Share This Page

Drug Price Trends for BROMPHEN-PSE-DM

✉ Email this page to a colleague

Average Pharmacy Cost for BROMPHEN-PSE-DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BROMPHEN-PSE-DM 2-30-10 MG/5 ML | 75907-0207-16 | 0.08012 | ML | 2025-12-17 |

| BROMPHEN-PSE-DM 2-30-10 MG/5 ML | 00121-0933-04 | 0.08020 | ML | 2025-12-17 |

| BROMPHEN-PSE-DM 2-30-10 MG/5 ML | 00121-0933-16 | 0.08012 | ML | 2025-12-17 |

| BROMPHEN-PSE-DM 2-30-10 MG/5 ML | 00574-1104-16 | 0.08012 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bromphen-PSE-DM

Introduction

Bromphen-PSE-DM is a combination over-the-counter (OTC) medication predominantly used to treat cold and cough symptoms. Comprising brompheniramine (an antihistamine), pseudoephedrine (decongestant), and dextromethorphan (antitussive), it targets multiple symptoms simultaneously, making it a popular remedy in OTC formulations. Despite its broad usage, the medication’s market landscape remains complex, influenced by regulatory, competitive, and patent-related factors. This analysis explores the current market environment, key drivers, competitive dynamics, and future price projections for Bromphen-PSE-DM.

Market Overview

Regulatory Environment

The varied regulatory landscape significantly influences Bromphen-PSE-DM's market potential. Pseudoephedrine, a precursor in methamphetamine synthesis, is tightly regulated under the Combat Methamphetamine Epidemic Act (CMEA) in the U.S., which imposes limits on sales, tracking requirements, and storage regulations [1]. This regulatory environment impacts the distribution and pricing structures, as pharmacies and distributors incur higher compliance costs.

Additionally, the antihistamine component, brompheniramine, and dextromethorphan face restrictions related to age limits and abuse potential, particularly for dextromethorphan. Strict regulations can influence supply chain dynamics and formulary formulations, indirectly impacting pricing and market size.

Market Size and Demand

Over-the-counter cold remedies like Bromphen-PSE-DM generate consistent demand, especially during peak cold and flu seasons in temperate regions. The global OTC cold medication market was valued at approximately USD 9 billion in 2021 and is expected to grow at a CAGR of around 4% through 2028 [2].

Within this framework, Bromphen-PSE-DM’s specific market niche is constrained by the availability of alternative formulations and the increasing shift toward non-sedating antihistamines and combination therapies with improved safety profiles. Nevertheless, its efficacy, broad symptom coverage, and OTC availability sustain its market presence.

Distribution Channels

The primary distribution channels include pharmacies, drugstores, supermarkets, and online platforms. Growing online pharmacy sales, fueled by consumer preference for convenience and telehealth services, are expanding access but also introducing regulatory and pricing variability.

Competitive Landscape

Major Competitors

The market for cough and cold OTC medications is highly competitive, with key players such as Johnson & Johnson, GSK, Sanofi, and private-label brands. Many competitors offer similar symptom-relief combinations, often with variations in ingredient concentrations, formulations, or proprietary delivery systems.

Notably, newer formulations with non-sedating antihistamines or alternative decongestants (e.g., phenylephrine substituting pseudoephedrine) are gaining market traction due to regulatory pressures and safety concerns [3].

Patent and Exclusivity Status

Most formulations of Bromphen-PSE-DM are off-patent, existing as generic drugs. This status fosters a highly fragmented market with intense price competition. Patent expirations, coupled with regulatory requirements for OTC drugs, often lead to commoditization and price erosion.

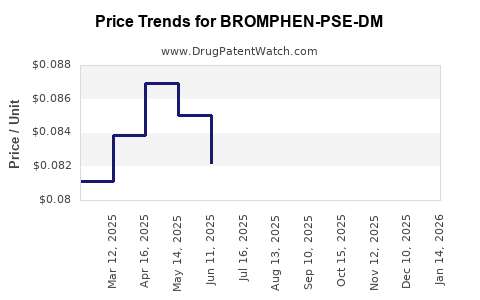

Price Trends and Projections

Current Pricing Dynamics

The average retail price for a standard package of Bromphen-PSE-DM varies geographically but generally ranges from USD 5-10 per pack (containing 100 tablets or equivalent). Generic formulations dominate the market, providing competitive pricing options. Brand-name products may command premiums in the USD 8-12 range.

Wholesale acquisition costs (WAC) trend slightly lower than retail prices, with discounts available for bulk purchasing by pharmacies or healthcare providers.

Factors Influencing Future Pricing

- Regulatory Changes: Stricter pseudoephedrine controls could limit supply, raising costs. Conversely, deregulation or loosening of sales limits could reduce prices.

- Manufacturing Costs: Increases in raw material prices, especially dextromethorphan and brompheniramine, impact production costs, influencing retail prices.

- Market Competition: Entry of low-cost generics and private-label brands exerts downward pressure on prices, particularly in saturated markets.

- Innovations: Development of new formulations or combination therapies could affect demand and pricing strategies of existing products.

- Distribution Channels: Expansion of online sales may lower distribution costs, leading to more aggressive pricing, but may also involve increased regulatory hurdles.

Projections (2023-2028)

Considering current market conditions and trends:

- Short-term outlook (2023-2024): Prices are expected to remain relatively stable with slight declines (~2-3%) driven by increasing generic competition. Retail prices for a standard pack are projected to hover around USD 5-7.

- Medium-term outlook (2025-2028): Slight price erosion may stabilize as market saturation reduces margin pressures. However, regulatory constraints on pseudoephedrine could create scarcity conditions, potentially causing short spikes in prices by approximately 5-7%. Overall, average retail prices could trend towards the USD 4-6 range for generics.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets where OTC cold remedies are underpenetrated.

- Development of reformulated products with improved safety profiles, capturing market share from traditional formulations.

- Leveraging online channels for direct-to-consumer sales, reducing distribution costs.

Risks:

- Heightened regulation concerning pseudoephedrine and dextromethorphan.

- Increasing competition from alternative formulations with better safety or convenience profiles.

- Price sensitivity among consumers, suppressing margins.

Key Takeaways

- Regulatory environment remains a critical factor influencing the supply, pricing, and competitiveness of Bromphen-PSE-DM.

- Generic competition and market saturation exert downward pressure on prices, though occasional supply constraints may cause short-term price hikes.

- The market outlook is characterized by modest declines in retail prices, stabilizing within the USD 4-7 range over the next five years.

- Online sales growth presents a strategic avenue for cost reduction and market expansion, contingent on regulatory compliance.

- Ongoing developments in formulation safety and delivery methods offer opportunities for differentiated products and premium pricing.

FAQs

1. How does regulation impact Bromphen-PSE-DM pricing?

Regulations, particularly on pseudoephedrine, increase compliance costs and limit supply, which can temporarily elevate prices. Over time, competition and regulatory adjustments tend to normalize pricing.

2. Will new formulations replace traditional Bromphen-PSE-DM products?

Potentially. Formulations featuring non-sedating antihistamines or alternative decongestants are gaining popularity due to safety concerns, which could reduce demand for traditional formulations.

3. What is the lifecycle outlook for Bromphen-PSE-DM?

As an off-patent OTC medication, its lifecycle relies on consumer demand, competitive pressures, and regulatory stability. Market share may decline slowly unless product differentiation or new formulations are introduced.

4. Are online sales affecting the pricing of Bromphen-PSE-DM?

Yes. Online channels often offer lower prices due to reduced overheads but also face increased regulatory scrutiny, affecting supply and pricing strategies.

5. What strategies can manufacturers adopt to sustain profitability?

Focus on formulation innovation, expanding into emerging markets, optimizing supply chains for cost efficiency, and leveraging direct-to-consumer online marketing can help maintain margins.

Sources

[1] U.S. Drug Enforcement Administration. Combat Methamphetamine Epidemic Act of 2005.

[2] Global Market Insights. OTC Cold Medications Market Report, 2022.

[3] National Institute on Drug Abuse. Dealing with Dextromethorphan Abuse, 2021.

More… ↓