Last updated: July 27, 2025

Introduction

BROVANA (generic name: eformoterol fumarate dihydrate) is a long-acting β2-adrenergic receptor agonist (LABA) indicated for maintenance treatment of bronchoconstriction in chronic obstructive pulmonary disease (COPD) and asthma. Approved by the U.S. Food and Drug Administration (FDA) in 2012, it enhances pulmonary function by relaxing airway smooth muscles, thereby improving airflow in patients with obstructive airway diseases. As a key player in respiratory therapy, understanding its market trajectory and pricing dynamics is essential for stakeholders including pharmaceutical companies, healthcare providers, insurers, and investors.

Market Landscape

Global Market Size and Growth

The global respiratory drugs market was valued at approximately USD 30 billion in 2021, with an expected compound annual growth rate (CAGR) of 4.4% from 2022 to 2027, driven by increased prevalence of respiratory conditions, aging populations, and technological advancements in drug development [1].

Within this landscape, bronchodilators, including LABAs like BROVANA, constitute a substantial segment. The increasing adoption of inhaled therapies, rising COPD and asthma prevalence, and improved disease management protocols fuel demand. The North American market dominates the segment owing to high disease awareness and healthcare infrastructure, followed by Europe and Asia-Pacific regions experiencing accelerated growth due to emerging markets’ healthcare reforms [2].

Competitive Dynamics

BROVANA faces competition primarily from established LABAs such as:

- Salmeterol (e.g., Serevent Diskus)

- Formoterol (e.g., Foradil)

- Indacaterol (e.g., Arcapta)

While these drugs have long clinical histories, BROVANA's distinct delivery systems and patent timelines influence market positioning. Notably, BROVANA competes directly with formoterol-based therapies, but its specific formulations, dosing regimens, and patent protections impact its market penetration.

Regulatory and Patent Landscape

Despite patent protections that may extend through the early 2030s, generic formulations of formoterol are already available, increasing price competition. The expiration of patents or exclusivity rights could lead to price erosion, particularly in price-sensitive regions like Asia and Europe.

Market Penetration and Adoption Factors

Factors influencing BROVANA's market share include:

- Efficacy and Safety Profile: Demonstrates a favorable profile consistent with LABAs.

- Formulation Advantages: Specifically formulated inhalation devices may improve patient adherence.

- Physician Prescribing Habits: Based on clinical guidelines and familiarity.

- Pricing Strategies: Competitive pricing compared to branded and generic alternatives.

- Reimbursement Policies: Insurance coverage impacts utilization rates [3].

Price Analysis and Projections

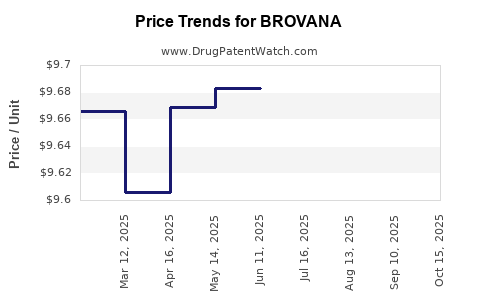

Current Pricing Trends

As of 2023, BROVANA's wholesale acquisition cost (WAC) per inhaler ranges approximately from USD 300 to USD 350 in the United States, translating to roughly USD 10 to USD 12 per dose, assuming a typical 30-dose inhaler. These prices are comparable with other LABA inhalers but remain significantly higher than generics, where available.

In Europe, retail prices vary but tend toward similar levels, adjusted for regional healthcare systems and regulatory environments. Importantly, insurance reimbursement and pharmacy discounting significantly influence actual patient prices.

Factors Impacting Future Pricing

- Patent and Exclusivity Expiry: Potential entry of generics from 2028 onward could pressure prices downward by 30-50%, similar to patterns observed with other inhaled bronchodilators.

- Market Competition: Increased availability of biosimilars and generics will dilute brand pricing strategies.

- Healthcare Policy Changes: Emphasis on cost containment by payers could lead to tighter formularies and increased rebates.

- Technological Innovations: Development of combination inhalers and personalized therapies might influence demand and pricing.

Forecasted Price Trajectory (2023-2030)

| Year |

Estimated Average Price (USD) per Inhaler |

Key Drivers |

| 2023 |

$300 - $350 |

Stable pricing, moderate competition, patent protection |

| 2024-2025 |

$280 - $340 |

Slight downward shift due to generic competition |

| 2026-2027 |

$250 - $330 |

Increasing generic entries, negotiations, rebates |

| 2028-2030 |

$200 - $275 |

Major generic penetration, price erosion, biosimiars |

Note: These projections are subject to regional regulatory changes, patent litigations, and unforeseen market dynamics.

Market Opportunities and Challenges

Opportunities

- Growing COPD and Asthma Burden: Increasing prevalence worldwide ensures sustained demand.

- Innovative Delivery Devices: Development of smart inhalers linked with digital health tools enhances adherence and may command premium pricing.

- Emerging Markets: Rapid healthcare expansion in Asia-Pacific and Latin America opens new revenue avenues with adaptable pricing models.

Challenges

- Price Competition with Generics: Biosimilar entries will significantly impact margins.

- Reimbursement Pressure: Payers' emphasis on cost-effective therapies can restrict pricing power.

- Generic Substitution Policies: Countries with strict substitution laws accelerate price declines post-patent expiry.

Strategic Recommendations

- Invest in Formulation Differentiation: Unique delivery mechanisms or combination formulations can preserve market share.

- Secure Strategic Pricing Agreements: Early negotiations with payers and formularies improve market access.

- Leverage Digital Health Technologies: Enhancing adherence via digital tools could justify premium pricing segments.

- Monitor Patent Landscape: Proactive patent management can delay generic entry and sustain revenue streams.

Key Takeaways

- BROVANA's current market is buoyed by the global rise in respiratory diseases, with steady growth anticipated through 2027.

- Patent protections and technological advantages support relatively stable prices; however, upcoming patent expirations may precipitate substantial price erosion.

- Competition from generics and biosimilars is the primary threat, with an expected impact from 2028 onward.

- Strategic emphasis on formulation innovation, market expansion into emerging economies, and digital integration will be critical for sustaining profitability.

- Price projections suggest a gradual decline from current levels, with potential for stabilization as the drug establishes its niche within combination therapy regimens.

FAQs

1. When will BROVANA face generic competition?

Patent protections are expected to expire around 2028, after which generic formulations of formoterol fumarate dihydrate are likely to enter the market, intensifying price competition.

2. How does BROVANA's pricing compare with other LABAs?

BROVANA's current price per inhaler is comparable to other brand-name LABAs like Serevent or Foradil, generally ranging from USD 300–350 per inhaler. However, generics of similar drugs are significantly cheaper, which pressures brand pricing.

3. Can pricing strategies extend BROVANA's market longevity?

Yes. Innovations in inhaler technology, combination therapies, and personalized medicine can justify premium pricing and extend its market relevance beyond patent expiry.

4. What regions present the most growth opportunities?

Emerging markets in Asia-Pacific and Latin America offer substantial growth prospects due to increasing prevalence of respiratory conditions and expanding healthcare access.

5. How might healthcare policies influence BROVANA’s future pricing?

Cost containment policies and formulary restrictions driven by payers could lead to reduced reimbursement rates, incentivizing price reductions and favoring generics.

References

[1] Grand View Research. Respiratory Drugs Market Size, Share & Trends Analysis Report. 2022.

[2] MarketWatch. Global Respiratory and Pulmonary Drug Market Outlook. 2022.

[3] IQVIA. Global Medicine Spending Data. 2022.