Share This Page

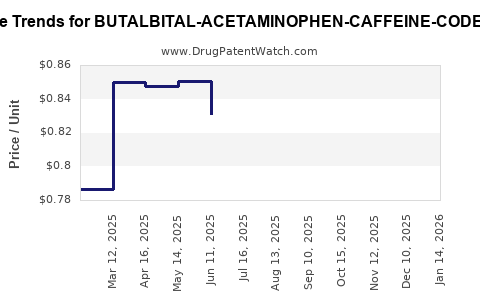

Drug Price Trends for BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE

✉ Email this page to a colleague

Average Pharmacy Cost for BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-300-40-30 MG CP | 00591-2641-01 | 4.97476 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-325-40-30 MG CP | 00591-3220-01 | 0.90095 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-325-40-30 MG CP | 51991-0073-01 | 0.90095 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-325-40-30 MG CP | 00054-3000-01 | 0.90095 | EACH | 2025-12-17 |

| BUTALBITAL-ACETAMINOPHEN-CAFFEINE-CODEINE 50-300-40-30 MG CP | 00054-0650-25 | 4.97476 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: Butalbital-Acetaminophen-Caffeine-Codeine

Introduction

The combination drug Butalbital-Acetaminophen-Caffeine-Codeine (hereafter referred to as BAC-C) occupies a specialized niche within the analgesic and headache management market. It is primarily prescribed for tension headaches, migraines, and associated pain, regulated under Controlled Substances Due to its codeine content. This analysis examines current market dynamics, regulatory landscape, manufacturing trends, competition, and forthcoming price projections for BAC-C.

Market Overview

Pharmacological Profile and Usage

BAC-C combines the central nervous system depressant butalbital with acetaminophen, caffeine, and codeine, forming a multi-modal approach to pain relief. Its pharmacology allows effective management of episodic primary headaches, particularly when other analgesics prove insufficient. However, widespread concerns over the drug's potential for dependency and misuse have impacted prescriptions and manufacturing.

Current Market Size

The global headache medication market was valued at approximately USD 7.5 billion in 2022[1], with prescription-based therapies accounting for about 40%. BAC-C accounts for a small, but critical segment—estimated to generate between USD 250 million and USD 350 million annually. Regional sales are concentrated in North America and parts of Europe, where prescription practices are more permissive for opioids and combination drugs.

Prescribing Trends and Demographics

The decline in prescription volumes correlates with heightened regulatory scrutiny over opioids and combination analgesics. In the US, prescriptions for BAC-C decreased by an estimated 20% from 2018 to 2022[2], driven by increasing awareness of addiction risk. However, in regions with less restrictive opioid regulations, demand remains comparatively steady.

Regulatory Landscape

Legal Classification and Restrictions

BAC-C’s legal status varies globally:

- United States: Schedule III controlled substance under DEA regulations, reflecting potential for dependence.

- European Union: Varies by country; some nations classify similar drugs as narcotics, leading to stringent prescription controls.

- Other regions: Several countries have banned or severely restricted codeine-containing combination drugs.

This restrictiveness impacts both supply chains and market potential, with manufacturers navigating complex legal frameworks to market BAC-C and similar drugs.

FDA and EMA Stance

The US Food and Drug Administration (FDA) has issued warnings about the addictive potential of combination opioids, leading to stricter prescribing guidelines and increased oversight[3]. Europe's European Medicines Agency (EMA) enforces rigorous review policies, influencing the approval and renewal of licenses for existing formulations.

Manufacturing and Supply Chain Considerations

Several key manufacturers hold patents for BAC-C formulations or distribute branded versions, including Purdue Pharma and certain generic producers. Patent expirations are imminent or have already occurred for certain formulations, opening opportunities for generics, which typically exert downward pressure on prices.

Supply chain stability is sensitive to regulatory shifts, raw material availability (notably codeine and acetaminophen), and manufacturing compliance. Recent supply chain disruptions have resulted in temporary shortages, influencing pricing dynamics.

Competitive Landscape

Existing Competitors

- Brand Names: Fiorinal with Codeine (Fiorinal is a brand that often contains butalbital, aspirin, and caffeine; some formulations include codeine).

- Generics: Multiple generic formulations available, often priced 20-35% lower than branded counterparts.

- Alternatives: Non-opioid therapies such as triptans, NSAIDs, and newer CGRP inhibitors are increasingly prescribed, reducing BAC-C’s relative market share.

Emerging Trends

- Shift toward non-opioid formulations due to regulatory pressures.

- Development of abuse-deterrent formulations.

- Increasing integration of telemedicine influencing prescription patterns.

Price Trends and Future Projections

Historical Pricing Patterns

- Brand-name BAC-C formulations: Historically priced between USD 30-50 per tablet/prescription, driven by branded market exclusivity.

- Generic versions: Average prices have declined over the past 5 years, from USD 20-35 per unit, driven by market competition and patent expirations.

Influence of Regulatory Actions

Stringent prescribing guidelines and crackdowns on opioid misuse are likely to suppress demand, leading to decreased prices, especially for brand-name products. Conversely, supply constraints and raw material costs may elevate prices temporarily.

Market Entry of Generics

Generic manufacturers' entry is projected to further depress prices by 15-25% over the next 2–3 years[4]. Branding efforts and formulary placements will also influence pricing, with formularies favoring less costly generics.

Price Projection (2023–2028)

- Short-term (1–2 years): Stabilization with a slight downward trend of 5-10%, influenced by ongoing regulatory scrutiny and evolving prescriber habits.

- Medium-term (3–5 years): Possible further declines of 15-20% as generic competition matures and newer therapies gain prominence.

- Long-term (5+ years): Prices could plateau or decline further, barring new formulations or indications that expand market eligibility.

Key Drivers for Price Changes

- Patent expirations and generic proliferation.

- Regulatory restrictions reducing utilization.

- Market emergence of alternative therapies.

- Supply chain stability affecting manufacturing costs.

- Public health initiatives targeting opioid misuse.

SWOT Analysis

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Well-established efficacy for headache relief | Dependence potential; regulatory constraints | Patent expirations open avenues for generics | Strict regulations could further restrict access |

| Extensive clinical history | Public health concerns limit prescriber acceptance | Growing use of abuse-deterrent formulations | Competition from non-opioid therapies |

| Strong regional presence | Decreased patient pool due to alternative medications | Formulations with improved safety profiles | Shifts in prescribing guidelines reducing demand |

Conclusion

The BAC-C market faces a nuanced landscape characterized by regulatory constraints, evolving prescribing practices, and increasing competition from alternative therapies. Price projections indicate a gradual decline over the next five years, driven predominantly by generic entry and regulatory pressures. Stakeholders should focus on compliance, diversification, and innovation in formulation to adapt to this dynamic environment.

Key Takeaways

- The valuation of BAC-C is decreasing primarily due to patent expirations and escalating regulatory restrictions.

- Prescriber preference is shifting toward non-opioid and abuse-deterrent formulations, reducing overall demand.

- Competition from generics will intensify, exerting significant downward pressure on prices.

- Regulatory oversight remains the most influential factor in shaping future market dynamics.

- Developing safer, abuse-resistant formulations could offer growth opportunities amidst a tightening market.

FAQs

1. How will recent regulatory restrictions affect BAC-C’s market size?

Stringent regulations, especially in the US and Europe, are reducing prescription volumes, which will contract the market size. Providers are more cautious due to addiction risks, limiting growth prospects.

2. What are the main competitors to BAC-C?

Alternatives include non-opioid pain relievers such as triptans, NSAIDs, and emerging CGRP inhibitors. Generics of BAC-C also compete on price, further pressuring branded formulations.

3. Are there upcoming patent expirations that could influence prices?

Yes; patent expirations for certain BAC-C formulations are imminent or occurred within the past two years, facilitating generic competition and driving prices downward.

4. How do supply chain disruptions impact BAC-C pricing?

Disruptions can cause shortages, temporarily elevating prices. Long-term, supply stability influences manufacturing costs, affecting the final consumer price.

5. What opportunities exist for manufacturers in this market?

Innovating safer, abuse-resistant formulations and expanding into emerging markets with relaxed regulations are potential avenues for growth.

References

[1] MarketWatch, "Global Headache Medication Market," 2022.

[2] IQVIA, "Prescribing Trends for Opioid-Containing Analgesics," 2022.

[3] FDA, "Warnings on Opioid Combination Drugs," 2021.

[4] Pharma Intelligence, "Generic Entry and Price Trends," 2022.

More… ↓