Share This Page

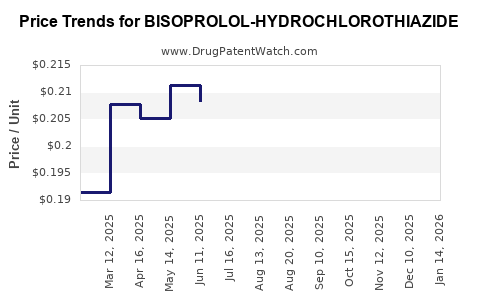

Drug Price Trends for BISOPROLOL-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for BISOPROLOL-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 42799-0922-02 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 29300-0189-05 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 42799-0922-01 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 00093-3243-56 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 29300-0189-13 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 00378-0505-01 | 0.22416 | EACH | 2025-12-17 |

| BISOPROLOL-HYDROCHLOROTHIAZIDE 10-6.25 MG TAB | 29300-0189-01 | 0.22416 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BISOPROLOL-HYDROCHLOROTHIAZIDE

Introduction

BISOPROLOL-HYDROCHLOROTHIAZIDE, a fixed-dose combination of a selective beta-blocker and a thiazide diuretic, is used primarily to manage hypertension and heart failure. Its market dynamics are driven by increasing cardiovascular disease prevalence, evolving prescription trends, regulatory landscapes, and manufacturing inputs. This analysis offers a comprehensive review of current market conditions, competitive positioning, key drivers, and forecasted pricing trajectories.

Market Overview

Therapeutic Context

Hypertension remains a leading global health concern, affecting approximately 1.39 billion adults worldwide (WHO, 2021). Fixed-dose combinations (FDCs), like BISOPROLOL-HYDROCHLOROTHIAZIDE, facilitate improved adherence and efficacy in hypertension management, aligning with current clinical guidelines emphasizing combination therapy for better blood pressure control (BNF, 2022).

Market Size and Growth

The global antihypertensive drugs market was valued at approximately USD 35 billion in 2022, with a compound annual growth rate (CAGR) of about 3.8%. The segment for combination drugs, including beta-blocker and diuretic FDCs, is expanding faster due to its enhanced compliance profile.

The specific segment for BISOPROLOL-HYDROCHLOROTHIAZIDE is niche within the broader antihypertensive market. Its adoption correlates directly with the prevalence of hypertension and the healthcare practices favoring FDCs, especially in developed regions like North America and Europe.

Key Market Drivers

- Growing Hypertension Prevalence: Increased awareness and screening initiatives contribute to escalating diagnosed cases.

- Preference for Fixed-Dose Combinations: Simplified dosing regimens improve patient compliance.

- Evolving Clinical Guidelines: Recommendations favoring combination therapies bolster demand.

- Patent Expirations and Generic Entry: Several branded formulations are approaching patent expiry, increasing generic competition.

Competitive Landscape

Brand Name and Generics

While BISOPROLOL-HYDROCHLOROTHIAZIDE is marketed by several pharmaceutical firms, patent expirations in many regions have led to saturation with generic versions. Generics typically capture significant market share post-patent expiry, exerting downward pressure on prices.

Major Players

- AbbVie (e.g., Concor Plus): Historically dominant in several markets, with well-established distribution channels.

- Sandoz and Teva: Leading generics manufacturers offering affordable options.

Market Entry Barriers

- Regulatory approval processes.

- Manufacturing quality standards.

- Physician prescribing habits favoring branded or generic options based on accessibility and trust.

Regulatory and Reimbursement Landscape

Regulatory agencies such as the FDA, EMA, and others require rigorous bioequivalence data for generics, influencing market entry strategies. Reimbursement policies also significantly influence pricing, especially in countries with national health systems.

In regions like the US and EU, reimbursement for AH drugs heavily favors cost-effective generics, accelerating price erosion over time.

Price Trends and Projections

Historical Pricing Overview

Initial branded BISOPROLOL-HYDROCHLOROTHIAZIDE formulations commanded premium pricing, approximately USD 2-4 per tablet in developed markets. As generic competition increased, prices declined significantly, with current generic versions now available at USD 0.50-1.00 per tablet.

Projected Price Trajectory (2023–2030)

- Short-term (2023–2025): Continued price erosion driven by increasing generic market penetration. Anticipated average price declines of 10–15% annually, stabilizing around USD 0.30-0.60 per tablet.

- Mid-term (2026–2028): Market saturation with generics; minimal further price reductions expected. Mergers, acquisitions, and new formulations might stabilize or marginally influence prices.

- Long-term (2029–2030): Potential premium resurgence with bioequivalent innovations, improved formulations, or new combination products offering differentiated bioavailability or dosing convenience.

Influencing Factors

- Regulatory changes favoring biosimilar or alternative formulations.

- Healthcare policy shifts toward cost containment.

- Patent litigations or effective expiration timelines.

- Market consolidation potentially affecting pricing power.

Supply Chain and Cost Factors

Manufacturing costs for BISOPROLOL-HYDROCHLOROTHIAZIDE are relatively stable, mainly involving active pharmaceutical ingredients (APIs), excipients, and manufacturing overheads. Fluctuations in API costs, especially now with global supply chain disruptions, can influence pricing strategies, though current trends suggest a downward pressure driven by generic competition.

Market Opportunities and Challenges

Opportunities:

- Expanding into emerging markets where hypertension prevalence is rising.

- Developing affordable combination formulations tailored for low-income populations.

- Integrating with digital health solutions to enhance adherence.

Challenges:

- Price competition among numerous generic providers.

- Evolving regulatory pathways.

- Competition from alternative antihypertensive combinations and novel therapies.

Conclusion

The market for BISOPROLOL-HYDROCHLOROTHIAZIDE is characterized by intense generic competition, leading to a steady decline in prices over the next several years. While branded formulations currently command higher prices, the entry of multiple generics is expected to sustain downward pricing pressure. The overall outlook is one of continued volume growth driven by increased hypertension prevalence, balanced against declining per-unit revenues.

Key Takeaways

- The global antihypertensive market is expanding, with fixed-dose combinations gaining favor due to adherence benefits.

- Post-patent expiration, prices for BISOPROLOL-HYDROCHLOROTHIAZIDE are projected to decline steadily, stabilizing at lower-cost generics.

- Market growth hinges on hypertension prevalence, regulatory policies, and competitive landscape evolution.

- Opportunities exist in emerging markets and for innovative formulations, but intense price competition remains a significant challenge.

- Stakeholders should monitor regulatory shifts, supply chain dynamics, and competitive tactics to optimize pricing and market positioning.

FAQs

1. What factors most influence the price of BISOPROLOL-HYDROCHLOROTHIAZIDE?

Patent status, generic competition, manufacturing costs, regulatory approvals, and reimbursement policies primarily influence pricing.

2. How does the market outlook differ between developed and emerging markets?

While developed markets experience significant price declines due to saturation with generics, emerging markets offer growth opportunities driven by rising hypertension prevalence, albeit with generally lower price points.

3. Are there new formulations or combinations expected to impact the BISOPROLOL-HYDROCHLOROTHIAZIDE market?

Yes. Innovations such as extended-release versions, bioequivalent formulations, or alternative fixed-dose combinations could influence market dynamics and pricing strategies.

4. How do regulatory pathways affect the entry of generics?

Stringent bioequivalence and quality standards can delay generic entry, maintaining higher prices temporarily, but once approved, they drive prices down due to competition.

5. What strategic moves should manufacturers consider to maintain profitability?

Investing in efficient manufacturing, diversifying portfolios with improved formulations, and expanding into growth markets are crucial to maintaining margins amidst price declines.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] British National Formulary. (2022). Hypertension Management Guidelines.

[3] MarketResearch.com. (2022). Global Antihypertensive Drugs Market Report.

[4] IQVIA. (2023). Global Generic Pharmaceuticals Market Trends.

[5] European Medicines Agency. (2022). Regulatory Guidelines for Fixed-Dose Combinations.

More… ↓