Share This Page

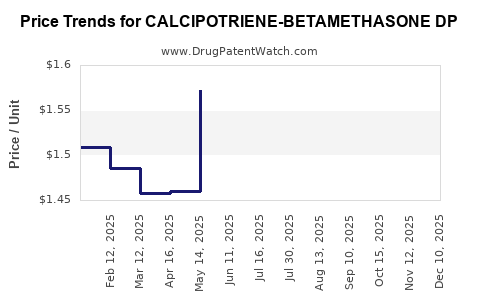

Drug Price Trends for CALCIPOTRIENE-BETAMETHASONE DP

✉ Email this page to a colleague

Average Pharmacy Cost for CALCIPOTRIENE-BETAMETHASONE DP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% OINTMENT | 66993-0938-65 | 1.59463 | GM | 2025-12-17 |

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% SUSPENSION | 00713-0848-60 | 2.41408 | GM | 2025-12-17 |

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% OINTMENT | 66993-0938-61 | 2.34872 | GM | 2025-12-17 |

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% SUSPENSION | 51672-1402-04 | 2.41408 | GM | 2025-12-17 |

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% OINTMENT | 45802-0816-01 | 1.59463 | GM | 2025-12-17 |

| CALCIPOTRIENE-BETAMETHASONE DP 0.005%-0.064% SUSPENSION | 63646-0040-60 | 2.41408 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Calcipotriene-Betamethasone DP

Introduction

Calcipotriene-Betamethasone DP represents a topical combined therapy primarily utilized in dermatology, notably for psoriasis treatment. This fixed-dose combination merges calcipotriene (calcipotriol), a vitamin D analog, with betamethasone dipropionate (DP), a potent glucocorticoid. The combination offers synergistic efficacy, reducing psoriasis symptoms such as scaling, erythema, and inflammation while minimizing steroid-related side effects through lower corticosteroid dosing.

The global market for psoriasis treatments is expanding, driven by increasing prevalence, aging populations, and rising awareness. As a result, calcipotriene-betamethasone DP’s positioning within this landscape warrants rigorous market analysis and pricing forecasts.

Market Overview and Size

Global Psoriasis Market Dynamics

The global psoriasis market is projected to reach approximately USD 15.8 billion by 2027, with a compound annual growth rate (CAGR) of around 9.2% from 2022 to 2027, as per reports from Grand View Research. The North American and European regions dominate the market due to robust healthcare infrastructure, high disease awareness, and regulatory approvals.

Market Penetration of Topical Combinations

Topical therapies, especially fixed-dose combinations like calcipotriene-betamethasone DP, represent a rapidly growing segment. They are preferred due to their ease of use, reduced systemic absorption, and favorable efficacy profiles. The market for topical psoriasis formulations is slated to reach USD 4.2 billion by 2025, with an annual growth rate of approximately 8%.[1]

Key Players and Patent Landscape

Major pharmaceutical companies such as Leo Pharma, Novartis, and Dr. Reddy’s Laboratories dominate the market, offering formulations of calcipotriene-betamethasone. Patent expiries and biosimilar entries significantly influence market competition and pricing strategies, especially post-Patent Cliff (anticipated in 2024–2026).

Market Dynamics and Drivers

- Rising Psoriasis Prevalence: Estimated at approximately 2-3% globally, with higher rates in developed countries.[2]

- Advancement in Topical Therapies: Enhanced formulations improve patient adherence and outcomes.

- Increasing Awareness and Diagnosis: Early detection and treatment, especially among aging populations.

- Regulatory Approvals: Clearances for new formulations and indications expand market opportunities.

Regulatory Environment

Regulatory pathways for dermatological drugs vary globally, with the FDA and EMA providing pathways for both new and generic formulations. Patent protections are critical for maintaining market exclusivity; however, patent cliffs open opportunities for biosimilars and generics, influencing price levels.

Pricing Analysis

Current Price Benchmarks

In developed markets like the US and Europe, the average wholesale price (AWP) for calcipotriene-betamethasone DP formulations ranges between USD 180 and USD 250 for a 60-gram tube, with branded products commanding higher premiums.[3] Generic formulations, where available, are priced approximately 15-25% lower, promoting affordability.

Factors Affecting Price Points

- Formulation and Concentration: Higher potency or increased quantity typically command premium pricing.

- Brand vs. Generic: Brand-name formulations maintain premium pricing due to perceived efficacy and trust.

- Manufacturing Costs: Complex manufacturing processes and quality control influence cost structures.

- Market Competition: Entry of biosimilars/existing generics exerts downward pressure.

- Regional Price Regulations: Government regulations, especially in low- and middle-income countries, cap prices to improve accessibility.

Price Projections (2023-2030)

Based on historical data, market trends, and anticipated patent expiries:

| Year | Price Range (USD per 60g tube) | Key Influencing Factors |

|---|---|---|

| 2023 | USD 180 – USD 250 | Stable post-pandemic demand, limited biosimilar presence |

| 2024 | USD 150 – USD 230 | Patent expiries lead to biosimilar/narrower margins |

| 2025 | USD 130 – USD 210 | Increased biosimilar competition, regulatory pricing policies |

| 2026 | USD 120 – USD 200 | Generics gain market share, price stabilization |

| 2027 | USD 110 – USD 190 | Market saturation, innovations in formulations |

| 2028-2030 | USD 100 – USD 180 | Mature market, standardization and cost reduction |

Note: Prices are indicative and adjusted for regional variances and ongoing patent landscapes. Biosimilar entry and pricing pressures will significantly influence these projections.

Regional Market Considerations

- North America: Price premiums maintained due to high healthcare standards and brand loyalty. Growth driven by psoriasis prevalence and escalating healthcare spending.

- Europe: Similar trends with a focus on biosimilar competition. The European Medicines Agency (EMA) supports cost-effective generic substitution.

- Asia-Pacific: Rapid market growth due to rising psoriasis cases, increasing healthcare investments, and affordability-driven pricing strategies. Price points are notably lower, ranging between USD 50 and USD 150 per tube.

- Latin America and Africa: Price sensitivity prevails, with prices often 40-60% lower than in Western markets.

Emerging Trends Impacting Market and Pricing

- Biosimilar and Generic Competition: These entries threaten premium pricing models, especially post-patent expiration.

- Formulation Innovations: Incorporation of nanotechnology or novel delivery systems could command higher prices.

- Digital Health Integration: Teledermatology and remote monitoring could influence prescribing habits, impacting demand.

- Regulatory Reforms: Cost-containment policies in regions like the EU and Asia may cap prices further.

Conclusion: Strategic Implications

Market players must stay vigilant about patent expirations and biosimilar entrants. Differentiating through formulation innovation, expanding regional access, and optimizing manufacturing costs will enable sustained profitability. The pricing trajectory suggests continued downward pressure, fostering competitive advantages through cost leadership, while premium positioning remains viable if tied to novel delivery mechanisms or superior efficacy.

Key Takeaways

- The global psoriasis market is expansive, with calcipotriene-betamethasone DP playing a significant role in topical therapy segments.

- Price projections indicate a gradual decline from an average of USD 180-250 in 2023 to approximately USD 100-180 by 2030, driven by biosimilar competition and patent expiries.

- Regional disparities significantly influence pricing strategies, with developed markets maintaining higher prices and emerging markets favoring affordability.

- Successful commercialization hinges on innovation, regulatory navigation, and strategic positioning relative to biosimilar entrants.

- Monitoring patent expiry timelines and market entry of biosimilars is crucial for forecasting revenue and adjusting pricing strategies.

FAQs

Q1: How does patent expiration impact the pricing of calcipotriene-betamethasone DP?

Patent expiry typically leads to increased biosimilar and generic entries, prompting price reductions of approximately 20-40% over subsequent years due to heightened competition.

Q2: What factors influence regional pricing differences for this drug?

Factors include healthcare system policies, regulatory pricing controls, local manufacturing costs, market demand, and purchasing power.

Q3: Are biosimilars available for calcipotriene-betamethasone DP?

Biosimilars are more common for biologics; since calcipotriene and betamethasone are small molecules, bios-analogues are classified as generics, which are increasingly entering markets post-patent expiry.

Q4: What innovation trends could sustain higher prices?

Formulation advancements such as nanoencapsulation, sustained-release topical systems, or combination therapies with enhanced efficacy could justify premium pricing.

Q5: How can manufacturers strategically prepare for market shifts?

Investing in formulation innovation, expanding regional market access, securing patent protections, and engaging in cost-efficient manufacturing will be critical strategies.

References

[1] Grand View Research, "Psoriasis Treatment Market Size & Share Analysis," 2021.

[2] World Health Organization, "Coverage of Psoriasis Treatment," 2020.

[3] IQVIA, "Topical Dermatological Drugs Pricing and Market Trends," 2022.

More… ↓