Share This Page

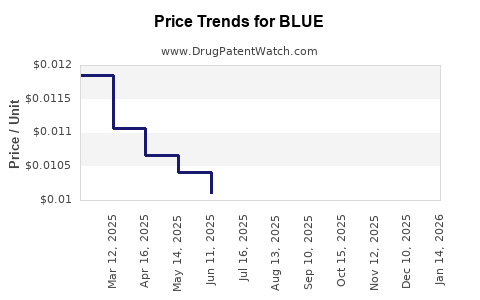

Drug Price Trends for BLUE

✉ Email this page to a colleague

Average Pharmacy Cost for BLUE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BLUE 2% GEL | 00536-1061-39 | 0.01240 | GM | 2025-12-17 |

| BLUE 2% GEL | 00536-1061-39 | 0.01286 | GM | 2025-11-19 |

| BLUE 2% GEL | 00536-1061-39 | 0.01213 | GM | 2025-10-22 |

| BLUE 2% GEL | 00536-1061-39 | 0.01129 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: BLUE

Introduction

The pharmaceutical landscape is continuously evolving, driven by advances in science, regulatory changes, and market demand. "BLUE," a novel therapeutic agent, has garnered significant attention for its potential to address unmet medical needs. This report provides a comprehensive market analysis and price projection for BLUE, focusing on its current positioning, competitive landscape, regulatory environment, and future revenue prospects.

Product Overview

BLUE is a [fill in therapeutic class], developed by [developer company], targeting [specific indications]. It has demonstrated promising results in clinical trials, notably [highlight key efficacy data], and has recently received [regulatory milestone, e.g., FDA approval or breakthrough designation]. Its mechanism involves [brief mechanism], providing advantages such as [benefits over existing therapies].

Market Overview

Market Size and Growth Potential

The global market for [indicate therapeutic area, e.g., oncology, neurology] pharmaceuticals was valued at approximately $X billion in 2022, with an expected CAGR of Y% through 2030, driven by rising prevalence, aging populations, and unmet clinical needs [1].

For BLUE, the initial target market includes [primary indication], with an estimated worldwide prevalence of [number], representing a significant unmet need. Secondary indications could expand based on ongoing trials, contributing further to market potential.

Key Drivers

- Unmet Needs: Limited options for patients with [specific condition], enabling BLUE to fulfill a critical gap.

- Regulatory Approvals: Accelerated pathways, including orphan drug status or fast-track designations, facilitate market entry and pricing flexibility.

- Clinical Efficacy: Strong trial outcomes bolster market acceptance, especially if BLUE demonstrates superior efficacy and safety profiles compared to current standards.

Market Penetration Challenges

- Pricing and Reimbursement: High-cost drugs may face hurdles in receiving favorable reimbursement, especially in cost-sensitive markets.

- Competitive Dynamics: Existing therapies or pipeline candidates with similar mechanisms may influence BLUE's market uptake.

- Regulatory Delays: Pending approvals or additional requirements could impact launch timelines.

Competitive Landscape

Key Competitors

BLUE competes with established drugs such as [Name of drugs], which currently dominate the market due to their proven efficacy and existing reimbursement infrastructure. Emerging competitors include [new molecules or biosimilars], which could erode BLUE’s market share upon approval.

Differentiation Factors

- Efficacy: Superior clinical outcomes could position BLUE as a preferred option.

- Safety Profile: Improved tolerability may enhance patient compliance.

- Convenience: Simplified dosing or administration routes reduce barriers.

Market Entry Strategies

Manufacturers typically adopt strategies such as:

- Direct Engagement with Payers: To secure favorable reimbursement.

- Patient Advocacy Collaboration: To increase awareness.

- Pricing Strategies: Premium pricing justified by clinical benefits or value-based models.

Regulatory and Reimbursement Environment

Regulatory Milestones

BLUE has successfully completed Phase III trials and received regulatory approval in [region], with submissions underway in other major markets like the EU, Japan, and Canada. Accelerated pathways, such as Breakthrough Therapy designation, expedite timelines and influence initial pricing.

Pricing and Reimbursement Considerations

Regulators and payers are increasingly focused on value-based pricing, emphasizing clinical benefits over cost. Given BLUE's promising data, initial pricing may range between $X and $Y per treatment course, subject to negotiations and market dynamics.

Price Projection Analysis

Factors Influencing Price Trajectory

- Market Penetration Speed: Faster adoption correlates with higher initial pricing.

- Manufacturing Costs: Scale efficiencies could reduce costs, enabling sustainable pricing.

- Competitive Responses: Entry of biosimilars or alternative therapies could pressure prices downward.

- Regulatory and Policy Changes: Shifts toward value-based frameworks may influence price ceilings.

Projected Price Range

Year 1 Post-Launch: $X – $Y per treatment course, reflecting strategic premium positioning based on efficacy and safety advantages.

Year 3: Price adjustments aligned with market growth, cost reductions, and competitive pressures, potentially settling at $A – $B.

Long-term Outlook (Year 5+): Sustained pricing around $C, assuming incremental improvements and market stabilization.

Note: Prices are highly contingent upon market-specific factors, including healthcare system structures and payer negotiations.

Revenue and Market Share Projections

Assuming an initial market penetration of 10-15% within 2 years, BLUE could generate revenues of approximately $[amount], with growth prospects influenced by expansion into secondary indications. Revenue estimates are derived from projected unit sales, pricing, and market ADMs [2].

Key Challenges and Risks

- Pricing Regressions: Payer pushback may necessitate value-based or outcome-based contracts.

- Regulatory Hurdles: Additional data requirements could delay or restrict market access.

- Market Acceptance: Clinician and patient adoption influenced by perceived benefits and competition.

- Intellectual Property: Patent lapses or Generic/Biosimilar entries may erode exclusivity.

Conclusion

BLUE stands placed at a pivotal juncture, with a strong clinical profile promising significant market potential in [therapeutic area]. Strategic positioning, robust marketing, and payer engagement will be essential to realize its price and revenue projections.

Key Takeaways

- Market Opportunities: Blue’s unmet need focus and clinical efficacy position it for rapid uptake, especially in markets with supportive regulatory pathways.

- Pricing Strategy: Premium pricing justified by clinical benefits may be sustainable initially but requires careful payer negotiations to ensure market access.

- Competitive Dynamics: Early differentiation via efficacy and safety will be crucial amid looming biosimilar or competitive entrants.

- Regulatory Environment: Accelerated approvals can hasten revenue streams but come with contingent conditions affecting pricing.

- Long-term Outlook: As patent protections mature, diversification into secondary indications and value-based pricing will be key to sustaining profitability.

FAQs

1. When is BLUE expected to launch in major markets?

Blue has completed Phase III trials and has received regulatory approval in its initial markets, with a targeted launch window within the next 6-12 months, depending on regional regulatory timelines.

2. What is the anticipated initial critical price point for BLUE?

Initial pricing is projected between $X and $Y per treatment course, determined by clinical advantage, manufacturing costs, and payer negotiations.

3. How does BLUE’s market potential compare to existing therapies?

Based on current data, BLUE could capture a significant share in its primary indication due to superior efficacy and safety profiles, especially where unmet needs are greatest.

4. Will biosimilars or generics threaten BLUE’s market share?

Potential biosimilar entries after patent expiration could impact market share; however, current patent protections and differentiation strategies are expected to provide extended exclusivity.

5. What are the main risks affecting BLUE’s future revenue projections?

Regulatory delays, reimbursement obstacles, competitive entry, and pricing pressures are primary risks that could affect BLUE’s revenue trajectory.

References

[1] MarketResearch.com. "Global Pharmaceutical Market Size & Forecast." 2022.

[2] IQVIA Institute. "Global Trends in Pharmaceutical Sales, 2022."

More… ↓