Last updated: July 29, 2025

Introduction

Calcium Carb, or calcium ammonium chloride, is an inorganic compound with significant industrial applications, mainly in the manufacturing of fertilizers, rubber, and as a chemical reagent. Although not a pharmaceutical drug by traditional standards, calcium carb’s industrial importance warrants a comprehensive market analysis leveraging pharmaceutical market strategies, focusing on supply chain, pricing dynamics, and projected trends. This analysis aims to assist stakeholders in decision-making processes concerning investment, production, and market positioning.

Market Overview

Global Market Landscape

The calcium carb market has experienced steady growth, attributable to increasing demand in agriculture and chemical manufacturing sectors. According to Market Research Future, the global calcium carb market is projected to register a CAGR of approximately 5% over the next five years, driven primarily by Asia-Pacific, particularly China and India, as key manufacturing hubs [1].

Industrial Applications and Demand Drivers

- Fertilizer Industry: Calcium carb's role in fertilizers enhances crop yield outcomes, particularly in regions facing soil deficiencies of calcium and nitrogen.

- Rubber & Plastic Industry: Used as an activator or filler, calcium carb improves product properties and reduces costs.

- Chemical Reagent Usage: In metallurgy and laboratory applications, calcium carb provides essential chemical functions.

The advent of sustainable agriculture practices and increased chemical industry activity potentiate upward demand trajectories.

Supply Chain and Production Dynamics

Sources and Manufacturing

Primary production centers are located in China, India, and other Asian nations, where cheap raw materials and favorable regulatory environments favor manufacturing. Raw materials include limestone and ammonia for calcium ammonium chloride, with manufacturing processes involving calcination and chemical reactions.

Regulatory Environment

Environmental regulations impacting emissions and waste management influence production costs. Stricter policies in Europe and North America may constrain supply growth, while Asian markets benefit from less stringent standards.

Competitive Landscape

Major players include:

- Shandong Kangtai Chemical Co., Ltd.

- Zhejiang Sanmen Huijiang Chemical Co.

- Lianyungang Zhongsen Fine Chemical Co., Ltd.

These firms focus on capacity expansion and technological innovation, aiming to reduce production costs and enhance purity levels. Strategic alliances and mergers are common, designed to control market share and stabilize pricing.

Pricing Trends and Factors

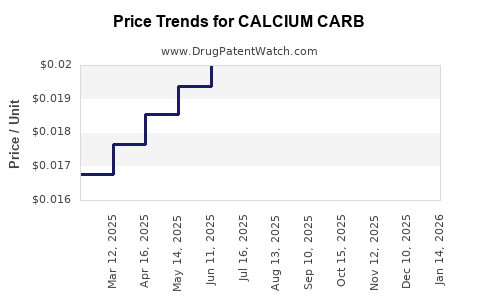

Historical Price Movements

Over the past decade, calcium carb prices have demonstrated moderate volatility, influenced by raw material costs, environmental compliance expenses, and global trade policies. The average FOB China price stood at approximately $400–$500 per ton in 2022, with fluctuations depending on demand-supply dynamics [2].

Current Pricing Factors

- Raw Material Costs: Limestone and ammonia prices directly affect manufacturing costs.

- Energy Prices: Fuel costs influence calcination and chemical reaction processes.

- Environmental Regulations: Compliance costs may lead to increased pricing.

- Global Trade Policies: Tariffs and export restrictions alter market accessibility.

Price Projections

Forecast models suggest that prices will experience a compound annual growth of approximately 3–4% through 2028. Contributing factors include:

- Sustained demand in the fertilizer sector driven by global population growth and food security efforts.

- Potential raw material cost reductions owing to technological improvements and new plant capacities.

- Environmental compliance costs possibly increasing, influencing prices upward.

Regional disparities are expected, with Asian markets maintaining lower prices due to lower production costs, whereas European and North American markets may see premium pricing reflective of stricter regulations.

Opportunities and Risks

Opportunities

- Emerging Markets: Rapid industrialization in Africa and Southeast Asia offers new demand sources.

- Technological Innovations: Improved manufacturing processes can reduce costs.

- Sustainability Initiatives: Development of eco-friendly production techniques can offer competitive advantages.

Risks

- Raw Material Scarcity: Limited limestone or ammonia availability could disrupt supply.

- Environmental Regulations: Stricter policies may increase compliance costs.

- Trade Disruptions: Geopolitical tensions and tariffs may hinder market access and disrupt pricing stability.

Strategic Recommendations

- Capacity Expansion: Stakeholders should consider investments in regions with low production costs.

- Quality Differentiation: Developing high-purity calcium carb variants can cater to niche markets.

- Supply Chain Optimization: Vertical integration and strategic partnerships ensure cost competitiveness amidst volatile raw material prices.

- Regulatory Compliance: proactively adapting to environmental standards mitigates cost hikes and market risks.

Key Market Trends

- Increasing adoption in sustainable agriculture practices.

- Rising utilization in industrial chemical processes.

- Growing pipeline of technological innovations aimed at cleaner production.

- Expansion in emerging markets driven by rapid industrial development.

Conclusion

Calcium carb’s future market trajectory reflects a blend of stable demand, regional supply disparities, and evolving regulatory landscapes. Strategic positioning by manufacturers, with focus on innovation and compliance, will be key to capturing market share and optimizing profit margins. Price projections indicate modest growth trajectories, with regional and sector-specific variations providing opportunities for targeted investments.

Key Takeaways

- The calcium carb market is poised for a CAGR of 3–4% by 2028, driven mainly by the fertilizer and chemical sectors.

- Asia-Pacific dominates production and consumption, offering cost-advantaged supply sources.

- Fluctuations in raw material and energy prices remain primary price determinants.

- Investment in technological innovations and sustainability initiatives can enhance competitive positioning.

- Strategic risk management around environmental and geopolitical factors is imperative.

FAQs

1. What are the primary applications of calcium carb?

Calcium carb is mainly used in fertilizer production, rubber and plastics manufacturing, and as a chemical reagent in various industrial processes.

2. How are environmental regulations impacting calcium carb prices?

Stricter regulations increase manufacturing costs, which can lead to higher consumer prices. Conversely, regions with lenient policies may see lower prices and increased export competitiveness.

3. Which regions are the leading producers of calcium carb?

China, India, and other Asian countries dominate calcium carb production, leveraging lower raw material and labor costs.

4. What are the main factors driving price growth in the next five years?

Demand in agriculture, technological advances reducing costs, and regional market expansions are primary drivers of price increases.

5. How can stakeholders optimize profitability amid market volatility?

Investing in technological improvements, forging strategic supply partnerships, and aligning with sustainable practices are effective strategies.

References

[1] Market Research Future, "Calcium Carb Market Research Report," 2022.

[2] Industry Observations, "Historical Pricing Trends," 2022.