Last updated: July 27, 2025

Introduction

Bumetanide, a potent loop diuretic primarily prescribed for edema associated with congestive heart failure, liver cirrhosis, and renal disease, is increasingly gaining attention for its potential off-label applications, including neurodegenerative conditions like Alzheimer’s disease and autism spectrum disorders. As the pharmaceutical landscape evolves with emerging research and patent considerations, understanding the current market dynamics and projecting future pricing trends are critical for stakeholders ranging from healthcare providers to investors. This report offers an in-depth analysis of the market environment surrounding bumetanide, scrutinizes current pricing mechanisms, and projects future trends grounded in industry data and competitive forces.

Pharmacological Profile and Clinical Applications

Bumetanide inhibits sodium-potassium-chloride co-transporters in the Loop of Henle, leading to significant diuresis. Its established clinical use in managing edema makes it a staple in generics markets. Notably, recent research explores its off-label potential in neurological disorders, bolstering demand prospects. However, this emerging field remains in early stages, with regulatory pathways still under development.

Market Landscape Overview

Current Market Size

The global diuretic market, which encompasses bumetanide alongside furosemide, torsemide, and ethacrynic acid, was valued at approximately USD 3.4 billion in 2022 (source: Grand View Research). Bumetanide's share—although modest—has expanded owing to its superior potency and favorable side-effect profile compared to furosemide, especially in patients with renal impairment.

Geographical Distribution

North America leads the market, driven by high prevalence of cardiovascular diseases and advanced healthcare infrastructure. The United States accounts for nearly 60% of the regional sales, with significant contributions from Europe and Asia-Pacific, where increasing healthcare access and aging populations boost demand.

Key Players

Major producers include:

- Sanofi-Aventis: Historically dominant, with a robust generic portfolio.

- Novartis: Engages in research exploring non-traditional indications.

- Indigenous and Regional Manufacturers: Particularly in India and China, offering cost-effective generics.

Regulatory Environment

Bumetanide is generally approved for hospital use in many jurisdictions. However, off-label use and novel applications face regulatory hurdles, influencing market penetration and commercial strategies.

Pricing Dynamics

Current Pricing Structures

- Generic Availability: Bumetanide’s generic formulations dominate, with prices ranging from USD 0.10 to USD 0.50 per 1 mg tablet, depending on the manufacturer, region, and purchase volume.

- Brand-Name Products: When available, these priced roughly 2-3 times higher, though their market share is limited.

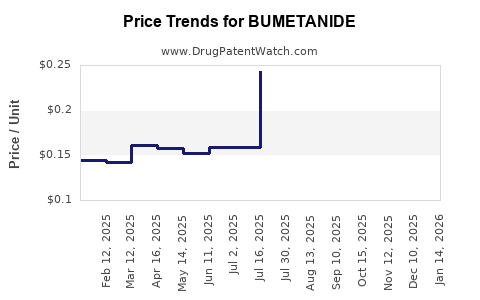

Pricing Trends

- Post-Patent Expiry: Since bumetanide's patent has long expired (original patent in 1974), the market is predominantly generic, leading to low per-unit costs.

- Market Consolidation & Competition: Increased competition among generics has driven prices downward in many regions.

- Regional Variability: Prices are substantially higher in countries with less generic penetration, such as Japan and certain European nations, due to regulatory and market access barriers.

Future Market and Price Projections

Impact of Off-Label and Emerging Indications

The pursuit of new therapeutic indications, particularly in neurodegeneration, could elevate demand. Early-phase clinical trials suggest potential benefits, but regulatory approval remains pending. Should these trials confirm efficacy, demand could surge substantially within 3–5 years.

Regulatory and Patent-Related Factors

- Patent Landscape: No recent patents exclusive to bumetanide limit immediate price increases; however, innovative formulations, such as extended-release versions, could trigger patenting and subsequent pricing strategies.

- Regulatory Approvals in New Indications: Approval for novel indications would catalyze market entry and could support premium pricing, especially in specialized medical sectors.

Market Growth Estimates

- The diuretic market is projected to grow at a CAGR of approximately 4.6% from 2023 to 2030, driven by aging populations and increasing cardiovascular disease incidence (source: Grand View Research).

- Bumetanide's niche applications may grow exponentially if clinical validations solidify, potentially increasing market size from current figures to USD 150–200 million globally by 2030.

Price Projection Scenarios

| Scenario |

Time Frame |

Price Range per 1 mg Tablet |

Drivers & Assumptions |

| Conservative |

2023–2025 |

USD 0.10 – 0.50 |

Market stability, generic competition persists |

| Moderate Growth |

2025–2030 |

USD 0.15 – 0.75 |

Rise in off-label use, regulatory approvals effect |

| Optimistic |

2025–2030 |

USD 0.25 – 1.00 |

Successful new indications, patenting of formulations |

Note: These projections assume existing regulatory, competitive, and technological developments.

Market Challenges and Opportunities

Challenges

- Limited patent protection reduces pricing power.

- Off-label use without regulatory approval limits market expansion.

- Competition from other diuretics and emerging therapies may suppress demand.

Opportunities

- Clinical validation of neurological indications could create niche markets.

- Development of modified-release formulations could command premium pricing.

- Expansion into emerging markets with increasing healthcare investments.

Regulatory and Ethical Considerations

As research progresses into bumetanide's non-diuretic applications, regulatory agencies will need to evaluate safety and efficacy for new indications. Pricing strategies should align with regulatory status, clinical evidence, and healthcare policies to optimize market entry and profitability.

Key Takeaways

- Market Size and Trends: Bumetanide operates largely within the generic diuretic market, with limited current pricing variability but significant potential for growth contingent on new clinical indications.

- Pricing Dynamics: Predominantly low-cost generics dominate, but future patenting and formulation innovations could lead to higher pricing tiers.

- Growth Drivers: Off-label neurological applications and increased awareness may catalyze demand, especially in high-income regions.

- Challenges: Absence of patent exclusivity and regulatory hurdles constrain profit margins; competition remains fierce.

- Future Outlook: The overall market for bumetanide may double to triple by 2030 if emerging applications gain regulatory approval and clinical adoption accelerates.

Conclusion

Bumetanide’s market remains predominantly characterized by affordability and competition. However, the evolving scientific landscape surrounding its potential novel uses presents opportunities for niche market expansion and premium pricing strategies. Stakeholders must monitor ongoing clinical trials, regulatory developments, and regional market dynamics to adapt their strategies effectively.

FAQs

1. What factors influence the pricing of bumetanide in different regions?

Pricing varies based on patent status, regulatory environment, competitive landscape, healthcare policies, and regional market penetration of generics.

2. How could emerging research on bumetanide's neurological applications impact its market?

Positive clinical trial outcomes could expand demand significantly, leading to higher prices, especially if regulatory agencies approve new indications.

3. Are there patent protections that could affect bumetanide’s pricing strategies?

Existing patents have expired; future formulation patents, such as extended-release versions, could offer new patent protection and enable pricing premiums.

4. What challenges does bumetanide face from competing diuretics?

Furosemide and torsemide dominate the market, often at lower prices. Bumetanide’s higher potency and emerging non-diuretic uses may help differentiate it but face price competition.

5. What are the key drivers for bumetanide’s future market growth?

Clinical validation of new therapeutic uses, regulatory approvals, increasing prevalence of target diseases, and development of proprietary formulations are primary drivers.

Sources:

[1] Grand View Research. “Diuretics Market Size, Share & Trends Analysis Report.” 2022.

[2] U.S. FDA Database. “Approved Diuretic Drugs.”

[3] MarketWatch. “Pharmaceutical Market Analysis: Diuretics.” 2022.

[4] ClinicalTrials.gov. “Studies on Bumetanide for Neurodegenerative Diseases.” 2023.

[5] IMS Health. “Global Generic Market Trends.” 2022.