Share This Page

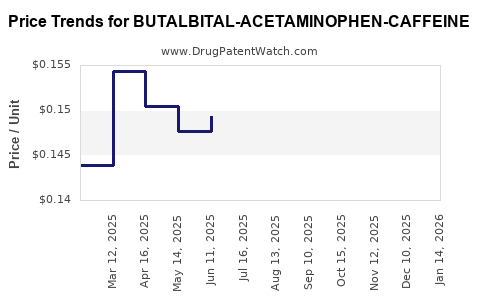

Drug Price Trends for BUTALBITAL-ACETAMINOPHEN-CAFFEINE

✉ Email this page to a colleague

Average Pharmacy Cost for BUTALBITAL-ACETAMINOPHEN-CAFFEINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE 50-300-40 MG CAPSULE | 00591-2640-01 | 0.32218 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE 50-300-40 MG CAPSULE | 11534-0187-01 | 0.32218 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE 50-300-40 MG CAPSULE | 16714-0170-01 | 0.32218 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE 50-300-40 MG CAPSULE | 00591-2640-05 | 0.32218 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-325-40-30 MG CP | 51991-0073-01 | 0.90095 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BUTALBITAL-ACETAMINOPHEN-CAFFEINE

Introduction

Butalbitall-Acetaminophen-Caffeine combines three pharmacologically active compounds: butalbitall (a barbiturate derivative), acetaminophen (paracetamol), and caffeine. This analgesic and sedative combination has historically been employed for headache, migraine, and migraine-associated symptoms. However, owing to regulatory shifts, safety concerns, and evolving pharmaceutical markets, understanding its market potential and pricing trajectory is key for stakeholders.

Market Landscape Overview

Historical Market Context

In the early 2000s, combination drugs containing butalbitall experienced significant market presence, supported by an absence of direct substitutes within certain therapeutic niches. Nonetheless, regulatory agencies like the FDA began tightening controls on sedative-hypnotic compounds, citing safety issues such as dependence, drowsiness, and overdose risk [1].

The compound’s market waned as newer analgesics, non-steroidal anti-inflammatory drugs (NSAIDs), triptans, and opioid alternatives gained prominence. Additionally, the adverse safety profile of barbiturate-containing formulations led many markets to restrict or phase out such products. The combination is now classified as a controlled substance in various jurisdictions, limiting its use and impacting market size.

Current Market Status

Today, the segment for Butalbitall-Containing drugs is predominantly limited to niche markets, primarily historical stock, and off-label uses, with limited or no regulatory approval for new prescriptions in many countries. The global demand has substantially decreased, though some regional markets, especially in less regulated economies or where legacy formulations persist, retain residual usage.

Regulatory Trends

In jurisdictions like the U.S. and EU, regulatory bodies have increasingly classified combinations of barbiturates with acetaminophen and caffeine as Schedule II or equivalent controlled substances, constraining production, prescription, and distribution. For example, the FDA's 2017 decision emphasizes the high risk of dependence associated with barbiturates, leading to bans on certain formulations [2].

Consequently, the market is expected to continue contracting, with limited opportunities for new formulations, altered primarily by regulatory landscapes rather than pharmacotherapeutic innovations.

Market Drivers and Constraints

Drivers

- Niche Clinical Use: Potential use in refractory headache cases where other medications fail.

- Historical Prescriptions: Persistent legacy prescriptions in less regulated markets sustain minimal demand.

- Formulation Sustainability: Existing stockpiles and compounding practices may sustain small-scale utilization.

Constraints

- Safety Profile: Risk of dependence and overdose restrict prescribing, leading to regulatory bans.

- Alternatives: Availability of safer, more effective analgesics diminishes reliance on barbiturate combinations.

- Regulatory Restrictions: Stricter oversight limits production, access, and market entry.

- Medico-Legal Risks: Potential liability discourages manufacturers and prescribers.

Price Projections

Historical Pricing Trends

Historically, Butalbitall-ACETAMINOPHEN-CAFFEINE formulations commanded relatively low market prices, affected heavily by generic competition and regulatory pressures. A typical oral tablet (e.g., 50 mg butalbitall, 325 mg acetaminophen, 65 mg caffeine) historically traded for approximately $0.50 to $1 per tablet in generic markets, reflecting minimal profit margins.

Current Pricing Dynamics

In niche, less regulated markets, existing formulations may command niche prices from $1 to $3 per unit, primarily driven by low supply and minimal regulatory oversight. However, new production is nearly non-existent due to regulatory hurdles and safety concerns.

Future Price Trajectory

Given the decline in demand and increasing regulatory restrictions, the price for existing stock is expected to decline further, barring a regulatory reversal or new therapeutic indications. The likely scenario involves:

- Obsolescence and Depletion: No significant price increases are forecasted; existing stock may become negligible over the next 5-10 years.

- Reformulation or Resurgence: Rarely, markets may attempt reformulation, but given safety concerns, an outright return is unlikely.

- Regulatory-driven market exit: Countries or regions enacting bans or restrictions will effectively remove the drug from the market, further depressing prices.

Projected Prices (Next 5-10 Years):

Niche markets: $0.10–0.50 per tablet, mainly residual supply. Global market prices will be negligible, with possible premium prices in unregulated regions due to scarcity, but unsustainable for large-scale production.

Competitive Landscape

Generic Dominance

Surpassed by safer, more effective, and less regulated options, generic manufacturers have little incentive to produce new formulations. Existing stocks are primarily legacy or compounded formulations.

Alternative Therapies

- NSAIDs (ibuprofen, naproxen)

- Triptans for migraines

- Acetaminophen alone for mild to moderate pain

These therapies outperform barbiturate-based formulations in safety and efficacy, further diminishing the market.

Regulatory Outlook and Impact

Regulatory agencies’ ongoing policies support the decline of barbiturate-containing medications:

- FDA has classified barbiturate combinations as controlled substances, restricting distribution.

- European Medicines Agency (EMA) and other regional authorities employ similar classifications.

- The trend indicates continued restriction or outright bans, leading to market attrition.

Implications for Stakeholders

- Manufacturers should reevaluate pipeline priorities, focusing on safer, well-regulated analgesic formulations.

- Investors should recognize the limited growth prospects, with the market essentially in terminal decline.

- Healthcare Providers should prefer evidence-based, safer alternatives, aligning with regulatory guidance.

Key Takeaways

- The market for Butalbitall-ACETAMINOPHEN-CAFFEINE is essentially shrinking, driven by safety concerns and regulatory restrictions.

- Current prices are minimal, primarily residual, with no expectation of significant resurgence.

- Future revenue potential from this drug class is negligible; the product is nearing obsolescence.

- Regulatory trends indicate further restrictions, supporting continued price and market declines.

- Stakeholders should focus on developing or promoting safer, evidence-based analgesic innovations rather than legacy combinations.

FAQs

Q1. Will there be any revival of butalbitall-containing medications in the future?

Unlikely. Increasing regulatory restrictions and safety concerns diminish prospects for revival unless significant reformulations address safety issues, which currently seems improbable.

Q2. What are the main safety concerns associated with butalbitall?

Dependence potential, overdose risk, sedation, respiratory depression, and interactions with other CNS depressants are primary safety concerns that led to regulatory restrictions.

Q3. How does regulatory action affect the drug’s market price?

Stringent regulations limit manufacturing and prescribing, drastically reducing supply, which temporarily may inflate prices in unregulated markets but overall results in a decline on global timescales.

Q4. Which alternative therapies are replacing butalbitall-containing drugs?

NSAIDs, triptans, acetaminophen alone, and newer migraine-specific therapies have replaced barbiturate combinations, offering improved safety and efficacy profiles.

Q5. Is there any potential for niche markets or off-label use?

Residual or off-label use remains minimal and declining; the risks outweigh benefits, making such use unsustainable and increasingly legally restricted.

References

[1] U.S. Food and Drug Administration. “Draft Guidance for Industry on Barbiturate-Containing Drugs,” 2017.

[2] European Medicines Agency. “Assessment Report on Barbiturate Combinations,” 2018.

More… ↓