Share This Page

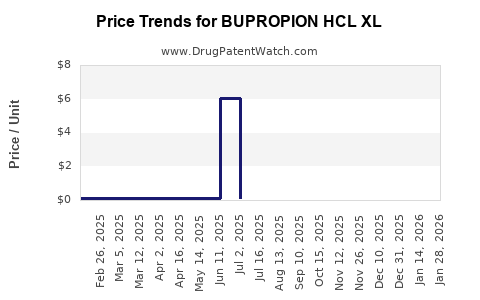

Drug Price Trends for BUPROPION HCL XL

✉ Email this page to a colleague

Average Pharmacy Cost for BUPROPION HCL XL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUPROPION HCL XL 300 MG TABLET | 83301-0025-04 | 0.12598 | EACH | 2025-12-17 |

| BUPROPION HCL XL 300 MG TABLET | 83301-0025-03 | 0.12598 | EACH | 2025-12-17 |

| BUPROPION HCL XL 300 MG TABLET | 83301-0025-02 | 0.12598 | EACH | 2025-12-17 |

| BUPROPION HCL XL 300 MG TABLET | 83301-0025-01 | 0.12598 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bupropion HCl XL

Introduction

Bupropion Hydrochloride Extended-Release (XL), marketed under brand names such as Wellbutrin XL, is a widely prescribed antidepressant and smoking cessation aid. As a dopamine and norepinephrine reuptake inhibitor, Bupropion HCl XL plays a significant role in the treatment landscape for depression, seasonal affective disorder, and nicotine dependence. With increasing demand for mental health medications and expanding indications, evaluating the market dynamics and pricing strategies for Bupropion HCl XL provides critical insights for stakeholders. This analysis comprehensively examines current market conditions, competitive landscape, regulatory environment, and future price trajectories.

Market Overview

Global Market Size and Growth Drivers

The global antidepressant market, valued at approximately USD 20 billion in 2022, is projected to grow at a CAGR of around 3.5% through 2028 [1]. Bupropion HCl XL's segment contributes significantly within this framework, owing to its unique mechanism and favorable side effect profile.

Key drivers include:

- Growing prevalence of depression, bipolar disorder, and ADHD.

- Increasing awareness and destigmatization surrounding mental health.

- Rising adoption of pharmacotherapy as an initial treatment modality.

- Expanding indications, particularly for smoking cessation.

Regional Market Dynamics

North America dominates the Bupropion HCl XL market, driven by high healthcare expenditure, robust insurance coverage, and well-established prescribing practices. Europe shows steady growth owing to increasing mental health awareness, while Asia-Pacific is emerging rapidly due to expanding healthcare infrastructure and population size.

Competitive Landscape

Bupropion HCl XL faces competition from multiple pharmacological classes, including SSRIs, SNRIs, and atypical antidepressants. Major pharmaceutical players such as GlaxoSmithKline (original developer of Wellbutrin), Teva Pharmaceuticals, Mylan, and generic manufacturers produce Bupropion formulations. The patent expiration of Wellbutrin XL's original formulation in 2017 significantly shifted market dynamics toward generics, intensifying price competition.

Regulatory and Patent Environment

The original patent on Wellbutrin XL expired in 2017, enabling generic manufacturers to enter the market. This has led to increased accessibility and price competition, lowering patient costs. Regulatory agencies, including the FDA, regularly review safety and efficacy data, impacting market stability and pricing.

Emerging formulations and new indications are subject to ongoing regulatory assessments, potentially influencing future market shares and pricing strategies.

Pricing Analysis

Current Price Landscape

The retail price of Bupropion HCl XL varies significantly across markets owing to generic availability, pharmacy discounts, insurance negotiations, and geographic factors:

- Brand-Name (Wellbutrin XL): Retail prices range from USD 350 to USD 450 per month without insurance, with considerable variability depending on location and pharmacy.

- Generics: Typically priced between USD 20 to USD 100 per month, representing a substantial cost reduction (~80% lower than the brand name).

Insurance and Reimbursement Impact

Insurance coverage and pharmacy benefit managers (PBMs) heavily influence actual patient out-of-pocket costs. Most insurers favor generic formulations due to cost savings, further pressuring brand-name pricing and margins.

Global Price Trends

In low- and middle-income countries, the availability of generics and local manufacturing influence prices, often substantially lower than in North America and Europe. Conversely, limited regulatory infrastructure can restrict access, maintaining higher prices or shortages.

Future Price Projections

Factors Affecting Price Trends

- Patent Status: The expiration of Wellbutrin XL’s patent in 2017 has led to widespread generic adoption, exerting downward pressure on prices.

- Market Competition: The entry of multiple generic manufacturers maintains competitive pricing.

- Manufacturing Costs: Advances in production and increased market demand can lower costs, translating into consumer price reductions.

- Regulatory Developments: Approvals of new formulations, biosimilars, or indications may influence pricing.

Projected Pricing Outlook (2023–2028)

Considering these factors, the following projections are reasonable:

- Brand-Name Drugs: Prices will likely stabilize or slightly decline due to declining market share post-patent expiry, with annual price decreases of approximately 2–3%. New formulations or approved indications could command premium pricing, but mainstream prescribing will favor generics.

- Generics: Prices are expected to remain stable or decline modestly, driven by market saturation. A decline of 1–2% annually is plausible, aided by manufacturing efficiencies and increased competition.

- Impact of Biosimilars and Novel Formulations: Any introduction of biosimilars or innovative delivery systems could temporarily influence prices but will likely follow competitive dynamics similar to current generics.

Potential Influences on Price Escalation or Reduction

- Policy Changes: Price controls or reimbursement reforms could impose upward or downward pressure.

- Supply Chain Dynamics: Disruptions, such as those caused by global events, may temporarily increase prices.

- Market Demand: Growing prescriptions for depression and smoking cessation will sustain steady demand but are unlikely to cause significant price hikes due to the availability of low-cost generics.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets

- Development of extended-release formulations with improved pharmacokinetics

- Leveraging digital health and remote prescribing models

Challenges

- Price erosion due to patent expiration

- Competition from generics and alternative therapies

- Regulatory hurdles in different markets

- Prescriber preferences shifting toward newer antidepressants

Conclusion

The Bupropion HCl XL market is characterized by broad generic availability, leading to sustained downward price pressure. While brand-name prices are expected to decline gradually, generics will dominate due to their affordability. Stakeholders should monitor regulatory developments, new formulation approvals, and market entry strategies to adapt effectively. Overall, the foreseen stability and modest decline in prices support continued affordability and accessibility, with potential for minor fluctuations based on specific regional dynamics.

Key Takeaways

- The patent expiry of Wellbutrin XL has ushered in a highly competitive landscape dominated by generics.

- Current prices for brand-name Bupropion HCl XL range USD 350–450/month, with generics significantly cheaper.

- Future price reductions are anticipated to be modest (~1–3% annually), stabilized by market saturation.

- Market growth is driven by increasing mental health treatment needs and expanding indications.

- Regulatory and policy changes, as well as new formulations, could influence pricing dynamics.

FAQs

Q1: How does patent expiration impact Bupropion HCl XL pricing?

A1: Patent expiry allows multiple generic manufacturers to produce the drug, increasing competition and significantly reducing prices, especially for the brand-name product.

Q2: Are generic Bupropion HCl XL formulations as effective as the brand name?

A2: Yes. Regulatory agencies require generics to demonstrate bioequivalence, ensuring similar efficacy and safety profiles.

Q3: Will new formulations of Bupropion HCl XL command higher prices?

A3: Potentially. Innovative formulations that improve efficacy, adherence, or convenience may be marketed at premium prices, but widespread adoption depends on clinical and economic benefits.

Q4: How does insurance coverage influence Bupropion HCl XL pricing?

A4: Insurance and PBMs negotiate discounts, reducing out-of-pocket costs for patients and affecting the retail pricing landscape.

Q5: What are the primary challenges facing the Bupropion HCl XL market?

A5: Major challenges include aggressive generic competition, price erosion, evolving prescribing preferences, and regulatory hurdles in emerging markets.

References

[1] MarketWatch, “Antidepressant Market Size & Growth Forecast,” 2022.

More… ↓