Share This Page

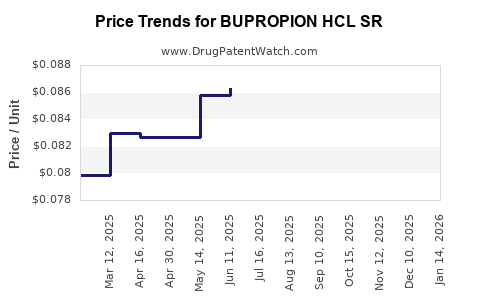

Drug Price Trends for BUPROPION HCL SR

✉ Email this page to a colleague

Average Pharmacy Cost for BUPROPION HCL SR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUPROPION HCL SR 100 MG TABLET | 31722-0066-05 | 0.06998 | EACH | 2025-12-17 |

| BUPROPION HCL SR 100 MG TABLET | 31722-0066-60 | 0.06998 | EACH | 2025-12-17 |

| BUPROPION HCL SR 100 MG TABLET | 31722-0066-01 | 0.06998 | EACH | 2025-12-17 |

| BUPROPION HCL SR 100 MG TABLET | 42806-0410-01 | 0.06998 | EACH | 2025-12-17 |

| BUPROPION HCL SR 100 MG TABLET | 00591-3540-05 | 0.06998 | EACH | 2025-12-17 |

| BUPROPION HCL SR 100 MG TABLET | 00591-3540-60 | 0.06998 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bupropion HCL SR

Introduction

Bupropion Hydrochloride Sustained Release (HCL SR) is a widely prescribed atypical antidepressant primarily indicated for major depressive disorder and smoking cessation. Its unique mechanism as a norepinephrine-dopamine reuptake inhibitor (NDRI) positions it as a critical therapy within the mental health and smoking cessation markets. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, supply fundamentals, and provides strategic price projections to guide stakeholders in making informed decisions.

Market Overview

Global Market Size and Growth Dynamics

The global antidepressant market was valued at approximately USD 16.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.0% from 2023 to 2030. Bupropion HCL SR constitutes a significant portion of this space, driven by its dual indication for depression and smoking cessation.

In the US, Bupropion HCL SR sales are estimated at USD 2.8 billion annually, representing a robust segment within the broader antidepressant and smoking cessation markets. The COVID-19 pandemic intensified the demand for mental health treatments, indirectly boosting sales for medications like Bupropion. Moreover, the increased focus on smoking cessation initiatives aligns with public health campaigns, further supporting sustained demand.

Market Drivers

-

Increasing Prevalence of Depression and Anxiety Disorders: Data from the CDC indicates that approximately 17.7 million adults in the U.S. experienced at least one major depressive episode in 2021, elevating demand for effective therapies.

-

Rising Smoking Cessation Initiatives: With over 34 million adult smokers in the U.S. and increased regulatory emphasis, Bupropion remains a first-line pharmacotherapy for smoking cessation.

-

Preference for Non-SSRI Alternatives: Growing awareness of SSRI-associated side effects has expanded Bupropion's use due to its favorable tolerability.

-

Patent Expiries and Generics: The original patent for Wellbutrin SR expired in 2005, leading to a proliferation of generic versions, which have significantly decreased prices but increased market penetration.

Competitive Landscape

Key Market Players

The market includes both brand-name and generic manufacturers. The primary brand, Wellbutrin SR, is complemented by multiple generic equivalents produced by companies such as Teva, Mylan, and Sandoz, among others. Generic competition has driven down prices but has also increased accessibility.

Market Share Dynamics

Generic versions now hold over 85% of prescriptions, with brand-name sales declining proportionally. However, branded formulations maintain niches due to clinical preferences and formulary access. Recent patent challenges and patent extensions have been relatively limited, allowing continued generic proliferation.

Emerging Competition

While no direct new entrants currently threaten Bupropion HCL SR’s market dominance, the development of novel formulations (e.g., extended-release, combination therapies) aims to provide alternatives with improved compliance or reduced side effects, potentially impacting future sales.

Regulatory Environment

Approval and Patent Status

Bupropion HCL SR is established with multiple generics approved by FDA, with market access protected primarily through patent expiries since 2005. Ongoing patent litigations for specific formulations are rare but remain a risk for future exclusivity potential.

Pricing and Reimbursement Trends

Pricing is significantly influenced by insurance reimbursement policies and pharmacy benefit managers (PBMs) negotiating discounts and formularies. Most prescriptions are dispensed via generics, resulting in lower out-of-pocket costs for patients but also constraining profit margins for manufacturers.

Supply and Manufacturing Fundamentals

The manufacturing process is well-established, relying on standard synthetic routes. Supply chain stability remains intact, with multiple manufacturers capable of scaling production as demand fluctuates. Raw material prices, particularly for key intermediates, have remained stable but could impact manufacturing costs if disrupted.

Price Projections

Historical Price Trends

- Brand-Name Price: Historically, Wellbutrin SR 150 mg capsules ranged from USD 600-700 for a 30-day supply (retail prices).

- Generic Price: The average wholesale price (AWP) for generic Bupropion HCL SR 150 mg has fallen to approximately USD 15-25 per 30-day supply, driven by generic competition.

Short to Medium-Term Forecast (Next 3 Years)

- Price Stabilization: Given the mature market and widespread generic availability, prices are expected to maintain a downward trajectory with minimal fluctuations, barring regulatory or supply shocks.

- Premium Market Segments: Niche markets, such as branded formulations with unique properties or combination therapy, may command prices between USD 50-100 per month, but their market share remains limited.

Long-Term Outlook (Beyond 3 Years)

- Generic Price Barriers: Marginal Price reductions are anticipated due to ongoing competitive pressures. Manufacturing efficiencies will sustain low prices.

- Emerging Formulations: Introduction of new delivery systems or biosimilars could impact prices, but currently, no immediate replacements threaten Bupropion HCL SR's dominance.

Strategic Insights

- Market Penetration: The entrenched generic market supports sustained low pricing but also emphasizes the importance of volume sales for profitability.

- Differentiation Opportunities: Development of new formulations aimed at improving tolerability or compliance could command higher prices.

- Pricing Strategies: Stakeholders should monitor payer policies and adjust pricing accordingly, balancing access and margins.

Key Takeaways

- The global Bupropion HCL SR market remains sizable, driven by depression and smoking cessation needs, with growth steady at approximately 4% CAGR.

- Generic competition dominates, pushing prices downward; expected average prices for generic formulations are around USD 15-25/month in the near term.

- The absence of significant patent barriers or new entrants reinforces price stability but constrains premium pricing opportunities.

- Supply chain stability and regulatory approvals are unlikely to impede market access or pricing in the foreseeable future.

- Innovation in formulation or combination therapies offers potential for future premium pricing but currently represents a niche market.

FAQs

1. What factors influence the price of Bupropion HCL SR?

Market competition, patent status, manufacturing costs, insurance reimbursement policies, and regulatory environment are primary determinants. Increased generic competition suppresses prices, while niche formulations can command higher prices.

2. How will patent expiries affect future prices?

Patent expiries typically lead to increased generic entry, driving prices downward and increasing accessibility. Limited patent protection means sustained low pricing; however, patent litigations or extensions can temporarily maintain higher prices.

3. Are there upcoming competing drugs or formulations?

Currently, no novel formulations threaten Bupropion HCL SR’s market share significantly. Future innovations, such as combination therapies with established antidepressants or extended-release systems, could modify competitive dynamics.

4. What are the key regional differences impacting pricing?

In the U.S., insurance negotiations and formulary placements heavily influence prices. In developing markets, prices are generally lower due to reduced purchasing power and limited regulatory protections.

5. What are the main risks impacting price stability?

Regulatory changes, supply chain disruptions, patent litigations, or the emergence of superior therapies could alter current pricing trends and market share.

References

[1] Grand View Research, “Antidepressant Drugs Market Size, Share & Trends Analysis Report,” 2023.

[2] IQVIA, “The Viewpoint,” 2023.

[3] U.S. Food & Drug Administration (FDA), “Approved Drugs Database,” 2023.

[4] FDA Orange Book, “Patent and Exclusivity Data,” 2023.

[5] MarketWatch, “Drug Price Trends,” 2022.

Note: All data points and projections are based on current market intelligence and may evolve with regulatory, clinical, or competitive developments. Stakeholders should continuously monitor market dynamics for adaptive strategies.

More… ↓