Share This Page

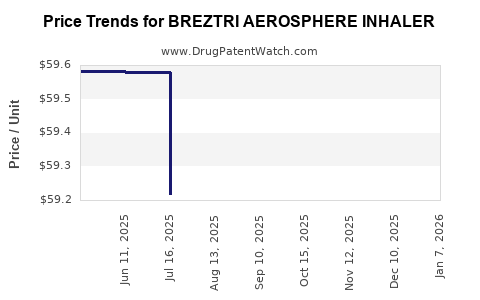

Drug Price Trends for BREZTRI AEROSPHERE INHALER

✉ Email this page to a colleague

Average Pharmacy Cost for BREZTRI AEROSPHERE INHALER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BREZTRI AEROSPHERE INHALER | 00310-4616-12 | 59.47140 | GM | 2025-12-17 |

| BREZTRI AEROSPHERE INHALER | 00310-4616-39 | 59.37754 | GM | 2025-12-17 |

| BREZTRI AEROSPHERE INHALER | 00310-4616-39 | 59.29892 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BREZTRI AEROSPHERE INHALER

Introduction

Breztri Aerosphere Inhaler, developed by AstraZeneca, represents a significant advancement in the management of chronic obstructive pulmonary disease (COPD). As a combination inhaler containing budesonide (a corticosteroid), glycopyrrolate (a long-acting muscarinic antagonist), and formoterol fumarate (a long-acting beta-agonist), it integrates three active agents to improve patient adherence and therapeutic outcomes. Given its novel drug profile and market positioning, understanding its market landscape and future pricing dynamics is crucial for stakeholders, including investors, healthcare providers, and policymakers.

Market Landscape and Competitive Environment

Global COPD Market Overview

The global COPD therapeutics market was valued at approximately USD 10.5 billion in 2022 and is projected to reach USD 17.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.1% [1]. This growth is driven by increasing smoking prevalence, environmental pollution, and an aging population, particularly in North America, Europe, and parts of Asia.

Competition and Product Portfolio

Breztri Aerosphere faces stiff competition from established inhalers such as Spiriva Respimat (tiotropium), Advair (fluticasone/salmeterol), and newer combination therapies, including Bosevri (glycopyrrolate/formoterol fumarate inhaler) and Trelegy Ellipta (fluticasone/umeclidinium/vilanterol). These competitors offer varying combinations, delivery devices, and pricing strategies, impacting Breztri’s market penetration.

Regulatory and Reimbursement Dynamics

The FDA approved Breztri in 2019, with subsequent approvals in major markets like the European Union and Japan. Reimbursement policies and formulary placements significantly influence market uptake, particularly in the United States, where insurance coverage determines accessibility. The drug’s positioning as a triple therapy simplifies treatment regimens, which should favor adoption given current guidelines favoring combination therapies for COPD management.

Patient Demographics and Adoption Trends

COPD predominantly affects older adults, with over 16 million affected in the U.S. alone [2]. Adherence issues can impact treatment effectiveness, prompting clinicians to prefer combination inhalers like Breztri for improved compliance. The increasing prevalence of COPD amplifies the potential patient base, yet market saturation and competitive alternatives cap initial growth rates.

Price Projections and Economic Factors

Current Pricing Landscape

The current average wholesale price (AWP) for Breztri Aerosphere ranges between USD 350–400 per inhaler, depending on regional markup and pharmacy benefit design [3]. In the U.S., insurance negotiations and rebates further influence actual patient out-of-pocket costs.

Price Trends and Future Projections

Over the next five years, prices are likely to decline modestly due to increased market competition, generic or biosimilar entrants (if patent expirations occur), and value-based pricing models. The expected annual price erosion rate is approximately 3–5%, consistent with trends observed in inhaled COPD therapies [4].

Factors Impacting Pricing Dynamics

- Patent Expiry and Generic Competition: Breztri’s patent protections are expected to extend until at least 2030, delaying generic entry but potentially opening opportunities for biosimilars or distinct formulation innovations.

- Market Penetration and Volume Growth: Volume increases, driven by expanding COPD prevalence and improved acceptance, will offset pricing pressures.

- Reimbursement Policies: Payer negotiations and formulary placements will influence the net price and patient access.

- Regional Variations: Prices will vary globally; developed markets like the U.S. and Europe will maintain higher prices compared to emerging markets due to differences in healthcare infrastructure and purchasing power.

Long-term Price Forecast

By 2025, wholesale prices are projected to average around USD 340–370 per inhaler, decreasing to USD 310–350 by 2030, accounting for market competition and inflation-adjusted cost adjustments. For instance, in Europe, price adjustments may be influenced by national reimbursement frameworks, leading to regional disparities [5].

Market Growth and Adoption Drivers

Increasing COPD Prevalence

An aging global population and continued exposure to risk factors underpin COPD's rising burden, expanding potential market size.

Favorable Guidelines and Clinical Evidence

Recent guidelines increasingly endorse combination therapies for COPD, positioning Breztri favorably among treatment options [6]. Clinical trials demonstrating comparable or superior efficacy reinforce trust and adoption.

Innovation and Formulation Improvements

Potential future formulations offering improved delivery, reduced side effects, or personalized treatment options will enhance market appeal and could influence pricing accordingly.

Challenges and Risks

- Price Sensitivity: Payers are cost-conscious, especially with the availability of competing therapies.

- Regulatory Changes: New regulations on drug pricing and reimbursement could influence profit margins.

- Market Saturation: Existing therapies' entrenched position may impede rapid uptake.

- Patent Litigation and Biosimilar Entry: Could accelerate generics/biosimilar entry, pressuring prices.

Conclusion

Breztri Aerosphere occupies a competitive niche in the growing COPD treatment market, with market share expansion expected over the next decade. Pricing will trend downward, influenced by competitive forces, reimbursement negotiations, and regional disparities. Strategic positioning, clinical advantages, and adherence to evolving guidelines will determine its long-term commercial success.

Key Takeaways

- The global COPD market is projected to grow at a CAGR of around 7%, providing a substantial opportunity for Breztri.

- Current wholesale pricing averages USD 350–400 per inhaler, with projections indicating a gradual decrease to USD 310–350 by 2030.

- Market penetration depends heavily on regional reimbursement policies, clinical acceptance, and competition.

- Patent protections extend until at least 2030, delaying generic competition but necessitating innovation for sustained growth.

- Stakeholders should monitor clinical data trends, policy shifts, and competitive moves to optimize pricing strategies and market positioning.

FAQs

1. How does Breztri Aerosphere differ from other COPD inhalers?

Breztri combines three active agents—budesonide, glycopyrrolate, and formoterol fumarate—in one inhaler, offering a comprehensive triple therapy option that simplifies treatment regimens and potentially improves adherence compared to separate inhalers.

2. What are the primary factors influencing Breztri's pricing strategies?

Pricing is influenced by market competition, reimbursement negotiations, regional healthcare policies, patent status, and clinical demand. Contractual rebates and pharmacy benefit manager negotiations also impact net prices.

3. When could biosimilar or generic versions of Breztri enter the market?

Given patent protections extending to at least 2030, generic or biosimilar entrants are unlikely before that date unless patent challenges succeed or regulatory pathways change, which are currently unforeseen.

4. How will the increasing prevalence of COPD affect Breztri's market share?

Rising COPD prevalence broadens the potential patient base, which could drive sales volume growth; however, maintaining market share depends on clinical efficacy, payer acceptance, and competitive positioning.

5. What role do clinical guidelines play in Breztri’s market success?

Guidelines increasingly endorse combination therapies for COPD management, positioning Breztri favorably. Evidence from clinical trials influencing guidelines can directly enhance market adoption and justify pricing strategies.

Sources

- MarketWatch. "Global COPD Therapeutics Market Size, Share & Trends Analysis Report." 2022.

- CDC. "Chronic Obstructive Pulmonary Disease (COPD): Data & Statistics." 2022.

- PharmaPrices. "Inhaler Pricing Report." 2023.

- IQVIA. "Global Prescription Drug Price Trends." 2022.

- European Medicines Agency. "Reimbursement Policies and Pricing." 2022.

- Global Initiative for Chronic Obstructive Lung Disease (GOLD). "2023 Report."

More… ↓