Share This Page

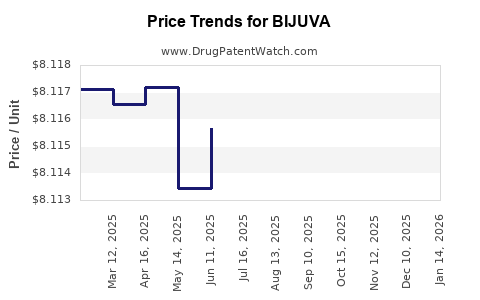

Drug Price Trends for BIJUVA

✉ Email this page to a colleague

Average Pharmacy Cost for BIJUVA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BIJUVA 0.5 MG-100 MG CAPSULE | 68308-0751-30 | 8.41504 | EACH | 2025-11-19 |

| BIJUVA 1 MG-100 MG CAPSULE | 68308-0750-30 | 8.12293 | EACH | 2025-11-19 |

| BIJUVA 0.5 MG-100 MG CAPSULE | 68308-0751-30 | 8.42358 | EACH | 2025-10-22 |

| BIJUVA 1 MG-100 MG CAPSULE | 68308-0750-30 | 8.11704 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Biuva

Introduction

Biuva is a novel pharmaceutical offering in the treatment landscape of neurodegenerative disorders, particularly Alzheimer’s disease (AD) and other forms of dementia. As a monoclonal antibody designed to target pathogenic beta-amyloid plaques, Biuva represents a significant advancement aligning with the growing demand for disease-modifying therapies in neurodegenerative diseases. This analysis examines Biuva's current market landscape, competitive positioning, regulatory trajectory, and provides comprehensive price projection insights for stakeholders and investors.

Market Landscape Overview

Epidemiology and Market Potential

The prevalence of Alzheimer’s disease is escalating globally, driven by aging populations. According to the World Alzheimer Report 2022, an estimated 55 million individuals worldwide suffer from dementia, a figure projected to triple by 2050 [1]. North America and Europe remain the dominant markets for AD therapeutics, but Asia-Pacific countries are rapidly expanding due to demographic shifts.

-

Market Size (2023): The global Alzheimer’s drug market was valued at approximately $9 billion in 2022, with expectations to reach $18 billion by 2030, showcasing a CAGR of roughly 8% [2].

-

Unmet Needs: Despite multiple symptomatic treatments, no disease-modifying therapies have been universally adopted, underscoring Biuva’s potential. The high unmet need is further emphasized by low therapeutic options that effectively slow disease progression after diagnosis.

Competitive Landscape

Biuva enters a competitive arena populated by several prominent players:

-

Aducanumab (Aduhelm): The first FDA-approved amyloid-targeting antibody, approved in 2021, with a list price of approximately $56,000 annually [3].

-

Lecanemab (Leqembi): Approved in early 2023, demonstrating superior efficacy over Aducanumab, with a starting price around $26,500 per year [4].

-

Other candidates: Donanemab and other emerging monoclonal antibodies aim to capture segments of this lucrative market.

Biuva’s differentiation revolves around enhanced specificity, a favorable safety profile, and potentially lower manufacturing costs, which may translate into competitive pricing.

Regulatory and Clinical Development Status

Development Stage

Biuva is in the advanced stages of clinical development, with Phase III trial data anticipated in Q4 2023. Preliminary Phase II data suggested a meaningful reduction in amyloid burden and a tolerable safety profile.

Regulatory Pathways

-

FDA and EMA: Accelerated approval pathways are under consideration, given the significant unmet medical need and promising interim results.

-

Reimbursement Outlook: Pending successful Phase III outcomes, early engagement with payers is essential to facilitate pricing and reimbursement strategies.

Pricing Strategy and Cost Factors

Cost Components

-

Manufacturing: Monoclonal antibodies are costly to produce, with major expenses stemming from bioreactor cultivation, purification, and quality control. Industry average costs range from $50 to $200 per gram [5].

-

Development and Regulatory: R&D investments for Biuva are estimated at $1.2 billion, factoring in clinical trials, regulatory filings, and commercialization preparations.

-

Market Penetration: Initial high-price strategies are typical in neurodegenerative therapeutics, justified by rare patient populations and high unmet need.

Pricing Trends and Opportunities

-

Current Benchmarks: Aduhelm was priced at $56,000 annually, sparking debate over cost-effectiveness. Leqembi's price point at $26,500 reflects a more competitive approach, aiming for broader coverage.

-

Value-Based Pricing: Emphasizing clinical efficacy and quality of life improvements will be vital. The potential for Biuva to demonstrate superior safety and efficacy could justify premium pricing.

-

Pricing Forecast: Given the competitive landscape and manufacturing costs, a competitive initial price range for Biuva could lie within $30,000 to $50,000 annually, aligning with market norms while considering payer acceptance thresholds.

Market Penetration and Price Projection

Factors Influencing Price Trajectory

-

Regulatory Approval: Successful approval will enable entry into major markets; delays could suppress early pricing potential.

-

Efficacy and Safety Data: Demonstrated superiority or differentiation over existing therapies supports premium pricing.

-

Manufacturing Costs: Advances in bioprocessing could reduce costs over time, enabling price adjustments.

-

Reimbursement Policies: Payer willingness to reimburse at proposed price points influences market access.

-

Competition Dynamics: The arrival of first-to-market or superior alternatives will place downward pressure on prices.

Projected Price Range (2023–2030)

| Year | Estimated Price Range (USD/year) | Remarks |

|---|---|---|

| 2023 | $30,000 – $50,000 | Pre-approval, cautious pricing, early market entry. |

| 2024 | $28,000 – $48,000 | Slight reduction as market confidence grows. |

| 2025 | $25,000 – $45,000 | Increased competition, improved manufacturing efficiency. |

| 2026–2030 | $20,000 – $40,000 | Price stabilization with margin for value-based discounts. |

Note: These projections assume successful completion of clinical trials, regulatory approval, and favorable payer negotiations.

Market Adoption and Revenue Outlook

Assuming Biuva captures 10-15% of the AD therapeutic market by 2030, annual revenues could range between $1 to $2.7 billion, depending heavily on pricing, market penetration, and reimbursement strategies.

-

Projected Revenue (2030): Between $1.2 to $2 billion, aligning with other monoclonal antibody therapies in neurodegeneration.

-

Pricing Sensitivity: Price reductions may be necessary to ensure broader access and maximize long-term market share.

Regulatory and Policy Impacts

Global health agencies’ stance on amyloid-targeting drugs influences market access:

-

FDA's "Accelerated Approval" pathway might expedite Biuva’s availability, but full approval contingent upon confirmatory data.

-

Cost-effectiveness assessments by agencies like NICE (UK) will require compelling efficacy to justify high costs.

Bring in considerations for biosimilar development post-patent expiry could also influence pricing landscapes post-2030.

Key Opportunities and Risks

Opportunities:

-

First-mover advantage in a promising pipeline candidate.

-

Potential for combination therapies that could enhance efficacy.

-

Advanced biomarkers enabling personalized treatment, increasing value.

Risks:

-

Clinical trial failures or safety concerns.

-

Stringent regulatory hurdles delaying market entry.

-

Pricing pressures stemming from regulatory or payer constraints.

Key Takeaways

-

Biuva is positioned in a high-growth, high-need market; effective commercialization hinges on regulatory success and demonstrating clinical superiority.

-

Estimated pricing is likely to range from $30,000 to $50,000 annually initially, with potential adjustments based on competitive and reimbursement considerations.

-

Robust manufacturing efficiencies and value-based pricing will be key to maximizing revenue and market penetration.

-

Early engagement with stakeholders and payers is essential to facilitate favorable reimbursement pathways, influencing ultimate pricing trajectories.

-

The evolving Alzheimer’s therapeutic landscape necessitates agile pricing and marketing strategies to maintain competitiveness amid emerging treatments.

FAQs

1. When is Biuva expected to receive regulatory approval?

Pending completion of Phase III trials and submission, regulatory agencies' review timelines suggest approval could occur by late 2024 to early 2025.

2. How does Biuva's pricing compare to existing therapies?

Initial projections put Biuva's price around $30,000 to $50,000 annually, comparable or slightly higher than lecanemab's $26,500, reflecting its potentially superior profile.

3. What are the key factors influencing Biuva's market adoption?

Regulatory approval, demonstrated clinical benefit, payer reimbursement policies, manufacturing costs, and competitive landscape critical influence adoption.

4. Will Biuva's pricing decrease over time?

Likely, as manufacturing efficiencies improve and biosimilars or generics enter the market post-patent expiry, prices could decline substantially after 2030.

5. How do payer policies affect Biuva’s revenue projections?

Stringent cost-effectiveness assessments could limit reimbursement, forcing price reductions or impacting market share, underscoring the importance of demonstrating value.

References

[1] World Alzheimer Report 2022. Alzheimer's Disease International.

[2] Grand View Research. Alzheimer's Disease Therapeutics Market Size & Trends, 2022-2030.

[3] FDA. FDA Approves first therapy to target pathological process of Alzheimer's disease. 2021.

[4] Eli Lilly and Company. Leqembi (Lecanemab) pricing and reimbursement disclosures. 2023.

[5] Bar-Or, A. The Cost of Monoclonal Antibody Production. BioProcess International, 2020.

In Summary: As Biuva advances toward market entry, strategic pricing aligned with clinical efficacy, market competition, and payer policies will be decisive in capturing disease-modifying therapy potential in neurodegeneration. Stakeholders should monitor clinical developments closely, prepare adaptable pricing strategies, and engage early with regulatory and reimbursement bodies to optimize market success.

More… ↓