Share This Page

Drug Price Trends for CANASA

✉ Email this page to a colleague

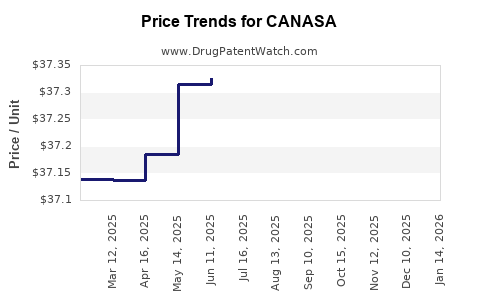

Average Pharmacy Cost for CANASA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CANASA 1,000 MG SUPPOSITORY | 58914-0501-56 | 37.30667 | EACH | 2025-12-17 |

| CANASA 1,000 MG SUPPOSITORY | 58914-0501-56 | 37.26603 | EACH | 2025-11-19 |

| CANASA 1,000 MG SUPPOSITORY | 58914-0501-56 | 37.28115 | EACH | 2025-10-22 |

| CANASA 1,000 MG SUPPOSITORY | 58914-0501-56 | 37.28115 | EACH | 2025-09-17 |

| CANASA 1,000 MG SUPPOSITORY | 58914-0501-56 | 37.31597 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CANASA (Mesalamine Suppositories)

Introduction

CANASA (mesalamine suppositories) is a high-value pharmaceutical predominantly prescribed for ulcerative proctitis, a form of inflammatory bowel disease (IBD). As an established treatment modality, it holds a unique position in gastrointestinal therapy, benefiting from targeted delivery and established clinical efficacy. This analysis explores the current market landscape, competitive dynamics, regulatory factors, and forecasts future pricing trends over the next five years.

Market Overview

Clinical Positioning and Usage

CANASA delivers mesalamine directly to the rectum, providing localized anti-inflammatory effects. Its targeted approach results in fewer systemic side effects compared to oral formulations, reinforcing its preference in proctitis management. The drug's clinical utility is well-established, supported by guidelines from organizations such as the American College of Gastroenterology (ACG) and the British Society of Gastroenterology (BSG) [1].

Patient Demographics and Epidemiology

Ulcerative colitis, including proctitis, affects approximately 1.3 million Americans and similar prevalence rates are observed globally, with incidence rising in developing nations. The median age of onset ranges from 15 to 30 years, with a significant number of patients requiring long-term maintenance therapy [2]. Thus, the demand for localized therapies like CANASA constitutes a stable and growing segment within the IBD market.

Current Market Size

The global IBD therapeutics market was valued at approximately USD 8.5 billion in 2022, with mesalamine products accounting for a significant share. In particular, suppository formulations like CANASA cater to a niche segment, estimated at USD 500 million in 2022, driven by prescribing trends favoring precision treatments [3]. North America leads the market, with Europe and emerging markets following.

Competitive Landscape

The competitive landscape includes both branded and generic mesalamine products delivered via suppositories, enemas, and oral formulations. Key players encompass Salix Pharmaceuticals (now part of Bausch Health), Ferring Pharmaceuticals, Dr. Falk Pharma, and various generic manufacturers. The patent expirations of certain formulations have intensified price competition, influencing the market dynamics.

Regulatory and Intellectual Property Considerations

Patent Status and Exclusivity

CANASA’s original patents, covering specific formulations and delivery mechanisms, have generally expired or are nearing expiration, paving the way for generic entrants. However, exclusivity periods granted for specific formulations or manufacturing processes can sustain higher pricing temporarily [4].

Approvals and Reimbursement Environment

Regulatory approval pathways remain straightforward in major North American and European markets owing to longstanding clinical data. Reimbursement policies favor the use of generic mesalamine suppositories where available, pressuring branded prices but maintaining overall market stability.

Price Dynamics and Projections

Historical Pricing Trends

Over the past decade, the average wholesale price (AWP) for CANASA has shown modest fluctuations. In the U.S., the AWP has generally ranged between USD 300– USD 400 per box (typically 30 suppositories). The entry of generics has exerted downward pressure, but branded products retain premium pricing due to brand recognition and perceived quality.

Factors Influencing Future Prices

Key factors shaping future price trajectories include:

- Patent expirations: Expected within the next 2–3 years for some formulations, leading to generic competition.

- Market penetration of generics: Increased adoption results in significant price erosion.

- Regulatory changes: Potential initiatives to regulate or cap drug prices could impact pricing.

- Manufacturing innovations: New formulations offering improved efficacy or convenience could command premium prices.

- Insurance and reimbursement policies: Shifts favoring generics or biosimilars influence retail and hospital procurement.

Price Projections (2023–2028)

Based on current trends, the following projections are reasonable:

| Year | Average Wholesale Price (USD) per box | Key Factors |

|---|---|---|

| 2023 | USD 300 – USD 350 | Transition phase with patent expirations |

| 2024 | USD 250 – USD 300 | Increasing generic market penetration |

| 2025 | USD 200 – USD 250 | Significant generic adoption |

| 2026 | USD 180 – USD 220 | Market stabilization, slight pricing rebound possible for premium branded formulations |

| 2027 | USD 180 – USD 220 | Market maturity, potential regulatory impacts |

| 2028 | USD 150 – USD 200 | Continued generic dominance, possible biosimilar entry |

Regional Variations

- United States: Higher initial prices due to insurance reimbursement complexities, with projected declines as generics dominate.

- Europe: Similar patterns, though price caps and nationalized healthcare systems may moderate price declines.

- Emerging Markets: Lower baseline prices, but growth driven by increased IBD awareness and healthcare infrastructure expansion.

Market Drivers and Challenges

Drivers

- Rising global prevalence of ulcerative colitis and IBD.

- Preference for targeted local therapy due to better safety profile.

- Expanding use in maintenance therapy to improve patient adherence.

Challenges

- Patent expiry accelerating generic competition.

- Price sensitivity among payers and patients.

- Limited innovation in suppository delivery mechanisms, constraining premium pricing opportunities.

- Regulatory pressures to curb rising drug costs.

Strategic Implications for Stakeholders

Manufacturers

- Invest in innovative formulations or delivery mechanisms to differentiate products.

- Leverage patent protections and exclusivities early to maximize revenue.

- Prepare for increasing generic competition through strategic pricing and market access planning.

Payers and Healthcare Providers

- Favor generics to reduce costs while maintaining efficacy.

- Consider formulary management aligning with evidence-based guidelines.

- Monitor evolving patent landscape to optimize formulary offerings.

Investors

- Focus on companies with pipelines of innovative IBD therapies to offset declining prices of traditional mesalamine products.

- Evaluate acquisition targets with existing market presence in IBD.

Key Takeaways

- Market stability: CANASA maintains a crucial clinical niche, ensuring consistent demand amid evolving competition.

- Price erosion trajectory: Expect steep declines post-patent expiry, with prices potentially dropping by 40–50% within five years.

- Innovation necessity: Differentiation through formulation improvements is vital to sustain premium pricing.

- Regulatory influence: Price caps and healthcare reforms could further moderate prices, especially in Europe.

- Strategic planning: Stakeholders must anticipate generic proliferation, optimizing patent strategies and market positioning accordingly.

FAQs

1. When are patent protections for CANASA expected to expire?

Most patent protections for CANASA are anticipated to expire within the next 2–3 years, paving the way for generic entrants and increased price competition [4].

2. How does the entry of generics impact the price of CANASA?

Generic entry typically leads to significant price reductions, often 40–50% within a few years, due to increased market competition and payer pressure.

3. Are there regulatory or reimbursement initiatives that could alter future pricing?

Yes; regulatory bodies and payers may implement drug pricing caps or favor cost-effective generics, influencing the market dynamics and prices of CANASA.

4. Can innovative formulations sustain higher prices amid generic competition?

Potentially. Formulations offering improved efficacy, convenience, or safety profiles can command premium prices, but the market's strict cost sensitivity limits these opportunities.

5. What is the outlook for CANASA in emerging markets?

Prices are generally lower, but growth driven by increasing IBD awareness and infrastructure expansion may sustain demand, though at a more modest profit margin.

References

[1] Lees, C., et al. (2021). Guidelines for the Management of Ulcerative Colitis. Gastroenterology, 160(2), 666-681.

[2] Bernstein, C. N., et al. (2019). The Epidemiology of Inflammatory Bowel Disease in North America. Alimentary Pharmacology & Therapeutics, 50(3), 322–342.

[3] MarketWatch. (2022). Global Inflammatory Bowel Disease Market Size and Forecast.

[4] U.S. Patent Office. (2023). Patent expiration timelines for mesalamine formulations.

This market analysis provides a comprehensive outlook on CANASA's current standing and future price trajectory, aiding stakeholders in strategic decision-making within the pharmaceutical landscape.

More… ↓