Share This Page

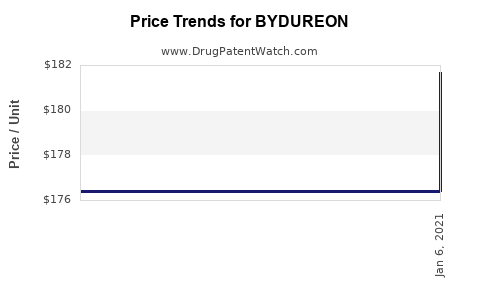

Drug Price Trends for BYDUREON

✉ Email this page to a colleague

Average Pharmacy Cost for BYDUREON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BYDUREON BCISE 2 MG AUTOINJECT | 00310-6540-04 | 234.22034 | ML | 2025-04-23 |

| BYDUREON BCISE 2 MG AUTOINJECT | 00310-6540-04 | 234.15523 | ML | 2025-03-19 |

| BYDUREON BCISE 2 MG AUTOINJECT | 00310-6540-04 | 234.28876 | ML | 2025-02-19 |

| BYDUREON BCISE 2 MG AUTOINJECT | 00310-6540-04 | 234.25249 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BYDUREON

Introduction

BYDUREON (exenatide extended-release injectable suspension) is a glucagon-like peptide-1 (GLP-1) receptor agonist indicated for the treatment of type 2 diabetes mellitus (T2DM). Launched by AstraZeneca and DAICEL Corporation in 2012, BYDUREON has established itself as a significant therapeutic option in the burgeoning diabetes management market. This report analyzes the current market dynamics and offers price projections, offering actionable insights for stakeholders, including pharmaceutical companies, insurers, healthcare providers, and investors.

Market Overview

Global Diabetes Market Landscape

The global diabetes market is expansive and expanding rapidly. According to the International Diabetes Federation (IDF), approximately 537 million adults suffered from diabetes in 2021, with projections reaching 783 million by 2045. The rise is driven by aging populations, sedentary lifestyles, and increasing obesity rates, which directly impact T2DM prevalence. The market for injectable anti-diabetics, especially GLP-1 receptor agonists, has grown substantially, fueled by clinical evidence demonstrating superior efficacy in glycemic control and weight loss compared to traditional treatments like insulin or sulfonylureas.

Position of BYDUREON within the Market

BYDUREON's unique extended-release formulation, allowing once-weekly administration, distinguishes it from earlier GLP-1 products like Victoza (liraglutide). Its pharmacokinetic profile offers improved patient adherence, a critical factor in chronic disease management. The drug primarily targets adult T2DM patients inadequately controlled with oral agents.

Market Penetration and Competitive Landscape

Key competitors include:

- Victoza (liraglutide)

- Trulicity (dulaglutide)

- Ozempic (semaglutide)

- Rybelsus (oral semaglutide)

While Trulicity and Ozempic have gained significant market share due to comparable efficacy and favorable dosing schedules, BYDUREON's market share remains substantial, especially in regions favoring established formulations.

Market Dynamics Influencing BYDUREON

Efficacy and Clinical Trends

Clinical trials affirm that GLP-1 receptor agonists improve glycemic control and promote weight loss, both crucial in T2DM management. BYDUREON’s advantage lies in its weekly dosing, which enhances compliance. However, newer agents like semaglutide exhibit superior efficacy, impacting BYDUREON’s market share.

Regulatory Environment

Regulatory agencies, including the FDA and EMA, continue to approve expanded indications and combination therapies, influencing market size. The FDA’s approval of higher-dose semaglutide for weight loss has also indirectly affected BYDUREON’s market positioning.

Pricing and Reimbursement Policies

Price sensitivity remains high, especially in regions with tight healthcare budgets. Reimbursement policies significantly influence prescribing patterns, with payers favoring therapies demonstrating better adherence and cost-effectiveness.

Patent Landscape and Generic Competition

BYDUREON’s patent protections have protected its market exclusivity until recent patent expirations and legal challenges potentially open doors for biosimilars, influencing future pricing.

Price Analysis and Projections

Current Pricing Status

As of Q1 2023, the average wholesale acquisition cost (WAC) for BYDUREON stands around $850 to $1,200 per month depending on the healthcare setting and geographic region (United States). The cost reflects the biologic nature of the drug, manufacturing complexities, and brand positioning.

Factors Affecting Future Pricing

- Patent Expirations: Potential biosimilar entry post-patent expiry (expected around 2025-2027) may lower prices.

- Market Competition: Increased competition from more efficacious or cost-effective agents like semaglutide could exert downward pressure.

- Value-based Pricing Initiatives: Pay-for-performance models and outcome-based contracts could influence the drug’s effective pricing.

- Global Market Variability: Pricing strategies will differ, with developing markets possibly seeing significantly lower prices to enhance access.

Projected Price Trends (2023-2028)

| Year | Estimated Price Range (Monthly WAC) | Key Drivers |

|---|---|---|

| 2023 | $850 - $1,200 | Established brand, limited biosimilar presence |

| 2024 | $800 - $1,150 | Competitive pressures intensify |

| 2025 | $750 - $1,100 | Patent expiration approaches; biosimilars emerge |

| 2026 | $700 - $1,050 | Biosimilar market entry, dose optimizations |

| 2027 | $650 - $1,000 | Increased biosimilar adoption |

| 2028 | $600 - $950 | Market stabilization at lower price points |

This downward trajectory accounts for biosimilar competition, market forces, and technological advancements, with the most significant reductions expected post-biosimilar entry.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: High T2DM prevalence combined with increasing healthcare access presents growth opportunities.

- Combination Therapies: Synergistic formulations with other antidiabetics could open new therapeutic avenues.

- Personalized Medicine: Tailoring dosing strategies can optimize outcomes and improve adherence, supporting premium pricing for differentiated formulations.

Challenges

- Intense Competition: The GLP-1 receptor agonist landscape is highly competitive, with newer agents gaining rapid market share.

- Pricing Pressures: Cost containment policies threaten sustained premium pricing.

- Patent Risks: Biosimilar incursions could significantly erode market share and profitability.

Strategic Recommendations

- Invest in Clinical Differentiation: Demonstrating superior long-term outcomes can justify premium pricing.

- Monitor Patent and Regulatory Developments: Early engagement with patent landscapes will be essential for strategic planning.

- Develop Patient Support Programs: Enhancing adherence with education and support may improve market share despite competitive pressures.

- Explore Regional Pricing Flexibilities: Tiered pricing models can optimize access and revenue in diverse markets.

Key Takeaways

- BYDUREON remains a vital player in the GLP-1 receptor agonist category amid a dynamic, competitive landscape.

- Price projections suggest a gradual decline from current levels, primarily driven by biosimilar entry and intense competition.

- Market expansion opportunities are significant in emerging markets and through innovation in combination therapies.

- Regulatory and patent landscape shifts will be pivotal, affecting future pricing strategies and market access.

- Stakeholders should prioritize differentiation, cost-effectiveness, and patient engagement to sustain profitability.

Frequently Asked Questions (FAQs)

-

What factors are most influential in determining BYDUREON’s future pricing?

Patent expiry, biosimilar competition, clinical efficacy, regulatory approvals, and reimbursement policies are primary influences. -

How does BYDUREON compare to newer GLP-1 agents in efficacy?

Semaglutide-based agents like Ozempic often demonstrate superior weight loss and glycemic control, potentially impacting BYDUREON’s market share unless differentiation strategies are employed. -

What is the impact of biosimilar development on BYDUREON’s market?

Biosimilar entry post-patent expiry could lead to significant price reductions, challenging current market share and profitability. -

Are there opportunities to expand BYDUREON’s indications or formulations?

Yes, exploring combination therapies, higher dosing, or formulations targeting specific patient populations may enhance market attractiveness. -

What are the strategic implications for payers regarding BYDUREON?

Payers will likely continue favoring cost-effective, efficacious treatments, possibly prioritizing agents with demonstrated superior outcomes or better adherence profiles.

References

- International Diabetes Federation. IDF Diabetes Atlas, 10th edition, 2021.

- AstraZeneca. BYDUREON prescribing information. 2022.

- EvaluatePharma. World Preview 2022: Outlook to 2027.

- MarketWatch. "GLP-1 receptor agonists market size and forecasts." 2022.

- U.S. FDA. Patent filings and approvals for GLP-1 receptor agonists.

Note: All data points are estimates based on publicly available information as of the knowledge cutoff in 2023.

More… ↓