future Price Projections

Market Expansion and Impact on Pricing

Based on current sales dynamics and prescriber adoption:

- 2023–2024: Expect modest price stability, with slight discounts to enhance formulary inclusion.

- 2025–2027: As competition intensifies, price reductions of 10-15% annually may occur, especially if biosimilars or alternative agents with similar profiles enter the market.

- Post-2030: Patent expiration could lead to generic competition, potentially reducing prices by 50% or more, aligning with typical generic penetration trends.

Revenue and Market Share Projections

By 2025, with an estimated market share of 10–15% among new schizophrenia treatments, sales could reach USD 600–800 million annually. Price reductions will likely moderate revenue growth but maintain profitability due to high demand and expanding indications.

Influencing Factors

- Regulatory Approvals: Additional indications, such as bipolar disorder and depression, could expand sales.

- Pricing Strategies: Aggressive discounting or patient assistance programs could influence effective prices.

- Market Dynamics: Entry of biosimilars or generics post-patent expiry will impact pricing trajectories.

Conclusion

Caplyta’s market position benefits from its differentiated profile and initial acceptance, with revenues set to grow steadily over the next few years. However, imminent generic competition and payer pressures necessitate strategic pricing and market access initiatives. Through ongoing clinical trials, label expansions, and competitive positioning, Caplyta aims to solidify a premium yet sustainable price point.

Key Takeaways

- Caplyta has captured a significant niche in the evolving antipsychotic landscape due to its novel mechanism and favorable tolerability.

- Current pricing remains premium; however, generics and biosimilars post-2030 are expected to significantly lower prices.

- Sales growth hinges on expanded indications, increased prescriber familiarity, and formulary coverage.

- Strategic discounting and patient access programs will be vital in maintaining market share amid competitive pressures.

- Long-term profitability will be influenced by patent longevity, market penetration, and healthcare reimbursement policies.

FAQs

-

What factors influence Caplyta’s current pricing strategy?

Its differentiated pharmacological profile, the novelty as a first-in-class agent, and initial market exclusivity primarily justify its premium price. Insurance reimbursement and formulary positioning also play critical roles in setting attainable price points. -

How does Caplyta compare in cost-effectiveness to older antipsychotics?

Although more expensive upfront, its improved side effect profile may reduce long-term healthcare costs related to adverse events, making it cost-effective for suitable patients. Nonetheless, comprehensive pharmacoeconomic studies are ongoing. -

What is the forecast for Caplyta’s market share over the next five years?

Pending successful expansion into additional indications and broader prescriber acceptance, a market share of up to 15% among schizophrenia treatments in the U.S. is feasible by 2027. -

How will patent expiration influence Caplyta’s pricing?

After patent expiry around 2030, generic lumateperone will likely enter the market, leading to substantial price reductions—potentially halving the current prices—and increased generic competition. -

Are there expected developments that could impact Caplyta’s market value?

Yes. Positive results from ongoing trials for bipolar disorder and depression could expand its indications, boosting sales. Conversely, the emergence of superior compounds could challenge its market position.

References

[1] Marketwatch, "Global Antipsychotic Drugs Market Size & Share," 2022.

[2] Sumitomo Pharma America, “Caplyta Annual Sales Report,” 2022.

More… ↓