Last updated: July 28, 2025

Introduction

Bupropion Hydrochloride (HCl) is a widely prescribed antidepressant and smoking cessation aid, marketed under brand names such as Wellbutrin, Zyban, and generics. Its unique dual mechanism as a norepinephrine-dopamine reuptake inhibitor makes it a vital therapeutic agent for depression, seasonal affective disorder, and nicotine dependence. This analysis assesses the current market landscape, competitive dynamics, regulatory environment, manufacturing trends, and projects future pricing trajectories.

Market Overview

Current Market Size and Key Segments

The global market for bupropion HCl is valued at approximately $1.5 billion in 2023, with the North American region commanding over 60% of the market share, mainly driven by high prescription rates for depression and smoking cessation. Europe and Asia-Pacific segment contribute the remaining share, reflecting differing healthcare policies and prescribing patterns.

The primary indications include:

- Major depressive disorder (MDD)

- Seasonal affective disorder (SAD)

- Smoking cessation (as Zyban)

Market Drivers

- Rising prevalence of depression: WHO estimates over 280 million globally suffer from depression, bolstering demand for effective antidepressants.

- Smoking cessation initiatives: Governments and healthcare providers promote bupropion-based therapies due to FDA approval for smoking cessation.

- Generic penetration: Expiration of patent exclusivity has increased generic availability, lowering prices and widening access.

Competitive Landscape

- Branded drugs: Wellbutrin and Zyban remain significant, supported by established prescriber trust.

- Generics: Multiple manufacturers produce generic bupropion HCl, significantly impacting pricing and market share. Companies such as Teva, Mylan, and Sun Pharma dominate generic supply.

The entry of biosimilar or alternative therapies (e.g., SSRIs, SNRIs, and novel antidepressants) continues to influence the market dynamics.

Regulatory Environment

FDA approvals and international regulatory decisions shape market access. Recently, the agency approved new formulations—extended-release variants—enhancing patient adherence and therapeutic efficacy. Patent litigations and exclusivity periods profoundly influence generic entry timelines and pricing strategies.

Manufacturing and Supply Chain Considerations

- Raw materials: The primary raw ingredient, phenylacetic acid derivatives, depends on complex synthesis processes and regional supply chains that are susceptible to disruptions.

- Manufacturing costs: With the advent of efficient synthesis and scale, margins have been compressed, fostering price competition.

- Regulatory compliance: Good Manufacturing Practices (GMP) and quality standards impose additional costs but ensure market credibility.

Price Dynamics and Projections

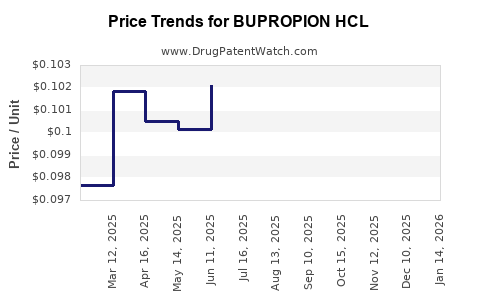

Historical Pricing Trends

- Brand-name formulations: Historically priced between $150–$250 per month, with a gradual decline post-generic entry.

- Generics: Current prices average around $20–$50 per month in the U.S., depending on supply and insurance coverage.

Factors Influencing Future Prices

- Patent expirations: Leading brand patents expired in 2011 for immediate-release formulations; extended-release patents have been subject to legal challenges, allowing generics to capture market share.

- Pricing competition: Increased generic dissemination exerts downward pressure, with annual price declines averaging 5–10% over recent years.

- Regulatory innovations: Approval of new formulations (e.g., extended-release variants) can temporarily stabilize pricing due to patent protections and clinical advantages.

- Market penetration and access: Broader insurance coverage and generic availability will continue to drive prices downward, particularly in mature markets.

Projected Price Range (2024–2028)

- Brand-name drugs: Expected to maintain elevated prices $150–$200/month temporarily due to ongoing patent protections and formulation innovations.

- Generics: Anticipated to hover around $10–$30/month owing to increased competition, with minor fluctuations based on regional patent litigations and supply chain stability.

Emerging Opportunities and Challenges

- New formulations: Extended-release (ER) and sustained-release (SR) variants with improved adherence could sustain higher prices briefly but are vulnerable to generic competition.

- Price erosion risks: Continued patent expirations and regulatory pressures threaten further price reductions.

- Market consolidation: Potential mergers and acquisitions could stabilize pricing through portfolio expansion and manufacturing efficiencies.

Strategic Outlook

- For manufacturers: Emphasizing formulation innovations, investing in new delivery systems, and securing market exclusivity via patents and legal protections remain critical to maintaining pricing power.

- For healthcare providers: Favoring generic options for cost savings, with limited impact on overall utilization growth.

- For regulators: Ensuring balanced competition and innovation pathways that support affordable access without stifling innovation.

Key Takeaways

- The bupropion HCl market is mature, with significant generics-driven price declines expected over the next five years.

- New formulations offer temporary pricing premiums but face intense competition upon patent expiration.

- Market penetration in emerging economies presents growth opportunities, driven by increasing mental health awareness and smoking cessation programs.

- Supply chain resilience and raw material costs directly influence manufacturing costs and, consequently, retail pricing.

- Strategic patent management and formulation innovations are essential for sustaining profitability amid aggressive generic competition.

Conclusion

The future pricing trajectory of bupropion HCl hinges on patent landscapes, regulatory decisions, and competitive dynamics. While generic prices are set to decline further, innovative formulations and strategic patent protections could sustain premium pricing in select markets. Stakeholders must carefully navigate these factors to optimize profitability and ensure patient access.

FAQs

-

When did the patents for Wellbutrin and Zyban expire?

The primary patents for Wellbutrin IR expired around 2011, leading to a proliferation of generics. However, patents for certain extended-release formulations and delivery mechanisms have been litigated or extended, influencing market exclusivity until recent years.

-

What factors most significantly impact bupropion HCl pricing?

Patent status, generic competition, manufacturing costs, formulation innovations, and regional regulatory policies chiefly determine pricing.

-

Are there emerging formulations of bupropion HCl in development?

Yes. Extended-release and sustained-release variants with improved compliance profiles are currently in development or have recently received regulatory approval, which could influence future pricing strategies.

-

How do insurance providers influence the pricing of bupropion HCl?

Insurance coverage, formulary placements, and negotiated discounts significantly reduce out-of-pocket costs for patients, indirectly affecting net pricing trends.

-

What regions offer the highest growth potential for bupropion HCl?

Emerging markets in Asia-Pacific and Latin America present expanding patient bases with increasing healthcare infrastructure and awareness, offering growth avenues for manufacturers.

References

- World Health Organization. Depression fact sheet. 2023.

- U.S. Food and Drug Administration. Approved drug products. 2023.

- MarketWatch. Bupropion market analysis report. 2023.

- IQVIA. Prescription Trends and Market Data. 2023.

- IPWatchdog. Patent litigation landscape for antidepressants. 2022.