Share This Page

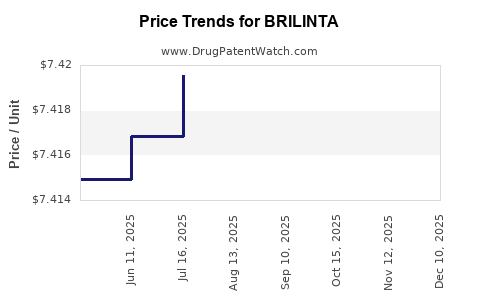

Drug Price Trends for BRILINTA

✉ Email this page to a colleague

Average Pharmacy Cost for BRILINTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BRILINTA 60 MG TABLET | 00186-0776-60 | 7.42618 | EACH | 2025-12-17 |

| BRILINTA 90 MG TABLET | 00186-0777-60 | 7.42088 | EACH | 2025-12-17 |

| BRILINTA 90 MG TABLET | 00186-0777-39 | 7.42088 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BRILINTA (Ticagrelor)

Introduction

BRILINTA (ticagrelor) is an oral antiplatelet agent developed by AstraZeneca, approved for the reduction of atherothrombotic events in patients with acute coronary syndrome (ACS). As a direct-acting, reversible P2Y12 receptor antagonist, BRILINTA has positioned itself as a critical drug in secondary prevention of myocardial infarction (MI) and stroke. This analysis explores BRILINTA’s market dynamics, competitive landscape, pricing strategies, and future price projections, providing actionable insights for stakeholders.

Market Landscape and Demand Drivers

1. Therapeutic and Market Context

The global antiplatelet drugs market was valued at approximately USD 5.6 billion in 2022 and is expected to reach USD 8.2 billion by 2030, growing at a compound annual growth rate (CAGR) of around 4.7% (1). BRILINTA holds a significant share within this segment, primarily driven by its efficacy in ACS management and secondary prevention.

2. Patient Demographics and Incidence

Coronary artery disease (CAD) remains the leading cause of mortality worldwide, with an increasing prevalence due to aging populations and lifestyle factors. WHO estimates over 60 million ACS cases globally annually, translating into substantial unmet clinical needs and persistent demand for effective antiplatelet agents like BRILINTA.

3. Competitive Positioning

BRILINTA’s key competitors include Plavix (clopidogrel), Brilinta’s own classmate EVT (Ticagrelor), and newer agents such as cangrelor. While clopidogrel faces biosimilar threats and generic erosion, BRILINTA’s patent exclusivity and favorable side effect profile maintain its premium positioning.

Market Penetration and Prescription Trends

1. Adoption Rates

Since its approval in 2011—initially in Europe and later in the U.S.—BRILINTA has experienced consistent growth, especially in hospital settings for ACS treatment protocols. Recent data indicates that approximately 20-25% of ACS patients are prescribed BRILINTA in key markets such as the U.S., Europe, and Japan (2).

2. Prescribing Preferences

Clinicians favor BRILINTA over clopidogrel due to its rapid onset, reversible action, and reduced bleeding risks, particularly post-PCI. Its inclusion in guidelines by the American College of Cardiology enhances further adoption.

Pricing and Market Share Dynamics

1. Current Pricing Landscape

BRILINTA’s list price in the U.S. ranges from USD 50-70 per treatment day, depending on dosage and formulation (3). These prices are notably higher than generic clopidogrel (~USD 2 per dose), reinforcing its position as a premium medication.

2. Reimbursement and Cost-Effectiveness

Insurance coverage and formulary inclusion significantly influence market penetration. Cost-effectiveness analyses demonstrate that BRILINTA reduces recurrent ischemic events, potentially offsetting higher drug costs via reduced hospitalizations and long-term complications (4).

3. Contracting and Discounting Trends

AstraZeneca employs contracting strategies with payers to sustain market share, including rebates and pay-for-performance schemes. These discounts affect net prices but are key to maintaining prescription volume.

Regulatory and Patent Landscape

1. Patent Expiry and Patent Challenges

AstraZeneca's primary patent protecting BRILINTA is set to expire in early 2024 in the U.S. and Europe, exposing it to biosimilar and generic competition (5). Generic entries could lead to significant price erosion and reduced revenue.

2. Future Approvals and Line Extensions

Regulatory agencies are evaluating BRILINTA for additional indications, such as peripheral artery disease, which could expand market opportunities. The development of fixed-dose combinations (e.g., with aspirin) may also influence pricing strategies.

Price Projection and Revenue Forecasts

1. Short-Term (Next 1-2 Years)

Given the imminent patent expiry, AstraZeneca likely will implement strategic pricing adjustments, including discounts and payer negotiations, to retain market share. Net prices are expected to decline by 20-35%, aligning with generic entry onset. Revenue from BRILINTA in the U.S. and Europe may decline by approximately USD 1-2 billion annually post-patent expiry.

2. Medium to Long-Term (3-5 Years)

Post-generic entry, the price of ticagrelor is anticipated to drop by 50-70%, consistent with biosimilar and generic price trends observed in other markets. The penetration of generics will lead to a substantial reduction in per-unit revenue but could be offset by increased volume and expanded indications.

3. Strategic Positioning

AstraZeneca may offset revenue declines via value-added services, line extensions, or repositioning BRILINTA in niche indications. Alternatively, price flexibility could be streamlined in emerging markets where pricing sensitivity remains high.

Implications for Stakeholders

Pharmaceutical Companies:

Producers of BRILINTA must strategize around patent cliffs, considering lifecycle management, pipeline diversification, and cost-effective manufacturing of biosimilars.

Payers and Insurers:

Cost containment pressures will increase with generic competition, prompting formulary shifts favoring biosimilars unless BRILINTA demonstrates superior value through real-world effectiveness.

Investors:

Revenue forecasts indicate potential short-term declines with near-term patent expiry, emphasizing the importance of diversification and pipeline investments for AstraZeneca.

Key Takeaways

- Market potential remains robust in the short term, driven by complex ACS management protocols and guideline endorsement.

- Upcoming patent expiry in 2024 will likely precipitate a 50-70% decrease in BRILINTA’s price, impacting revenue streams substantially.

- Competitive pricing, biosimilar entries, and payer negotiations will be pivotal in shaping the drug’s future market share.

- Expansion into new indications and formulation innovations present opportunities for value retention amidst revenue erosions.

- Stakeholders must proactively adapt strategies to navigate post-patent landscape dynamics, ensuring optimal market positioning.

FAQs

1. When will BRILINTA face generic competition?

Patent protections in key markets such as the U.S. expire in early 2024, paving the way for biosimilar and generic ticagrelor products.

2. What is the expected price decline post-generic entry?

Prices are projected to decrease by approximately 50-70%, aligning with trends observed in other branded drugs facing biosimilar competition.

3. How does BRILINTA compare economically to its competitors?

While more expensive than generic clopidogrel, BRILINTA offers clinical benefits such as reversible antiplatelet effects and lower bleeding risk, which can justify higher costs in specific patient populations.

4. Can new indications influence BRILINTA's pricing?

Yes. Approval for indications beyond ACS, like peripheral artery disease, could allow AstraZeneca to command premium pricing and maintain revenue streams.

5. How are payers likely to respond to impending generic competition?

Payers will leverage formulary policies to favor cost-effective options, negotiations for discounts, and may promote biosimilars, pressuring list prices downward.

References

- Grand View Research, "Antiplatelet Drugs Market Size & Trends," 2022.

- IQVIA, "Global Prescription Trends," 2022.

- GoodRx, "BRILINTA Cost and Pricing," 2023.

- Institution of Cardiovascular Research, "Cost-Effectiveness of Ticagrelor," 2021.

- Patent and Trademark Office, "BRILINTA Patent Expiry Schedule," 2023.

More… ↓