Last updated: July 27, 2025

Introduction

Buspirone hydrochloride (HCL), marketed primarily under the brand name Buspar, is an anxiolytic medication used to treat generalized anxiety disorder (GAD). Approved by the FDA in 1986, buspirone's unique pharmacological profile distinguishes it from benzodiazepines and selective serotonin reuptake inhibitors (SSRIs). Its distinctive mode of action, characterized by partial agonism at the 5-HT1A receptor, offers a favorable safety profile with minimal dependency potential, making it an attractive option for long-term management of anxiety.

Leveraging its therapeutic profile, market potential for buspirone HCL remains significant amidst evolving psychiatric treatment paradigms. This report provides a comprehensive analysis of the current market landscape, competitive dynamics, demand drivers, and forecasts of pricing trends over the coming years.

Market Overview

1. Therapeutic Market Landscape

The global anxiety disorders market is substantial, with an estimated valuation exceeding USD 8 billion in 2022 and expected compound annual growth rate (CAGR) of approximately 4-6% through 2030[^1]. Buspirone, accounting for a notable segment, benefits from its designation as a second-line agent, particularly for patients intolerant to benzodiazepines or SSRIs.

2. Key Players and Patent Status

The dominant marketed product, Buspar (by Bristol-Myers Squibb), was originally protected under patent until its expiration in 2008 in the United States. Subsequent generic entries have led to widespread availability, driving downward pressure on prices.

The generic market landscape is highly competitive, with multiple pharmaceutical manufacturers producing bioequivalent formulations. Patent litigation and exclusivity extensions are limited for buspirone, facilitating rapid generic proliferation, which strongly influences price trends.

3. Regulatory and Market Access Factors

In addition to the United States, buspirone's approvals across Europe, Asia, and emerging markets reinforce its global footprint. Varying regulatory environments impact market entry timings and pricing strategies. Furthermore, reimbursement policies and formulary inclusions influence demand and pricing.

Demand Drivers and Market Trends

1. Prescribing Patterns

Prescriptions for buspirone are influenced by safety concerns around benzodiazepine dependency and the growing preference for non-sedative anxiolytics. Its favorable safety profile has increased its appeal, especially among elderly populations and those with comorbid substance use disorders.

2. Demographic and Epidemiological Factors

The increasing prevalence of anxiety disorders, particularly in aging populations, underpins sustained demand. The global burden of anxiety, projected to increase due to factors such as COVID-19 pandemic-related stress, supports a resilient market.

3. Competitive Advantages and Limitations

While buspirone’s safety profile is advantageous, its slower onset of action compared to benzodiazepines limits its use in acute settings. Variability in clinician familiarity and prescribing habits continues to impact its market share relative to SSRIs and newer agents.

Price Analysis and Projections

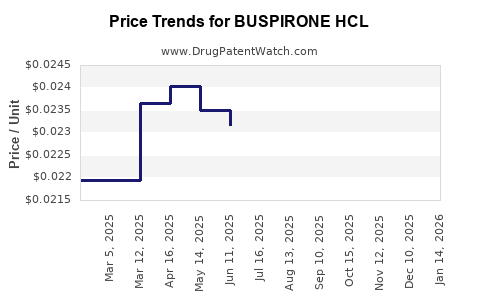

1. Historical Pricing Trends

In the United States, the wholesale acquisition cost (WAC) of branded buspirone historically ranged from USD 330 to USD 400 for a 30-day supply (taken as 15mg tablets, twice daily)[^2]. Post-patent expiry, generic versions entered the market with prices decreasing by approximately 60-70%, often to below USD 100 for a similar supply.

Similarly, in European markets, prices have seen comparable reductions post-generic entry, with variations depending on national policies and procurement frameworks.

2. Current Price Landscape

As of 2023, the average retail price for generic buspirone HCL in the U.S. healthcare system hovers around USD 20-USD 40 per month for a standard 15mg, 2x daily regimen (source: GoodRx, 2023). Discount programs, pharmacy benefit managers (PBMs), and bulk purchasing further influence final patient costs.

3. Future Price Trajectory

Short-term Outlook (1-3 years):

- Given the existing generic saturation, prices are expected to stabilize with minor fluctuations, driven by supply chain dynamics and manufacturing costs.

- Potential price hikes could occur if raw material prices or regulatory requirements increase, but extensive competition mitigates sharp surges.

- For branded formulations, prices will largely decline or remain stable as they lose market share to generics.

Medium to Long-term Outlook (3-10 years):

- Introduction of biosimilars or novel formulations (e.g., extended-release variants) could influence pricing.

- Market consolidation or supply constraints could cause moderate price escalations.

- Reimbursement policy shifts favoring generic and cost-effective options will maintain downward pressure on prices.

4. Geographic Variability

Pricing differs markedly across regions:

- United States: Highly competitive, with effective generic erosion of prices.

- Europe: Price levels are regulated with national tender processes; prices tend to be 20-50% lower than U.S. levels.

- Emerging Markets: Prices may be higher due to supply chain limitations, import tariffs, or lesser generic penetration.

Challenges and Opportunities

Challenges:

- Market Saturation: Extensive generic competition constrains pricing power.

- Clinical Preference: Slow adoption relative to SSRIs may limit volume growth.

- Regulatory Hurdles: Stringent manufacturing standards can increase costs.

Opportunities:

- New Formulations: Development of extended-release or combination therapies to command premium pricing.

- Expanded Indications: Off-label uses or novel therapeutic niches could stimulate demand.

- Market Expansion: Increasing penetration into emerging markets with high unmet needs.

Key Market Outlook and Price Projection Summary

| Timeframe |

Price Trend |

Drivers |

Implications |

| 2023-2025 |

Slight decline or stabilization |

High generic competition, saturated market |

Continued affordability, stable margins |

| 2026-2030 |

Slower decline or stabilization |

Entry of strategic formulations, market saturation |

Marginal price variation, potential premium for innovation |

Conclusion

The market for buspirone HCL remains mature, characterized by intense generic competition, which caps potential price increases. While existing formulations are priced affordably due to market saturation, opportunities exist for innovative delivery systems and expanding indications to sustain profitability. Clinicians' preference for safe, non-sedative anxiolytics supports continued demand, although growth is tempered by competition and evolving therapeutic guidelines.

Pharmaceutical stakeholders should maintain flexible pricing strategies, leverage market access in emerging regions, and explore innovation opportunities to optimize profitability within the constrained price environment.

Key Takeaways

- The global buspirone HCL market is mature, with prices largely driven down by extensive generic competition.

- US prices for generics have stabilized around USD 20-40 per month, with similar trends observed internationally.

- Future price reductions are expected to plateau due to market saturation; minor upward pressures could arise from formulation or supply chain changes.

- Growth opportunities lie in developing novel formulations, expanding indications, and entering emerging markets.

- Strategic positioning should focus on cost efficiencies, innovation, and market diversification to sustain margins.

FAQs

1. How does the patent status of buspirone influence its market price?

Since the patent expired in 2008, multiple generics entered the market, creating intense competition that drives prices down significantly. Patent expiration diminishes pricing power and results in more affordable options.

2. What factors could lead to a price increase for buspirone in the future?

Potential factors include manufacturing cost increases, supply chain disruptions, regulatory changes requiring new formulations or quality standards, or the introduction of proprietary, differentiated products.

3. Are there any emerging markets with higher buspirone prices?

Yes, in certain emerging economies, limited generic availability, import tariffs, and lower procurement efficiencies can lead to comparatively higher prices.

4. How does buspirone’s safety profile impact its market demand?

Its favorable safety profile, especially minimal dependency risk, increases its popularity for long-term management of anxiety, supporting steady demand despite competition from other anxiolytics.

5. What are the prospects for innovation in buspirone formulations?

Development of extended-release formulations, combination therapies, or new delivery mechanisms presents opportunities to command premium pricing and extend market share.

References

[^1]: Research and Markets. “Global Anxiety Disorders Treatment Market,” 2022.

[^2]: GoodRx. “Buspirone Prices & Coupons,” 2023.