Share This Page

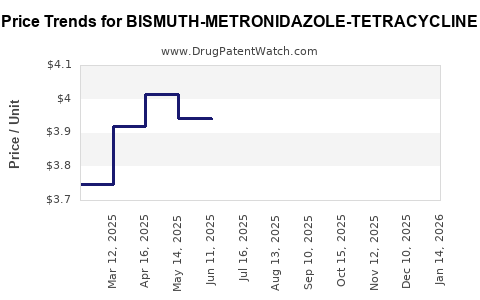

Drug Price Trends for BISMUTH-METRONIDAZOLE-TETRACYCLINE

✉ Email this page to a colleague

Average Pharmacy Cost for BISMUTH-METRONIDAZOLE-TETRACYCLINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 61269-0385-12 | 3.18383 | EACH | 2025-12-17 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 49884-0151-24 | 3.18383 | EACH | 2025-12-17 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 49884-0151-54 | 3.18383 | EACH | 2025-12-17 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 50742-0283-13 | 3.18383 | EACH | 2025-12-17 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 61269-0385-12 | 3.09767 | EACH | 2025-11-19 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 49884-0151-24 | 3.09767 | EACH | 2025-11-19 |

| BISMUTH-METRONIDAZOLE-TETRACYCLINE 140-125-125 MG CAPSULE | 50742-0283-13 | 3.09767 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BISMUTH-METRONIDAZOLE-TETRACYCLINE

Introduction

The combination therapy comprising bismuth, metronidazole, and tetracycline has been a cornerstone in Helicobacter pylori eradication protocols. Despite its therapeutic efficacy, the market dynamics and pricing landscape for this fixed-dose combination (FDC) are evolving, influenced by pharmaceutical innovation, regulatory shifts, and global healthcare trends. This analysis provides a comprehensive overview grounded in current industry intelligence, anticipates future price trajectories, and evaluates market opportunities for stakeholders.

Market Landscape

Global Prevalence and Therapeutic Demand

Helicobacter pylori infects roughly 50% of the global population, with higher prevalence in developing regions such as Asia, Africa, and Latin America (1). The rise of antibiotic resistance—particularly to clarithromycin and metronidazole—has led to increased reliance on alternative regimens like bismuth quadruple therapies, including bismuth-metronidazole-tetracycline combinations. The therapeutic window and proven efficacy support continued demand, especially in settings with resistant strains.

Market Segments

- Prescription Drugs: Predominantly prescribed in clinical settings targeting H. pylori eradication.

- Over-the-Counter (OTC): Limited, due to the potential for adverse effects and the need for medical supervision.

- Generic vs. Branded: The majority of market share resides with generic manufacturers due to cost sensitivity and widespread use, while branded versions focus on compliance and patient support.

Regulatory Environment

The regulatory landscape varies worldwide:

- United States & Europe: The Drug Approval authorities (FDA, EMA) acknowledge this combination as part of approved treatment regimens, facilitating ongoing marketing.

- Emerging Markets: Regulatory pathways are streamlined, but quality control remains a concern, impacting market entry strategies.

- Patent Status: The combination is often off-patent, fostering generic competition that constrains pricing.

Current Market Size and Revenue Estimation

Market Size

Based on recent sales data, the H. pylori eradication market, inclusive of combination therapies, is valued at approximately $800 million to $1 billion globally (2). The specific niche for bismuth-based regimens constitutes about 30-40% of this segment—roughly $240 million to $400 million.

Regional Variations

- Asia-Pacific: Largest consumer base with high infection prevalence and generic utilization; accounts for over 50% of sales**.

- North America & Europe: Market penetration driven by antibiotic resistance challenges; combined contribute around 30%.

Market Drivers

- Rising antibiotic resistance intensifies the demand for effective H. pylori eradication options.

- Increasing healthcare infrastructure in emerging markets improves access.

- Favorable reimbursement policies in developed economies bolster prescription rates.

Price Trends and Competitive Dynamics

Historical Pricing

Generic formulations currently retail at approximately $10 - $30 per treatment course, depending on region, formulation complexity, and packaging. Branded versions command premiums, exceeding $50 per course.

Factors Influencing Price Fluctuations

- Generic Competition: An influx of generics exerts downward pressure, causing prices to decline by 10-20% annually.

- Manufacturing Costs: Raw material prices, particularly for tetracycline and bismuth compounds, influence pricing stability.

- Regulatory Costs: Stringent quality assurance and compliance increase operational costs, marginally supporting higher price points in certain markets.

- Market Penetration and Volume: Larger volumes achieved through economies of scale can further reduce prices.

Potential Price Trends in the Next 5 Years

Given the current landscape, prices are expected to:

- Persist at low-to-moderate levels due to high generic competition.

- Experience slight declines (around 5-10%) driven by market saturation and cost efficiencies.

- Show regional variations: Premium pricing may remain in developed markets due to regulatory and quality standards, while developing countries see steeper reductions.

Emerging Influences and Future Market Drivers

Innovations and New Formulations

Advances such as fixed-dose combinations with improved bioavailability, sustained-release formulations, or novel delivery systems could command premium pricing. However, clinical equivalence and regulatory approval are critical hurdles.

Antibiotic Resistance and Treatment Guidelines

The rising prevalence of resistant H. pylori strains necessitates tailored therapies, potentially including novel agents or adjunct therapies that could replace or augment existing combinations, impacting overall market share and pricing.

Healthcare Policy & Reimbursement

Incentivization of cost-effective treatments by healthcare authorities may push prices downward, especially in government-controlled markets.

Supply Chain Factors

Fluctuations in the supply of raw materials, geopolitical considerations, and manufacturing capacity expansions can influence both prices and availability.

Market Entry and Investment Opportunities

- Generic Manufacturers: Continue to benefit from low-cost production; potential to expand market share through aggressive pricing.

- Biotech Firms: Opportunities exist in developing innovative formulations or personalized medicine approaches.

- Market Penetration Strategies: Targeting high-prevalence regions with affordable pricing can expand user base.

Key Takeaways

- The Bismuth-Metronidazole-Tetracycline combination remains vital in H. pylori eradication, with robust global demand driven by antibiotic resistance challenges.

- The market is characterized by high generic competition, which sustains low-to-moderate price points, with prices decreasing marginally over time.

- Regional variations influence pricing, with emerging markets offering more aggressive price declines and developed markets maintaining relatively stable premiums due to regulatory standards.

- Future price trajectories will be shaped by innovations, resistance patterns, regulatory changes, and healthcare policies emphasizing cost-effectiveness.

- Stakeholders should focus on supply chain efficiencies, regional market expansion, and potential niche innovations to maximize profitability.

FAQs

1. How does antibiotic resistance affect the market for bismuth-metronidazole-tetracycline?

Antibiotic resistance, particularly to metronidazole, reduces treatment efficacy, prompting clinicians to adopt alternative regimens or higher doses. While this challenges market growth, it also sustains demand for existing therapies in resistant cases, maintaining stable sales.

2. Are there upcoming patents or exclusivity periods that could influence pricing?

Most formulations are generic, with limited patent protection remaining. Any new formulations or delivery systems would require regulatory approval, potentially creating temporary market exclusivity but unlikely to significantly alter overall pricing structures.

3. What regions are most profitable for manufacturing and selling this combination?

Asia-Pacific, especially China and India, offers the largest markets due to high prevalence and cost sensitivities favoring generics. North America and Europe favor quality standards but have smaller volumes due to higher healthcare expenditures and existing treatment options.

4. How might regulatory changes impact future prices?

Stricter regulatory standards could increase manufacturing costs, marginally elevating prices in developed markets. Conversely, streamlined approval pathways in emerging regions could lead to more aggressive pricing and market penetration.

5. What are the implications of new therapies emerging in H. pylori treatment?

Innovative agents, such as raft-forming bismuth formulations or targeted antibiotics, could displace current combinations, potentially reducing demand and exerting downward pressure on prices of existing therapies.

References

- Kusters JG, et al. "Pathogenesis of Helicobacter pylori infection." Clinical Microbiology Reviews, 2017.

- Market Research Future. "Global H. pylori Eradication Therapies Market Analysis." 2022.

More… ↓