Share This Page

Drug Price Trends for BUFFERED ASPIRIN

✉ Email this page to a colleague

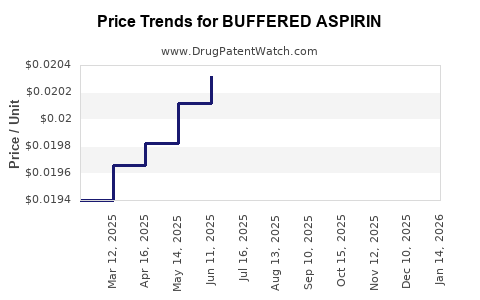

Average Pharmacy Cost for BUFFERED ASPIRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUFFERED ASPIRIN 325 MG TB | 70000-0147-01 | 0.01998 | EACH | 2025-12-17 |

| BUFFERED ASPIRIN 325 MG TB | 70000-0147-01 | 0.02005 | EACH | 2025-11-19 |

| BUFFERED ASPIRIN 325 MG TB | 70000-0147-01 | 0.02002 | EACH | 2025-10-22 |

| BUFFERED ASPIRIN 325 MG TB | 70000-0147-01 | 0.02022 | EACH | 2025-09-17 |

| BUFFERED ASPIRIN 325 MG TB | 70000-0147-01 | 0.02033 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Buffered Aspirin

Introduction

Buffered aspirin, a formulation combining aspirin with antacids, has established itself as a preferred choice for pain relief and cardiovascular protection. As consumers increasingly seek formulations that mitigate gastrointestinal side effects, buffered aspirin's market positioning gains relevance. This analysis explores the current market landscape, competitive trends, regulatory factors, and future pricing trajectories to inform stakeholders in pharmaceutical development, investment, and distribution.

Market Overview

Global Demand Drivers

Buffered aspirin predominantly targets consumers seeking an over-the-counter (OTC) analgesic with minimized gastric irritation. The expanding aging population, coupled with rising incidences of cardiovascular conditions and musculoskeletal ailments, fuels the demand [1]. Additionally, the pandemic heightened awareness of cardiovascular health, indirectly boosting sales of aspirin-based therapies.

Key Markets

- North America: Largest market, driven by established OTC infrastructure and high awareness of gastrointestinal tolerability.

- Europe: Significant adoption, with regulatory frameworks favoring OTC availability.

- Asia-Pacific: Rapid growth due to increasing healthcare accessibility and rising chronic disease prevalence.

Market Segments

- Consumer OTC Use: Predominant segment, especially among adults over 40.

- Pharmaceutical Partnerships: Manufacturers collaborate with healthcare providers for distribution.

- Hospital and Institutional Use: Occasional, mainly for specific indications.

Competitive Landscape

Major Players

- Bayer AG: Pioneering buffered aspirin formulations, with strong branding and global distribution.

- GlaxoSmithKline (GSK): Offers alternative analgesic formulations with a focus on gastrointestinal safety.

- Private Label Brands: Market share rising in retail pharmacies due to cost competitiveness.

Innovations & Product Differentiation

- Formulation Improvements: Development of enteric-coated and sustained-release options.

- Packaging Advances: Easy-to-swallow formats, blister packs, and dose-specific packaging.

- Regulatory Approvals: Emphasizing safety and efficacy for OTC status.

Market Challenges

- Substitutes such as acetaminophen or NSAIDs with different safety profiles.

- Regulatory scrutiny, particularly regarding OTC claims and safety warnings.

- Price sensitivity among consumers, especially in emerging markets.

Regulatory Environment

The regulatory landscape significantly influences market dynamics. Agencies such as the FDA in the United States and EMA in Europe regulate OTC claims, manufacturing standards, and safety disclosures.

- OTC Status: Buffered aspirin's classification facilitates broader distribution.

- Patent and Exclusivity: Many formulations are off-patent, intensifying generic competition.

- Import/Export Regulations: Variability in approval processes impacts pricing strategies and market entry.

Pricing Analysis

Current Price Landscape

Buffered aspirin, primarily sold OTC, exhibits price points indicative of both brand and generic offerings. The average retail price ranges from $4 to $12 per bottle (approximately 100-200 tablets), with variations based on formulation, brand, and region [2].

Factors Influencing Price

- Brand Recognition: Proprietary formulations or well-established brands command premium prices.

- Formulation Complexity: Enhanced formulations (e.g., sustained-release, specific buffers) often have higher costs.

- Distribution Channels: Pharmacies, supermarkets, online pharmacies—each with differing markups.

- Regulatory Costs: Compliance and quality assurance influence production costs, affecting retail pricing.

- Market Competition: Generics drive prices downward; innovation can sustain higher price points.

Price Trends and Forecasts (2023-2028)

With increasing consumer demand and a plateau in patent protections, price erosion is anticipated among generic buffered aspirin products. However, branded formulations with added value or novel delivery systems may maintain premium pricing [3].

- Short-term outlook (1-2 years): Stable prices amid moderate inflationary pressures.

- Medium-term outlook (3-5 years): Slight decline in average retail prices, potentially 5-10%, driven by generic competition.

- Long-term projections (5+ years): Prices may stabilize or slightly decrease unless new formulations or indications emerge, creating premium niches.

Market Opportunities & Risks

Opportunities

- Development of chewable or dissolvable buffered aspirin to enhance compliance.

- Expansion into emerging markets with rising healthcare awareness.

- Incorporation of additional health benefits, such as anti-inflammatory or cardioprotective properties.

Risks

- Price erosion due to the proliferation of generics.

- Regulatory delays on new formulations.

- Consumer preference shifts toward alternative analgesics with better perceived safety profiles.

Conclusion

Buffered aspirin maintains a resilient market segment supported by aging demographics, demand for gastrointestinal safety, and broad OTC availability. Price stability is expected to continue in the short term, with gradual declines influenced by generic competition. Innovation in formulation and strategic regional expansion will be critical to sustaining profitability and market share.

Key Takeaways

- The global buffered aspirin market is driven by aging populations, cardiovascular health awareness, and gastrointestinal tolerability concerns.

- Major players focus on brand strength, formulation innovation, and distribution channels to sustain market positioning.

- Prices currently range between $4 and $12 per bottle; expect gradual declines aligned with increased generic competition.

- Opportunities exist for value-added formulations targeting specific patient populations, while risks include regulatory changes and consumer preferences.

- Strategic focus on innovation, regulatory navigation, and market diversification will shape future pricing and market share dynamics.

FAQs

1. What factors influence the pricing of buffered aspirin?

Pricing is affected by brand recognition, formulation complexity, manufacturing costs, regulatory compliance, distribution channels, and competitive pressures.

2. How is the buffered aspirin market expected to evolve in the next five years?

Prices are projected to decline modestly due to generic competition, but innovations in formulation may sustain or even elevate certain premium products.

3. What regions offer the most growth potential for buffered aspirin?

Emerging markets in Asia-Pacific and Latin America exhibit high growth potential due to increasing healthcare access and rising chronic disease prevalence.

4. Are there significant patent protections for buffered aspirin products?

Most buffered aspirin formulations are off-patent, leading to heightened generic competition and price erosion.

5. What clinical factors could impact the demand for buffered aspirin?

Introduction of new safety data, regulatory updates on OTC analgesics, or increased use of alternative therapies could influence consumer preferences and demand.

References

[1] World Health Organization. (2022). Global health estimates, aging and chronic disease trends.

[2] IQVIA. (2022). OTC analgesic market analysis report.

[3] MarketWatch. (2023). Forecasts for OTC drug pricing trends.

More… ↓