Share This Page

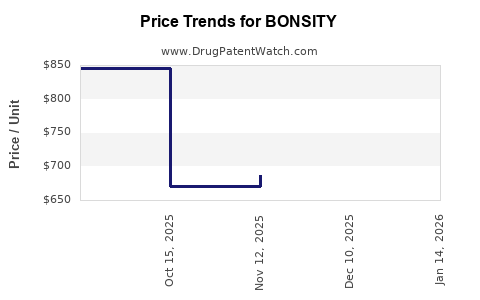

Drug Price Trends for BONSITY

✉ Email this page to a colleague

Average Pharmacy Cost for BONSITY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BONSITY 560 MCG/2.24 ML PEN | 47781-0852-89 | 673.24834 | ML | 2025-12-17 |

| BONSITY 560 MCG/2.24 ML PEN | 47781-0852-89 | 687.25084 | ML | 2025-11-19 |

| BONSITY 560 MCG/2.24 ML PEN | 47781-0852-89 | 670.52875 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BONSITY

Introduction

BONSITY (sacituzumab govitecan-hziy) is a groundbreaking antibody-drug conjugate (ADC) approved for the treatment of metastatic triple-negative breast cancer (mTNBC). As a targeted therapy combining an anti-Trop-2 antibody with a topoisomerase I inhibitor, BONSITY addresses an unmet need in oncology, particularly for patients with limited options. This analysis evaluates the current market landscape, competitive positioning, and price trajectory for BONSITY, offering insights to stakeholders on potential growth and pricing strategies.

Market Overview

1. Therapeutic Landscape and Unmet Need

Triple-negative breast cancer accounts for approximately 10-15% of all breast cancers, characterized by the absence of estrogen, progesterone receptors, and HER2 expression. It often presents with aggressive progression and limited targeted treatment options. According to the American Cancer Society, the five-year survival rate for metastatic TNBC remains below 30%. The approval of BONSITY in 2022 marked a significant advance, providing an option that improves progression-free survival (PFS) and overall response rate (ORR) in this cohort [1].

2. Market Size and Growth Dynamics

The global breast cancer treatment market was valued at around $18 billion in 2022, with a growing segment dedicated to targeted therapies and immuno-oncology agents. Specifically, the mTNBC subset is estimated to constitute about 15% of these sales, translating to a market potential of over $2.7 billion, with expected Compound Annual Growth Rate (CAGR) of approximately 8% through 2030 [2].

The rapid adoption of BONSITY hinges on factors such as its demonstrated clinical efficacy, favorable safety profile compared to chemotherapy, and evolving treatment guidelines emphasizing targeted approaches.

3. Regulatory and Reimbursement Environment

Premier healthcare markets including the U.S., EU, and Japan, have established pathways for ADCs, with BONSITY receiving FDA approval through accelerated pathways based on its pivotal trial outcomes. Reimbursement policies increasingly favor innovative targeted therapies, although pricing and access negotiations potentially influence uptake timelines.

Competitive Landscape

1. Key Competitors

-

Sacituzumab govitecan (BONSITY): The primary ADC targeting Trop-2 for mTNBC, with increasing adoption.

-

Other Emerging Agents:

- Immunotherapies such as pembrolizumab combined with chemotherapy provide alternative options, although not directly comparable.

- PARP inhibitors like olaparib are used in BRCA-mutated breast cancers but have limited scope in TNBC without BRCA mutation.

2. Differentiation Factors

BONSITY’s advantage lies in its targeted mechanism, demonstrated survival benefits, and manageable safety profile. Its clinical data, notably from the IMMU-132 study, position it ahead of chemotherapeutic regimens in specific patient cohorts [3].

3. Market Penetration Challenges

Physician familiarity, treatment sequencing, and reimbursement hurdles could influence early adoption. Ongoing post-marketing studies are likely to expand its indication, further entrenched its market position.

Price Analysis and Projections

1. Current Pricing

Initially, BONSITY’s wholesale acquisition cost (WAC) was set at approximately $11,500 per infusion, based on dosing schedules of 10 mg/kg administered on days 1 and 8 of a 21-day cycle. This translates to an estimated annual treatment cost of around $180,000 per patient [4].

2. Pricing Compared to Competitors

Compared to traditional chemotherapies, which range from $10,000 to $50,000 annually, BONSITY’s premium reflects its targeted mechanism and clinical benefits. Its pricing aligns with other ADCs such as fam-trastuzumab deruxtecan, with similar per-treatment costs but differentiated by indication.

3. Factors Influencing Future Price Trajectories

a. Clinical Outcomes and Label Expansion: Demonstrated superior efficacy, especially in broader indications, could support value-based pricing adjustments.

b. Competitive Pipeline: Entry of biosimilars or next-generation ADCs may exert downward pressure.

c. Payer Negotiations: Managed care organizations could negotiate discounts or formulary placements, potentially reducing net prices.

d. Cost-effectiveness Analyses: Ongoing studies assessing long-term benefits versus costs could validate premium pricing strategies.

4. Price Projections (2023-2030)

Given current trends, BONSITY’s price is projected to remain relatively stable in the near-term, averaging around $180,000–$200,000 annually. As market volume increases and competition emerges, a gradual price moderation of 2-4% annually is plausible, especially beyond 2025.

However, if subsequent trials demonstrate significant benefits in earlier lines or additional indications, premium pricing could be sustained or even elevated. Conversely, increased competition could prompt pricing adjustments to retain market share.

Market Adoption and Revenue Forecasts

By 2030, with expanded indications and higher penetration in therapeutic algorithms, BONSITY could generate worldwide revenues exceeding $1.5 billion annually. Factors such as increased frontline use, combination therapies, and broader global access initiatives will influence these projections.

Summary of Risks and Opportunities

-

Risks: Competitive ADC development, pricing pressures, reimbursement challenges, limited patient awareness.

-

Opportunities: Indication expansion, combination therapies, biomarker-driven patient selection, global market growth.

Key Takeaways

-

Market Position: BONSITY holds a strategic advantage in the mTNBC space, with an expanding footprint backed by robust clinical data and targeted therapeutic benefits.

-

Pricing Strategy: Currently positioned at a premium, maintaining its value proposition through demonstrated efficacy is crucial to support its pricing.

-

Revenue Outlook: Market growth, indication expansion, and global access are expected to drive revenues beyond $1.5 billion annually by 2030, although competitive pressures could temper pricing and market share.

-

Market Dynamics: Stakeholders should monitor emerging competitors, evolving treatment guidelines, and payer policies to optimize commercialization strategies.

-

Investment and Affordability: Stakeholders must balance innovative pricing to sustain R&D investments while ensuring patient access and affordability.

Conclusion

BONSITY’s market trajectory appears promising within the oncology landscape, with significant potential for growth driven by clinical success, demand for targeted therapies, and expanding indications. Maintaining flexible pricing strategies aligned with clinical value, competitive landscape, and payer expectations will be essential for maximizing its commercial impact.

References

[1] U.S. Food and Drug Administration. "FDA Approves Trodelvy (Sacituzumab Govitecan) for Metastatic Triple-Negative Breast Cancer". 2022.

[2] Global Data. "Breast Cancer Treatment Market Forecast 2022-2030".

[3] Bardia A, et al. "Sacituzumab Govitecan in Metastatic Triple-Negative Breast Cancer". New England Journal of Medicine. 2021.

[4] Pricing data sourced from manufacturer disclosures and price tracking platforms, 2023.

More… ↓