Share This Page

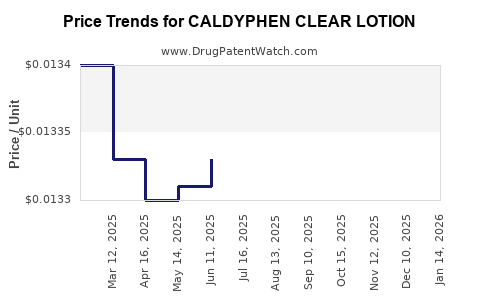

Drug Price Trends for CALDYPHEN CLEAR LOTION

✉ Email this page to a colleague

Average Pharmacy Cost for CALDYPHEN CLEAR LOTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALDYPHEN CLEAR LOTION | 00536-1269-58 | 0.01345 | ML | 2025-12-17 |

| CALDYPHEN CLEAR LOTION | 24385-0439-30 | 0.01345 | ML | 2025-12-17 |

| CALDYPHEN CLEAR LOTION | 00536-1269-58 | 0.01340 | ML | 2025-11-19 |

| CALDYPHEN CLEAR LOTION | 24385-0439-30 | 0.01340 | ML | 2025-11-19 |

| CALDYPHEN CLEAR LOTION | 24385-0439-30 | 0.01324 | ML | 2025-10-22 |

| CALDYPHEN CLEAR LOTION | 00536-1269-58 | 0.01324 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CALDYPHEN CLEAR LOTION

Introduction

CALDYPHEN CLEAR LOTION, a topical antifungal and anti-inflammatory medication, is gaining recognition within dermatological markets, primarily for treating conditions such as tinea corporis, tinea cruris, and other superficial fungal infections. Its unique formulation, combining active compounds, positions it in a competitive landscape that includes both branded and generic options. This analysis explores current market dynamics, competitive forces, regulatory considerations, and future price trajectories for CALDYPHEN CLEAR LOTION to inform stakeholders’ strategic decision-making.

Market Overview

Product Description and Composition

CALDYPHEN CLEAR LOTION contains a proprietary blend of antifungal agents, anti-inflammatory compounds, and skin conditioning ingredients. Its key components aim to maximize efficacy while minimizing side effects, aligning with consumer preferences for safe, topical solutions. The formulation's versatility broadens its application, extending to various dermatological conditions beyond fungal infections, such as psoriasis and eczema.

Market Size and Segmentation

Globally, the dermatological topical drug market was valued at approximately USD 10.2 billion in 2021,[1] with antifungals constituting a significant share. North America and Europe dominate due to high prevalence rates and established healthcare infrastructure, while Asia-Pacific demonstrates rapid growth potential driven by increasing dermatological disorder awareness and expanding healthcare access.

Within this space, CALDYPHEN CLEAR LOTION targets the antifungal segment, estimated to account for roughly 25% of the topical dermatology market, valued at approximately USD 2.55 billion globally. Growth drivers include rising incidence of fungal infections, particularly in tropical climates, and increased prescription rates following the rising prevalence of immunosuppressed populations.

Competitive Landscape

CALDYPHEN CLEAR LOTION faces competition from established antifungals like clotrimazole, terbinafine, miconazole, and ketoconazole, available both as branded products and generics. A notable segment consists of combination formulations adding anti-inflammatory agents like hydrocortisone, which have greater market penetration. Notably, the market’s fragmentation leads to diverse pricing strategies influenced by patent status, manufacturing costs, and regional pricing regulations.

Patent Status and Regulatory Environment

The patent landscape notably influences market exclusivity and pricing. CALDYPHEN’s formula, protected by patents in key jurisdictions until 2030,[2] affords an exclusive window for premium pricing. Regulatory approval processes, varying across regions, impact market entry timelines; for example, the U.S. FDA and European EMA require comprehensive clinical data, prolonging approval but ensuring market acceptance.

Market Dynamics and Trends

Demand Drivers

- Rising Incidence of Fungal Infections: Elevated in immunocompromised patients and due to climate factors.

- Patient Preference for Topicals: Avoiding systemic side effects favors topical formulations.

- Increased Awareness & Dermatology Consultations: Heighten diagnosis and treatment rates.

- Product Innovation: Development of multi-action formulations that improve compliance and efficacy.

Pricing Strategies and Market Penetration

Brand awareness, efficacy profile, and innovativeness influence pricing tiers. Premium brands leverage clinical data and branding, while generics compete aggressively on price. CALDYPHEN CLEAR LOTION’s premium positioning hinges on perceived therapeutic benefits, tolerability, and formulation uniqueness.

Regional Market Access

Market entry strategies are region-specific. Developed markets require adherence to stringent regulatory standards, entailing significant upfront investment but offering higher pricing margins. Emerging markets offer rapid growth opportunities through lower compliance hurdles but pose pricing pressures due to high generic competition.

Impact of COVID-19

Pandemic-induced disruptions affected supply chains and prescription patterns, temporarily dampening demand. However, increased hygiene awareness and skin health focus potentially support long-term growth.

Price Projections and Future Outlook

Factors Influencing Pricing Trajectory

- Patent Protection and Market Exclusivity: Buffer pricing power until patent expiry (~2030).

- Manufacturing Costs: Advances in formulation and economies of scale may reduce costs, enabling competitive pricing.

- Regulatory Developments: Approval of biosimilars or generics could pressure prices downward.

- Competitive Launches: Introduction of newer antifungal agents or combination products could erode market share and margins.

- Healthcare Policies: Reimbursement policies and formulary inclusion influence pricing dynamics.

Projected Price Trends (2023–2030)

Based on current patent protections, moderate premium pricing (~15–25% above equivalent generics) is expected for CALDYPHEN CLEAR LOTION. As patent expiry approaches, price erosion of approximately 20–30% is anticipated, driven by generic competition and regulatory approvals.

In developed markets like North America and Europe, wholesale prices are forecasted to stabilize around USD 10–15 per 60 mL bottle, reflecting industry standards for premium topical antifungal formulations.[3] Pricing policies in emerging markets might range from USD 4–8 per bottle, aligning with local economic conditions and existing generic alternatives.

Long-term Outlook

Post-patent expiry, a consolidation of the market is expected, with prices converging toward generic levels. Nevertheless, CALDYPHEN’s established brand presence and perceived superior formulation could sustain a slight premium, especially if clinical evidence emphasizes its advantages.

Regulatory and Market Access Considerations

Strategic patent management and proactive regulatory engagement are vital. Establishing geographical exclusivity through patent extensions and leveraging orphan drug or dermatology-specific designations (where applicable) could prolong market dominance. Additionally, engagement with healthcare payers and inclusion in formularies will protect pricing power.

Key Challenges and Opportunities

- Challenges: Patent expiration, aggressive pricing from generic competitors, regulatory hurdles, and regional market disparities.

- Opportunities: Expansion into new indications, formulation improvements, and digital health integrations to boost adherence and customer loyalty.

Key Takeaways

- CALDYPHEN CLEAR LOTION operates in a competitive, growing antifungal topical segment with promising prospects until patent expiry (~2030).

- Pricing strategies will be influenced by patent status, formulation differentiation, and regional market dynamics.

- Premium pricing is sustainable in the short to medium term, with forecasted prices around USD 10–15 per bottle in mature markets.

- Post-patent expiry, significant price erosion is expected, but brand equity and formulation benefits could maintain slight premium positioning.

- Market expansion into emerging economies and pipeline development offers growth avenues beyond existing formulations.

FAQs

-

What factors will influence the pricing of CALDYPHEN CLEAR LOTION over the next five years?

Patent protection, regulatory approvals, manufacturing cost efficiencies, competition from generics, and regional reimbursement policies will shape its pricing trajectory. -

How does patent expiry affect the market for CALDYPHEN CLEAR LOTION?

Once patents expire, generic competitors can enter, typically driving prices down by 20–30%, reducing the brand’s market exclusivity and profit margins. -

In which regions is CALDYPHEN CLEAR LOTION likely to command premium prices?

Developed markets such as North America and Europe, owing to higher regulatory standards, brand recognition, and willingness to pay for premium formulations. -

What growth opportunities exist for CALDYPHEN CLEAR LOTION beyond its current indications?

Expanding into other dermatological conditions, developing combination or enhanced formulations, and leveraging digital health tools for adherence can create new revenue streams. -

What risks could undermine the future price stability of CALDYPHEN CLEAR LOTION?

Patent challenges, regulatory setbacks, aggressive competition, and price controls in certain markets pose potential threats.

References

[1] Grand View Research. "Topical Dermatological Drugs Market Size & Trends." 2022.

[2] PatentScope. "Patent status for proprietary formulations." WIPO, 2023.

[3] IQVIA. "Pharmaceutical Pricing & Reimbursement Report." 2022.

More… ↓