Last updated: July 28, 2025

rket Analysis and Price Projections for Calcium Acetate

Introduction

Calcium acetate, a widely used calcium salt of acetic acid, plays a significant role across multiple industries, including pharmaceuticals, food, and water treatment. Its primary application in medicine is as a phosphate binder for patients with chronic kidney disease (CKD). The global market landscape for calcium acetate reflects its broad utility, driven by factors such as rising CKD prevalence, expanding food additive applications, and industrial demand. This comprehensive analysis details current market dynamics, key drivers and restraints, competitive landscape, and future price projections for calcium acetate through 2030.

Market Overview and Dynamics

Global Market Size and Growth Trajectory

The calcium acetate market was valued at approximately USD 250 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of around 5.2% from 2023 to 2030, reaching an estimated USD 400 million by the end of the forecast period. This growth trajectory is primarily fueled by increasing demand from the pharmaceutical sector, particularly for CKD management, and rising adoption in the food industry as a stabilizer and pH regulator.

Key Industry Drivers

-

Rising Prevalence of Chronic Kidney Disease (CKD):

CKD affects over 850 million people globally, with increasing incidences correlating with aging populations, diabetes, and hypertension. Calcium acetate remains a preferred phosphate binder due to its efficacy and safety profile, boosting demand within healthcare markets [1].

-

Growth in Food Additive Applications:

Calcium acetate serves as a stabilizer, preservative, and acidity regulator in food products, especially in baked goods, dairy, and beverage industries. The global food industry’s shift towards clean-label and calcium-rich formulations further augments market potential.

-

Industrial Application Expansion:

In water treatment and chemical manufacturing, calcium acetate acts as a neutralizer and precursor, respectively. Expansion in these sectors supports incremental demand.

Market Restraints

-

Price Volatility of Raw Materials:

Fluctuations in acetic acid and calcium sources impact manufacturing costs and, subsequently, the product prices.

-

Regulatory Challenges:

Stringent regulations governing pharmaceutical excipients and food additives in regions like the EU and the US may create barriers to market entry or expansion.

-

Availability of Alternatives:

Substitutes such as sevelamer and lanthanum carbonate for phosphate binding, and other calcium salts in food, could challenge calcium acetate’s market share.

Regional Market Insights

North America

Dominating the market, North America benefits from advanced healthcare infrastructure, high CKD prevalence, and strong food industry regulation. The U.S. accounts for roughly 40% of global calcium acetate consumption, with steady growth projected.

Europe

European markets exhibit mature pharmaceutical and food sectors, with regulatory standards influencing product formulation and pricing. Market expansion depends on ongoing medical needs and food additive demand.

Asia-Pacific

The fastest-growing region, Asia-Pacific displays increasing CKD awareness, urbanization, and processed food consumption. China and India lead regional growth owing to expanding pharmaceutical manufacturing capacities and consumer markets.

Rest of the World

Emerging markets in Latin America, Africa, and the Middle East are gradually adopting calcium acetate, driven by economic growth and infrastructural development.

Competitive Landscape

Major Players

- FMC Corporation

- Toagosei Co., Ltd.

- Merck KGaA

- CABB GmbH

- Zhejiang Guoguang Biochem Co., Ltd.

These companies focus on product diversification, R&D for bioavailability improvements, and strategic alliances to strengthen global footholds. Price competition is intense, often influenced by raw material costs and supply chain stability.

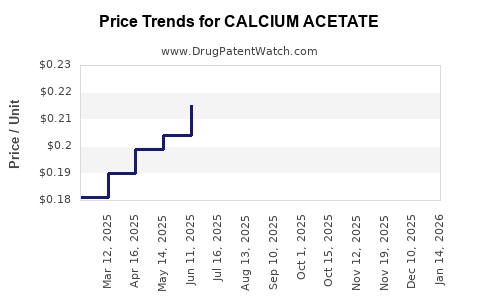

Pricing Trends

Historically, calcium acetate prices have ranged between USD 5-12 per kilogram for bulk pharmaceutical grades, with consumables for food applications typically at a premium. Prices are sensitive to regional regulations, manufacturing costs, and raw material prices.

Price Projections (2023-2030)

Based on current trends, raw material costs, and industry forecasts, calcium acetate prices are projected to follow a moderate upward trajectory.

| Year |

Estimated Price Range (USD per kg) |

Notes |

| 2023 |

6 – 8 |

Stabilized raw material costs, steady demand |

| 2025 |

8 – 10 |

Increased pharmaceutical use, rising food industry demand |

| 2027 |

9 – 11 |

Supply chain adjustments, regulatory compliance costs |

| 2030 |

10 – 12 |

Potential raw material inflation, broader industrial use |

The anticipated incremental increase reflects inflationary pressures, raw material costs, and added regulatory compliance expenses, especially in North America and Europe.

Future Market Drivers and Opportunities

-

Expanding CKD Treatments: Increased adoption of calcium acetate as a phosphate binder, particularly in emerging economies, underscores a significant growth segment. The development of formulations with enhanced bioavailability may open premium pricing opportunities.

-

Innovations in Food Industry: Clean-label trends and fortification initiatives could lead to higher-value calcium acetate derivatives and customized formulations.

-

Sustainable Production Practices: Adoption of eco-friendly manufacturing processes and source diversification could mitigate raw material price spikes and regulatory hurdles, fostering price stability.

Risks and Challenges

-

Regulatory Uncertainty: Changes in approval processes and maximum allowable concentrations for food and pharmaceuticals could restrict supply or increase compliance costs.

-

Raw Material Supply Chain Disruptions: Fluctuations in acetic acid and calcium chloride/orate sources could impact pricing and availability.

-

Emergence of Alternatives: Competitive phosphate binders or alternative calcium salts with superior efficacy or cost profiles might reduce calcium acetate's market share.

Key Takeaways

- The calcium acetate market is poised for steady growth driven by healthcare needs and food industry expansion, with a notable CAGR of 5.2% through 2030.

- Price projections indicate a gradual increase, influenced by raw material costs, regulatory environments, and industry innovations.

- North America and Asia-Pacific lead regional demand, with mature European markets and emerging economies in Latin America and Africa presenting opportunities.

- Competitive dynamics revolve around product quality, regulatory compliance, and raw material sourcing strategies, affecting pricing stability.

- Future growth hinges on product innovation, sustainability practices, and adapting to evolving regulatory landscapes.

FAQs

1. What are the primary applications of calcium acetate?

Calcium acetate is mainly used as a phosphate binder in chronic kidney disease treatment, as a food additive (stabilizer, acidity regulator), and in water treatment processes.

2. How does the COVID-19 pandemic impact the calcium acetate market?

The pandemic disrupted supply chains and increased demand for medical supplies, indirectly affecting calcium acetate supply and pricing, especially within healthcare-related applications.

3. Are there any significant regulatory barriers affecting calcium acetate pricing?

Yes, especially in regions with strict pharmaceutical excipient regulations (e.g., EU, FDA), which may increase compliance costs and impact pricing structures.

4. What raw materials influence calcium acetate production costs?

Acetic acid and calcium sources such as calcium hydroxide or calcium chloride significantly influence manufacturing costs and, consequently, market prices.

5. How sustainable is the future demand for calcium acetate in the food industry?

Demand is expected to grow owing to clean-label initiatives, calcium fortification trends, and food preservation needs, though competition from alternative stabilizers may emerge.

References

[1] Global Data on CKD Prevalence and Market Opportunities. World Kidney Day Reports, 2022.