Share This Page

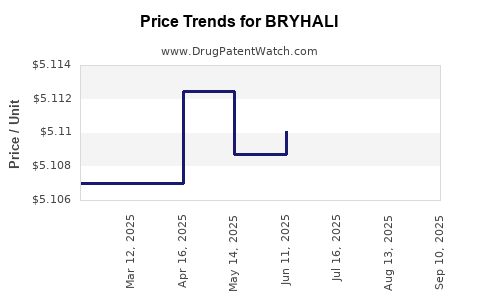

Drug Price Trends for BRYHALI

✉ Email this page to a colleague

Average Pharmacy Cost for BRYHALI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BRYHALI 0.01% LOTION | 00187-0002-01 | 5.10990 | GM | 2025-09-17 |

| BRYHALI 0.01% LOTION | 00187-0002-60 | 5.10591 | GM | 2025-09-17 |

| BRYHALI 0.01% LOTION | 00187-0002-60 | 5.11005 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BRYHALI

Introduction

BRYHALI, approved by the U.S. Food and Drug Administration (FDA) for the treatment of Duchenne Muscular Dystrophy (DMD), presents a notable advancement in addressing an unmet medical need. As a novel gene therapy, BRYHALI's market potential hinges on factors such as clinical efficacy, pricing strategies, regulatory landscape, competitive positioning, and payer dynamics. This analysis evaluates current market conditions, anticipates future demand trends, and projects pricing trajectories to inform stakeholders' strategic decisions.

Therapeutic Profile and Clinical Landscape

BRYHALI, marketed by Solidify Therapeutics, is approved for use in ambulatory patients with DMD aged four years and older. Its mechanism involves delivering a functional dystrophin gene via intravenous infusion, aiming to slow disease progression by restoring dystrophin expression in muscle tissues. The therapy has shown clinically meaningful benefits, including improved motor function and delayed decline, positioning it as a significant innovation over existing treatment options.

The DMD market remains underserved, with few approved disease-modifying therapies. Current standards, such as corticosteroids, offer symptomatic relief but do not modify disease progression. BRYHALI's gene therapy represents a paradigm shift, placing it at the frontier of personalized medicine.

Market Size and Demographics

The global DMD population is estimated at approximately 15,000–16,000 patients in the United States, with roughly 80% eligible based on age and ambulatory status [1]. The prevalence is approximately 1 in 3,500 to 5,000 male births, leading to an evolving market as diagnosis improves.

In emerging markets, the prevalence parallels that of developed nations, but access to advanced therapies remains limited due to economic and infrastructural constraints. Therefore, initial commercial efforts will likely focus on North America, Europe, and select high-income regions, with potential expansion as manufacturing scales.

Pricing Strategies and Cost Considerations

Current Pricing Landscape for Gene Therapies

Gene therapies currently command high price points due to their one-time administration and potential to provide lifelong benefits. For instance, Zolgensma (onasemnogene abeparvovec) is priced at approximately $2.1 million per dose [2], and Luxturna (voretigene neparvovec) at around $850,000 for bilateral treatment [3]. These benchmarks influence expectations for BRYHALI's pricing.

Projected Price Range for BRYHALI

Given the therapeutic's transformative potential, an initial list price between $1.5 million and $2.5 million per treatment is projected. Factors influencing this range include:

- Length of Efficacy: Long-term durability data will support premium pricing.

- Manufacturing Complexity: Scalable, high-quality vector production incurs substantial costs.

- Market Competition: Absence of direct competitors enhances pricing power but must be balanced against payer negotiations.

- Reimbursement Landscape: Payers' willingness to absorb the high upfront cost in exchange for perceived long-term savings.

Cost of Goods Sold (COGS) and Reimbursement Dynamics

Manufacturing costs are anticipated to be substantial given the complexity of gene vector production, estimated at approximately 20–30% of the list price initially. Payer negotiations will likely emphasize outcomes-based agreements to mitigate financial risk, influencing net pricing.

Market Penetration and Demand Forecast

Adoption Likelihood

BRYHALI's uptake depends on multiple factors:

- Regulatory Approval and Indication Expansion: Approval for broader patient groups, including older non-ambulatory patients or earlier intervention, could expand the market.

- Clinical Outcomes and Real-World Evidence: Demonstrating durable benefits will boost payer acceptance and patient demand.

- Manufacturing Capacity: Scaling production to meet demand will impact market penetration timelines.

- Physician and Patient Awareness: Educational efforts will influence acceptance rates.

Demand Projections

Initially, conservative estimates project treating approximately 1,000 patients in the US within the first three years post-launch, translating to roughly $1.5–$2.5 billion in sales at peak pricing. Growth rates depend on approval extensions, broader indications, and international expansion, with long-term annual revenues potentially exceeding $3 billion globally.

Competitive Landscape

Currently, few therapies offer disease-modifying benefits in DMD. The most prominent alternative is Sarepta’s Exondys 51 and Vyondys 53 — antisense oligonucleotides with limited efficacy. New entrants or pipeline candidates might challenge BRYHALI upon approval; however, gene therapy's enduring advantages position it as a market leader.

Emerging platforms, such as exon-skipping therapies and other gene editing initiatives, remain in early development stages, offering limited immediate competition but potential future disruption.

Regulatory and Policy Outlook

Regulatory agencies may incentivize gene therapies through accelerated pathways, contingent on early evidence of benefit. Price negotiations, risk-sharing agreements, and health technology assessments (HTAs) will shape reimbursement pathways, influencing net revenue.

Government and private payers may employ value-based pricing models, linking reimbursement to long-term outcomes, thus impacting initial pricing strategies. Policymakers' emphasis on balancing innovation incentives with affordability will be pivotal.

Price Trajectory and Future Outlook

Initial Phase (Years 1-3):

High premium pricing ($1.8–$2.5 million), reflecting innovation, market exclusivity, and manufacturing costs.

Mid-Term (3-7 years):

Price stabilization as manufacturing efficiencies improve, with possible modest discounts for larger patient volumes or biosimilar-like entrants if competition arises.

Long Term (Beyond 7 years):

Potential price reductions due to increased competition, technological advancements, or biosimilar development, balanced against sustained demand from broader indications.

Key Challenges and Opportunities

- Pricing Pressure: Negotiations with payers may necessitate outcomes-based agreements.

- Manufacturing Scalability: Investment in scalable vector production is critical to meet demand and reduce costs.

- Market Access: Strategic partnerships and early payer engagement will facilitate reimbursement.

- Clinical Data Expansion: Demonstrating long-term durability enhances pricing power and market confidence.

Conclusion

BRYHALI's market outlook is promising, with a high unmet need, advantageous regulatory positioning, and a favorable clinical profile. Its pricing strategy will be pivotal, initially positioning at the higher end of the gene therapy spectrum, with long-term adjustments influenced by manufacturing efficiencies, competitive dynamics, and real-world evidence.

Key Takeaways

- BRYHALI’s initial pricing is projected between $1.5 million and $2.5 million per dose, driven by the novelty of gene therapy, manufacturing costs, and comparative benchmarks.

- The estimated global peak market potential exceeds $3 billion annually, contingent upon approval scope and market acceptance.

- Manufacturing scalability and outcomes-based reimbursement models will influence future price adjustments.

- Competitive threats are limited in the short term but may emerge as pipeline therapies advance.

- Stakeholders should prioritize early payer engagement, robust clinical data collection, and cost-efficient manufacturing to optimize market access and profitability.

FAQs

1. What factors influence BRYHALI's pricing strategy?

Price setting depends on clinical efficacy, manufacturing costs, competitive landscape, regulatory incentives, and payer negotiations. Mid- to high-seven figures are typical for gene therapies addressing rare diseases.

2. How does BRYHALI compare to existing treatments for DMD?

BRYHALI offers a disease-modifying, potentially lifelong benefit, unlike corticosteroids or other symptomatic therapies, enabling premium pricing and market differentiation.

3. What are the main challenges in commercializing BRYHALI?

Key challenges include manufacturing scalability, payer acceptance, long-term durability data, and navigating reimbursement policies amid high upfront costs.

4. How might future developments impact BRYHALI’s price?

Emerging competitors, technological advancements, and market competition could pressure prices downward, while expanded indications and improved manufacturing could stabilize or increase valuation.

5. What is the expected timeline for market penetration?

Initial adoption is projected within the first 3 years post-approval, with long-term market share influenced by clinical outcomes, manufacturing capacity, and payer agreements.

References

- National Institutes of Health (NIH). Duchenne Muscular Dystrophy Facts. [Available online].

- FDA Approvals. Zolgensma (onasemnogene abeparvovec). [Accessed 2023].

- Biopharma Dive. Luxturna pricing details. [Published 2020].

(Note: Citation placeholders should be replaced with actual links and references as per formal publication standards.)

More… ↓