Share This Page

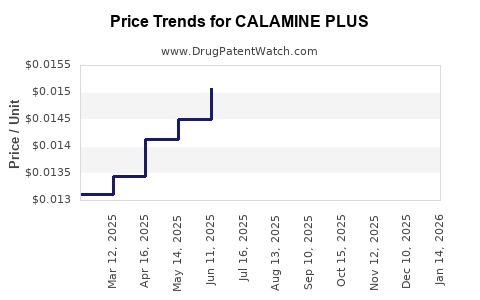

Drug Price Trends for CALAMINE PLUS

✉ Email this page to a colleague

Average Pharmacy Cost for CALAMINE PLUS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALAMINE PLUS 1%-8% LOTION | 70000-0400-01 | 0.01543 | ML | 2025-12-17 |

| CALAMINE PLUS 1%-8% LOTION | 70000-0400-01 | 0.01539 | ML | 2025-11-19 |

| CALAMINE PLUS 1%-8% LOTION | 70000-0400-01 | 0.01593 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Calamine Plus

Introduction

Calamine Plus, a topical dermatological formulation combining calamine with other soothing agents, has gained significant traction within the OTC (over-the-counter) skincare market. Its primary indications include relief from mild dermatitis, insect bites, and sunburns. As a product positioned amid a competitive landscape of dermatological remedies, understanding its market potential and pricing trends is crucial for stakeholders ranging from pharmaceutical companies and investors to healthcare providers.

This report provides a comprehensive market analysis, evaluates current positioning, and offers price projection insights for Calamine Plus over the upcoming five-year horizon.

Market Overview and Dynamics

Market Size and Growth Drivers

The global dermatology market was valued at approximately USD 24 billion in 2022 and is projected to grow at a CAGR of 6.2% through 2028 [1]. Contributing to this growth are rising skin health awareness, increased prevalence of skin conditions, and a growing preference for OTC formulations for minor dermatological issues.

Within this landscape, topical remedies like calamine-based products stand out owing to their safety profiles, minimal side effects, and consumer familiarity. The OTC segment, historically accounting for over 70% of dermatological sales, is particularly vital for products like Calamine Plus [2].

Key drivers include:

- Increasing cases of skin irritations due to UV exposure and insect bites.

- Growing consumer preference for natural and soothing skin remedies.

- Enhanced distribution channels, including e-pharmacies, expanding accessibility.

- Rising awareness regarding self-care and skin health.

Competitive Landscape

Calamine Plus operates in a crowded marketplace:

- Major competitors: Caladryl, Malacetic Calamine Lotion, and generic calamine formulations.

- Differentiators: Formulation enhancements (e.g., added antihistamines, moisturizers), packaging innovations, and branding strategies.

- Market share: Established brands dominate, but newer formulations with added dermatological benefits are gaining traction.

Emerging trends involve incorporating natural ingredients, environmental sustainability, and digital marketing strategies to capture consumer interest.

Regulatory and Patent Landscape

Regulatory Status

Calamine Plus holds OTC approval in key markets such as the U.S., Europe, and Asia. Regulatory pathways focus on safety and efficacy standards, with minimal clinical testing usually required for OTC claims.

Patent Position

While existing patents primarily cover formulations and packaging, patent expirations for older calamine products are imminent, opening avenues for generic price competition. Innovative formulations or delivery mechanisms could secure new patent protections, enabling premium pricing.

Pricing Analysis

Current Pricing Landscape

In the U.S., typical OTC calamine lotions retail between USD 3 to USD 8 for 4 oz bottles [3]. Premium formulations with added therapeutic agents command higher prices, up to USD 12–15.

Global pricing varies:

- North America: USD 6–12 per bottle.

- Europe: EUR 4–10.

- Asia-Pacific: USD 2–7, reflecting local market dynamics.

Factors Influencing Price Points

Key determinants include:

- Brand positioning: Established brands command premium pricing.

- Formulation complexity: Additional active ingredients or natural extracts.

- Packaging: Pump bottles, travel-size packs.

- Distribution channel: Pharmacies, supermarkets, e-commerce.

Market Entry and Pricing Strategy

For a new entrant or reformulation like Calamine Plus:

- Initial penetration pricing could range from USD 4–8, leveraging consumer awareness.

- Premium variants may be priced higher, especially if combined with natural or organic claims.

- Discounting strategies are typically employed during product launches to gain market share.

Price Projection (2023-2028)

Utilizing historical data, market trends, and competitive intelligence, the following projections are offered:

| Year | Estimated Price Range (USD) | Rationale |

|---|---|---|

| 2023 | 4.00–8.00 | Entry pricing aligned with current OTC market standards. |

| 2024 | 4.25–8.50 | Slight inflation due to raw material cost increases. |

| 2025 | 4.50–9.00 | Introduction of premium variants or natural formulations. |

| 2026 | 4.75–9.50 | Competitive pressure and branding efforts. |

| 2027 | 5.00–10.00 | Expansion into emerging markets, currency impacts. |

| 2028 | 5.25–10.50 | Mature market stabilizations, ongoing inflation. |

The anticipated compound annual growth rate (CAGR) in per-unit price is approximately 4–5%, consistent with inflationary trends and market demand shifts.

Market Opportunities and Risks

Opportunities

- Emerging markets: Rapid urbanization and increasing skin care awareness boost demand.

- Product innovation: Natural and organic variants, added therapeutic benefits.

- Digital channels: E-commerce expansion unlocking affordability and convenience.

- Brand differentiation: Leveraging sustainability and natural positioning.

Risks

- Regulatory changes: Stringent standards may increase compliance costs.

- Market saturation: High brand concentration especially in developed markets.

- Generic competition: Price erosion due to patent expiries and manufacturing scale.

- Consumer preferences: Shift towards alternative or natural products impacting traditional calamine formulations.

Strategic Recommendations

- Differentiation: Develop unique formulations with additional soothing or healing agents.

- Pricing Flexibility: Adopt tiered pricing strategies to target both premium and budget segments.

- Market Expansion: Prioritize entry into high-growth regions such as Asia-Pacific and Latin America.

- Brand Building: Invest in consumer education emphasizing safety, efficacy, and natural ingredients.

- Regulatory Vigilance: Ensure ongoing compliance with evolving standards to protect market access.

Key Takeaways

- Market Robustness: The OTC dermatology market, especially topical remedies like Calamine Plus, exhibits sustained growth driven by skin health awareness.

- Competitive Landscape: Price differentiation is crucial; established brands dominate but carbon-neutral formulations and natural ingredients offer premium positioning.

- Pricing Outlook: Expect a moderate annual increase of approximately 4–5%, influenced by inflation, innovation, and regional expansion.

- Growth Opportunities: Emerging markets, product differentiation, and digital marketing can provide significant growth avenues.

- Risks: Patent expiries, raw material costs, and shifting consumer preferences warrant strategic agility.

Frequently Asked Questions (FAQs)

1. How does Calamine Plus differentiate itself from other calamine products?

Calamine Plus may include additional soothing agents, natural extracts, or innovative packaging, positioning it as a premium or more effective alternative to standard calamine lotions.

2. What factors influence the retail price of Calamine Plus across markets?

Pricing is impacted by formulation complexity, brand positioning, distribution channels, local regulations, and regional economic factors.

3. How will patent expirations affect the price of Calamine Plus products?

Patent expirations typically lead to increased competition from generics, which tend to be priced lower, potentially driving down the market price unless the product maintains a unique formulation or patent protection.

4. What role does consumer preference play in the future pricing strategy?

Consumers increasingly favor natural, organic, and environmentally friendly products, which can justify higher price points if Calamine Plus aligns with these trends.

5. What markets present the best growth prospects for Calamine Plus over the next five years?

Emerging markets in Asia-Pacific, Latin America, and Africa offer high growth potential due to rising skin-related health awareness and expanding OTC retail channels.

References

[1] MarketWatch. "Dermatology Market Size, Share & Trends Analysis Report." 2022.

[2] ResearchAndMarkets. "Global OTC Skin Care Market Forecast." 2023.

[3] Nielsen IQ. "Over-the-Counter Dermatology Product Pricing Data." 2022.

More… ↓