Last updated: July 27, 2025

rket Analysis and Price Projections for Bromocriptine

Introduction

Bromocriptine, a potent dopamine receptor agonist, has established its position in the pharmaceutical landscape primarily for the treatment of conditions such as Parkinson’s disease, hyperprolactinemia, acromegaly, and type 2 diabetes. Since its introduction in the 1970s, bromocriptine's market dynamics have evolved alongside advancements in therapeutics, generics, and patent landscapes. This article analyzes its current market environment and projects future pricing trends based on regulatory, clinical, and economic factors.

Therapeutic Market Landscape

Applications and Market Drivers

Bromocriptine's primary indications—Parkinson’s disease and hyperprolactinemia—remain central to its valuation. The monocentric focus on neurodegenerative disorders is complemented by a growing off-label and combinational use in other endocrinological therapies. The aging global population and increasing prevalence of Parkinson’s, which affects over 10 million worldwide, bolster demand. Similarly, hyperprolactinemia's rising diagnosis contributes to steady prescription figures.

Other emerging factors include the drug's off-label use in managing certain cases of infertility and metabolic syndrome. The expanding understanding of dopamine agonists’ role in metabolic modulation underpins future demand projections.

Market Players and Competitive Dynamics

Bromocriptine is available globally through both innovator and generic manufacturers. The original patent, held by pharmaceutical giants, expired in many regions, enabling the proliferation of generic formulations. This proliferation has driven prices downward, yet branded products retain a segment of premium pricing due to established therapeutic efficacy and patient familiarity.

Key competitors in the market include companies like Novartis (original manufacturer), Teva, and Mylan. The entry of multiple generics has increased supply but also intensified price competition, especially in mature markets like the US, EU, and Japan.

Regulatory and Patent Landscapes

Patent exclusivity periods significantly impact pricing. Once expired, market entry of generics usually reduces the average price by 50-80%. Regulatory pathways such as the FDA's Abbreviated New Drug Application (ANDA) process streamline the approval of generics, sustaining competitive pressure. Patent litigations and data exclusivity protections occasionally inhibit generic entry, temporarily stabilizing prices.

Market Size and Revenue Estimates

Recent estimates rank bromocriptine's global market size at approximately USD 150-200 million annually. Growth projections indicate a compound annual growth rate (CAGR) of approximately 3-5% over the next five years, driven by increasing indications and off-label uses, with regional variations influenced by healthcare infrastructure and reimbursement policies.

Price Analysis and Factors Influencing Cost

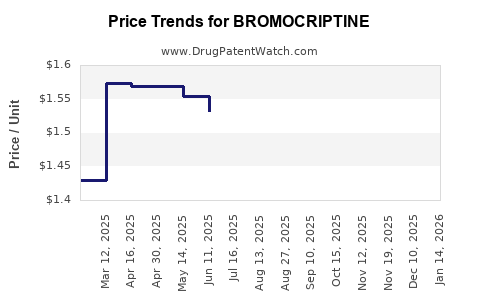

Current Pricing Trends

In the United States, a typical 30-tablet course of bromocriptine 2.5 mg costs about USD 25-40 for branded formulations, with generic versions averaging USD 10-20. In Europe, prices are comparable, often slightly lower due to centralized procurement and price regulation. In developing nations, prices can be significantly reduced due to local generics and government subsidies.

Impact of Generics and Biosimilars

The rise of generic bromocriptine has historically cut costs by 50-80%. However, market segments favor branded products for assured quality, influencing pricing strategies. The advent of biosimilars or specialized formulations could redefine future pricing if regulatory hurdles are overcome.

Regulatory Influences

Stringent regulatory environments, especially in high-income markets, influence drug pricing by necessitating rigorous quality standards, which sometimes disfavor low-cost manufacturers. Conversely, regulatory approvals for generic counterparts facilitate price reductions.

Reimbursement and Market Access

Insurance coverage and national health programs significantly impact retail prices. In countries with comprehensive reimbursement, prices tend to be stabilized, although cost-sharing mechanisms may influence final patient costs.

Future Price Projections

Short-Term Outlook (1-3 Years)

Given the patent expirations in multiple jurisdictions and the prevailing generic competition, bromocriptine prices are forecasted to decline modestly, with a 10-20% reduction projected in mature markets. The standardization and increased availability of low-cost generics will likely sustain low retail prices, with slight variations across regions.

Medium to Long-Term Outlook (3-10 Years)

As patents for bromocriptine lapse globally, continued generic proliferation will further depress prices. However, the development of extended-release formulations or combination therapies could command premium prices, especially if therapeutic advantages are demonstrated. Regulatory incentives and market demand for novel delivery systems could influence these trends.

Additionally, potential market consolidation, biosimilar innovations, or new entrants could introduce volatility but generally lead to downward pricing pressures.

Key Factors Modulating Future Pricing

- Patent Expirations: The gradual expiration of patents in major markets will be the most significant determinant.

- Generic Market Penetration: Growing number of manufacturers will sustain price competition.

- Regulatory Policies: Price control measures and reimbursement policies, particularly in national healthcare systems.

- Emerging Indications and Formulations: New delivery methods or expanded indications could introduce higher-priced options.

Conclusion

Bromocriptine’s market is characterized by mature generic competition, leading to relatively stable and declining prices. Future trajectories depend heavily on patent landscapes, regulatory policies, and ongoing clinical development. Stakeholders should monitor patent statuses, formulary preferences, and emerging formulations to optimize pricing strategies and market access.

Key Takeaways

- The global bromocriptine market is valued at approximately USD 150-200 million, with modest growth driven by aging populations and expanding indications.

- Patent expirations and generic proliferation have maintained low retail prices, with typical costs declining by up to 80% in mature markets.

- Price projections suggest continued downward trends over the next decade, with potential stabilization or increases only with new formulations or indications.

- Regulatory policies, reimbursement schemes, and competition will primarily influence future pricing dynamics.

- Strategic positioning around patent statuses and emerging formulations offers opportunities for cost management and market expansion.

FAQs

1. What factors impact the pricing of bromocriptine globally?

Pricing is influenced by patent status, generic competition, regulatory policies, reimbursement frameworks, and the availability of alternative treatments.

2. How does patent expiration affect bromocriptine prices?

Patent expiration typically leads to increased generic entry, resulting in significant price reductions, often by 50-80%, in affected regions.

3. Are there upcoming formulations that could change bromocriptine’s market value?

Yes, extended-release formulations and combination therapies being developed could command higher prices if they demonstrate superior efficacy or convenience.

4. Which regions are most likely to see the lowest bromocriptine prices?

Developing countries with strong generic markets and government-led subsidies generally offer the lowest prices, while high-income countries tend to maintain higher costs due to regulations and brand loyalty.

5. What are the primary therapeutic indications driving bromocriptine demand?

Parkinson’s disease, hyperprolactinemia, and acromegaly are the main drivers, with off-label uses in infertility and metabolic conditions contributing to demand stability.

Sources:

[1] Market Research Future, “Global Bromocriptine Market Analysis” (2022).

[2] Deloitte Insights, “Pharmaceutical Patent Expirations and Market Dynamics” (2021).

[3] IQVIA, “Global Pharmaceutical Pricing Trends” (2022).

[4] US FDA, “ANDA Approvals and Generic Drug Market Entry Data” (2023).

[5] WHO, “Global Burden of Parkinson’s Disease” (2022).