Last updated: July 28, 2025

Introduction

Butenafine Hydrochloride (HCl) is a potent antifungal agent primarily used in topical formulations to treat dermatophyte infections such as tinea corporis, tinea cruris, and tinea pedis. Approved in several markets, including the United States and Europe, it has gained significant clinical traction owing to its efficacy and minimal systemic absorption. This report offers a comprehensive analysis of the current market landscape and price projection trends for Butenafine HCl, emphasizing factors influencing its valuation, competitive dynamics, regulatory environment, and future pricing forecasts.

Market Overview

Indications and Clinical Applications

Butenafine HCl's primary applications are in treating superficial fungal infections. Its mechanism targets ergosterol biosynthesis, disrupting fungal cell membrane integrity, which renders it a specific and effective dermatological agent. The market is segmented geographically, with North America, Europe, and Asia-Pacific representing the principal regions.

Manufacturing and Supply Chain

Key pharmaceutical companies including Sanofi-Aventis, Sandoz, and Kaken Pharmaceutical manufacture Butenafine formulations. The active pharmaceutical ingredient (API) is produced primarily in India and China, contributing significantly to global supply, with subsequent formulation and distribution by multinational corporations.

Market Drivers

- Rising Incidence of Fungal Infections: Increasing prevalence of dermatophyte infections due to climate factors, lifestyle changes, and urbanization.

- Safety Profile: Favorable tolerability and minimal systemic toxicity support ongoing demand.

- Regulatory Approvals: Expansion of approvals in emerging markets fuels market growth.

- Enhanced Patient Compliance: Once-daily topical applications improve adherence.

Market Restraints

- Limited Indications: Restricted primarily to superficial fungal infections limits revenue potential.

- Competition: Presence of alternative antifungals (e.g., terbinafine, clotrimazole) influences pricing pressures.

- Generic Entrants: Entry of generics post-patent expiry exerts downward pressure on prices.

Competitive Landscape

The market is characterized by a handful of global players and regional manufacturers that compete chiefly on price, formulation quality, and clinical efficacy. Major competitors include:

- Sanofi-Aventis: One of the earliest developers with proprietary formulations.

- Sandoz: Offers generic versions, impacting market pricing.

- Kaken Pharmaceutical: Prominent in Asian markets.

- Emerging Players: Several regional manufacturers are entering the space with cost-effective generic products.

Patent Status: As of 2022, patent protections for Butenafine HCl formulations have expired or are nearing expiry in most jurisdictions, paving the way for increased generic competition and influencing pricing trends.

Regulatory and Market Access Factors

Regulatory agencies such as the FDA (USA), EMA (Europe), and the PMDA (Japan) regulate the approval of topical antifungals. Market entry hinges on robust clinical data, quality manufacturing, and compliance with local drug registration requirements. Pricing negotiations, especially in publicly funded systems, significantly influence net prices.

Market access strategies are increasingly focusing on demonstration of cost-effectiveness and patient adherence benefits to secure formulary inclusion.

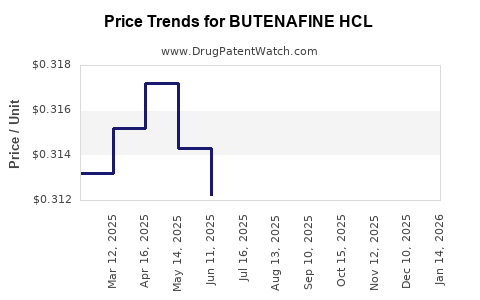

Current Pricing Trends

Pricing Spectrum

- Brand-Name Products: Typically priced between $15–$30 for a 15g tube in the U.S.

- Generic Formulations: Prices have decreased substantially, often below $10 for comparable quantities.

- Regional Variations: Pricing in emerging markets (e.g., India, Brazil) is markedly lower, sometimes under $5 per tube, driven by local manufacturing and competitive pressures.

Factors Influencing Prices

- Patent and Regulatory Status: Patent expirations lead to significant price reductions.

- Market Competition: The influx of generics drives wholesale and retail prices down.

- Distribution Channels: Direct hospital sales vs. pharmacy retail impact consumer prices.

- Reimbursement Policies: In markets with insurance coverage, negotiated prices are typically lower.

Price Projection Outlook

Short-Term (Next 1-2 Years)

- Stability in Prices: Given current patent statuses and market saturation, prices are expected to remain relatively stable, with slight declines owing to existing generic competition.

- Generic Penetration: As additional generics enter mature markets, prices may decrease by 10–15%.

Medium to Long-Term (3-5 Years)

- Further Price Erosion: Anticipated with increased generic supply; prices could decline by up to 30%–40% in mature markets.

- Emerging Markets: Prices may stabilize or increase slightly owing to increased demand and regulatory developments.

- Premium Formulations: Potential introduction of combination or improved formulations could command higher prices.

Influence of Market Dynamics

- Regulatory Advances: Streamlined approval processes may expedite generic entries.

- Healthcare Economics: Value-based reimbursement strategies could pressure prices downward.

- Supply Chain Factors: Raw material costs, especially for chemical synthesis, directly impact manufacturing costs and thus retail prices.

Future Market Potential

The global antifungal market is projected to grow at a CAGR of approximately 4.5% from 2022 to 2028, with topical agents like Butenafine HCl maintaining a steady share. Factors such as rising skin infection prevalence and increasing awareness contribute to steady demand growth.

By 2028, the global market valuation for Butenafine HCl-based products could approach USD 250–300 million, assuming consistent demand and competitive pricing environments. Price reductions associated with increased generic competition may suppress revenue growth but foster broader access.

Key Factors Impacting Pricing and Market Growth

- Patent Expiry and Entry of Generics: Critical drivers for price declines.

- Regional Regulatory Changes: Faster approvals in emerging markets facilitate broader adoption.

- Clinical Compliance and Patient Preference: New formulations with better adherence may command premium pricing.

- Price Sensitivity in Developing Countries: Lower income levels necessitate affordable formulations, potentially reducing profit margins in these regions.

Conclusion

The market for Butenafine Hydrochloride is characterized by a mature yet competitive landscape, driven by patent expirations and increasing generic penetration. Prices have trended downward, with projections indicating continued decline, especially in established markets, due to intensified competition. Nonetheless, regional disparities and innovation could sustain modest price premiums where formulations demonstrate enhanced efficacy or compliance benefits.

Business strategists should anticipate moderate price erosion but recognize expanding demand across emerging economies as opportunities for growth. Companies investing in formulation differentiation and cost-efficiency will better position themselves amid evolving market dynamics.

Key Takeaways

- Patent expirations and generics dominate pricing trends, precipitating significant price reductions in mature markets.

- Global demand for topical antifungals like Butenafine HCl continues to grow, driven by increasing dermatophyte infections, especially in urbanizing regions.

- Pricing in developing markets remains substantially lower, creating opportunities for market penetration with affordable formulations.

- Regulatory developments and healthcare reimbursement policies significantly influence future price trajectories.

- Innovation and formulation improvements can offer competitive advantages, enabling brands to command higher prices despite overall downward pressure.

FAQs

1. When did patent protection for Butenafine HCl expire, and how does it impact the market?

Most patents for Butenafine HCl expired between 2018 and 2021, leading to a surge of generic formulations and a substantial decline in retail prices. This increased accessibility and intensified competition across global markets.

2. How does the availability of generics affect the pricing of Butenafine HCl products?

Generic entry typically results in a 30-50% reduction in prices in mature markets, facilitating broader access but pressuring brand manufacturers to differentiate their offerings through formulation innovation or marketing.

3. Are there regional differences in Butenafine HCl pricing?

Yes. In high-income countries like the U.S. and parts of Europe, prices are higher ($15–$30 per tube) due to regulatory and reimbursement factors, whereas in emerging markets, prices are often below $5 per tube.

4. What factors could slow down future price declines?

Limited patent protection, regulatory barriers, and manufacturing costs could slow down price erosion. Additionally, if innovative formulations or combination products emerge, they may sustain premium pricing.

5. What are the opportunities for companies in the Butenafine HCl market?

Opportunities include expanding into emerging markets with affordable formulations, developing improved or combination topical therapies, and leveraging clinical data to demonstrate value for healthcare payers.

Sources:

[1] GlobalData. "Topical Antifungal Market Analysis." 2022.

[2] U.S. FDA Drug Database. "Butenafine Hydrochloride FDA Approvals." 2021.

[3] MarketWatch. "Antifungal Drugs Market Size and Forecast." 2022.

[4] IQVIA. "Global Dermatology Market Report." 2022.

[5] European Medicines Agency. "Butenafine HCl Product Registration." 2021.