Last updated: July 31, 2025

Introduction

Betaxolol hydrochloride (HCl) is a selective beta-1 adrenergic receptor blocker widely used in ophthalmology and cardiovascular medicine. Predominantly employed to reduce intraocular pressure in glaucoma and manage hypertension, Betaxolol’s unique pharmacological profile has secured a steady market share. This report presents a comprehensive analysis of the current market dynamics, competitive landscape, regulatory environment, and future pricing trends for Betaxolol HCl.

Pharmacological Profile and Market Fundamentals

Betaxolol is distinguished by its cardioselective beta-1 antagonistic activity, minimizing pulmonary side effects common with non-selective beta blockers. The drug's efficiency in lowering intraocular pressure without significant systemic side effects underpins its clinical value.

The global Betaxolol market has traditionally been driven by ophthalmology indications, with an increasing prevalence of glaucoma—estimated to affect over 70 million people worldwide [1]. The systemic use for hypertension further broadens its application scope.

Market penetration is influenced by factors such as drug efficacy, safety profile, and manufacturing costs. Patent exclusivity lapses in many regions, leading to the availability of generic formulations, which significantly impact pricing and market dynamics.

Current Market Landscape

Manufacturers and Supply Chain

Major pharmaceutical players producing Betaxolol HCl include:

- Ipsen Pharma (France)

- Alcon Laboratories

- Sandoz (Novartis)

- Aurobindo Pharma (India)

The proliferation of generics post-patent expiry has resulted in price erosion, intensifying competition. The supply chain is characterized by regional manufacturers, with India and China as leading producers due to cost advantages.

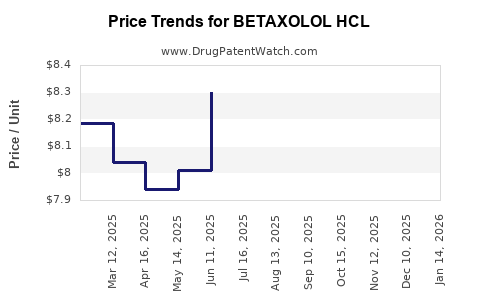

Pricing Trends

In developed markets such as the US and Europe, branded Betaxolol formulations retail at approximately $30–$50 per 10 mL bottle, with generics selling between $10–$20. In contrast, emerging markets typically see prices in the $2–$5 range, driven by lower manufacturing costs and differing market dynamics.

Regulatory Environment

Regulatory pathways are streamlined for generics through abbreviated new drug applications (ANDAs) in the US and similar processes in Europe, facilitating market entry and affecting price points. Regulatory authorities are increasingly enforcing quality standards, influencing manufacturing costs and, consequently, pricing.

Market Drivers and Challenges

Key Drivers

- Rising glaucoma prevalence globally, especially among aging populations

- Growing awareness and screening programs

- Demand for effective, well-tolerated medications

- Cost-parity of generic Betaxolol options

Market Challenges

- Competition from other beta-blockers and alternative therapies

- Patent cliffs for branded formulations

- Regulatory uncertainties affecting market access

- Pricing pressures and reimbursement constraints, especially in developed markets

Future Price Projections (2023–2030)

Short-Term Outlook (2023–2025)

In the immediate future, Betaxolol prices are expected to stabilize, with slight declines anticipated due to increased generic competition. Premium branded formulations may retain higher prices in developed markets initially, but generics are projected to reduce average retail prices by approximately 10–15% annually.

Mid to Long-Term Outlook (2026–2030)

Between 2026 and 2030, several factors could influence price trajectories:

- Market Saturation: Increased availability of generics will exert sustained downward pressure.

- Regulatory Changes: Price regulations and reform policies, especially in Asia and Latin America, may further depress prices.

- Emerging Markets: Demand for affordable medications will likely catalyze price stabilization at lower levels.

- Innovative Delivery Systems: The introduction of sustained-release formulations or combination therapies may command higher prices, offsetting generic price declines.

Overall, betaxolol HCl prices are projected to decrease by approximately 20–30% globally by 2030, with pronounced variations based on regional factors.

Market Opportunities

- Development of Fixed-Dose Combinations (FDCs): Combining Betaxolol with other ocular hypotensives can command premium pricing.

- Biosimilar Entry: Patent expirations pave the way for biosimilar entrants, further driving down costs.

- Geographic Expansion: Growing markets in Asia, Latin America, and Africa present opportunities for affordable formulations.

- Regulatory Incentives: Leveraging expedited approval pathways for clinical differentiation can enhance market share.

Conclusion

The Betaxolol HCl market is characterized by stable demand driven by the glaucoma and hypertension treatment markets. Price trends are predominantly influenced by generic competition, regulatory policies, and healthcare reimbursement dynamics. While short-term stability may prevail, an overarching downward trend in prices is projected over the next decade, driven by increasing generic penetration, especially in emerging economies.

Key Takeaways

- Market is mature, with significant generic competition leading to reduced prices globally.

- Developed markets anticipate a 10–15% annual price decline in the short term, with cumulative reductions of 20–30% by 2030.

- Emerging markets present growth opportunities due to targeted affordability initiatives.

- Innovation in delivery systems and combination therapies could sustain premium pricing in niche segments.

- Regulatory landscapes and patent expirations will be pivotal in shaping future market dynamics.

FAQs

1. How does patent expiration affect Betaxolol HCl pricing?

Patent expiry typically leads to an influx of generic manufacturers, increasing competition and substantially decreasing retail prices.

2. What are the primary factors influencing Betaxolol market growth?

Rising prevalence of glaucoma and hypertension, increased awareness, and expanding healthcare access are pivotal growth drivers.

3. Are there significant regional differences in Betaxolol pricing?

Yes; developed countries maintain higher prices due to brand dominance and reimbursement policies, whereas emerging markets favor lower-cost generics.

4. Will new formulations or delivery systems impact Betaxolol’s price?

Potentially. Innovative formulations like sustained-release systems could command higher prices but may face competitive pressures.

5. What future market trends should investors monitor?

Patent expirations, regulatory reforms, biosimilar development, and regional market expansion are key trends influencing Betaxolol’s pricing and market share.

Sources

[1] World Health Organization. "Global Prevalence of Glaucoma." 2020.