Last updated: July 28, 2025

Introduction

Betaxolol, a selective beta-1 adrenergic receptor blocker, is primarily prescribed for managing hypertension and glaucoma. Since its initial approval, betaxolol has maintained a niche but stable presence within cardiovascular and ophthalmic therapeutics. This analysis evaluates its market landscape, competitive environment, manufacturing dynamics, regulatory factors, and future price trajectories. The aim is to equip stakeholders with an informed view of betaxolol’s commercial prospects and pricing strategies.

Market Overview

Therapeutic Demand and Usage

Betaxolol’s primary applications include treatment of hypertension and glaucoma, with the latter often involving topical ophthalmic formulations. Its cardioselectivity offers advantages like fewer respiratory side effects compared to non-selective beta-blockers, reinforcing its therapeutic value, especially among patients with respiratory comorbidities.

Global hypertension prevalence is projected to reach 1.5 billion in 2025, fueling demand for beta-blockers like betaxolol. Additionally, glaucoma affects over 76 million individuals worldwide, with beta-blocker eye drops accounting for a significant segment in intraocular pressure management.

Market Size and Growth Trends

The global beta-blocker market was valued at approximately USD 4.2 billion in 2022, with betaxolol representing a modest but steady share, estimated at roughly USD 150 million. Growth is driven by increasing hypertensive populations in emerging markets and rising glaucoma diagnoses.

In ophthalmic formulations, betaxolol’s topical use is favored for its lower systemic absorption compared to oral administration, aligning with contemporary preferences for localized therapy.

Competitive Landscape

Betaxolol faces competition from other beta-blockers such as timolol, atenolol, metoprolol, and propranolol. In ophthalmology, timolol remains dominant due to its broader approval and extensive clinical history. Notably, newer agents like tafluprost and brimonidine have encroached on traditional beta-blocker markets for glaucoma.

Manufacturers vary from established pharmaceutical giants (e.g., Alcon, Santen) to generic producers, with patent expirations in the past decade enabling increased generic penetration.

Regulatory and Patent Environment

Patents and Exclusivity

Betaxolol’s initial patents have long expired, leading to widespread generic manufacturing. This has resulted in significant price erosion, particularly in developed markets.

Regulatory Approvals

Betaxolol’s formulations are approved in multiple jurisdictions, including the U.S., EU, and emerging markets. Regulatory bodies have generally maintained stability in approval status; however, approval of combination therapies and new topical formulations could influence market share.

Manufacturing and Pricing Dynamics

Manufacturing Costs

Generic manufacturing costs for betaxolol are relatively low, driven by established synthesis routes and economies of scale. However, quality control, formulation stability, and regulatory compliance contribute to ongoing expenses.

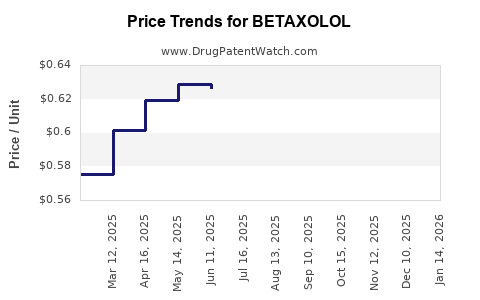

Pricing Trends and Factors

Historical pricing illustrates a substantial decline post-patent expiry, with oral formulations dropping from approximately USD 2 – 5 per tablet to less than USD 1 in many regions. Topical formulations command slightly higher prices, around USD 10 – 20 per bottle, depending on brand and region.

In the current landscape, brand-name formulations tend to command premium prices, especially in markets with limited generic penetration or brand loyalty. Conversely, high generic competition drives prices downward, often enabling pharmacy discounts and price-sensitive procurement strategies.

Future Price Projections

Influencing Factors

- Market Saturation: High generic penetration limits price increases.

- Regulatory Dynamics: Introduction of new formulations or combination therapies may create pricing premiums.

- Market Expansion: Increased access in emerging economies could support moderate price stability or slight elevation due to volume-driven revenue.

- Innovation: Lack of recent innovations in betaxolol formulations constrains upward pricing potential.

Projection Summary

-

Short-term (1–2 years): Prices are expected to remain stable or slightly decline owing to intense generic competition. Oral formulations likely to trade around USD 0.50 – 1 per unit, with ophthalmic drops maintaining USD 8 – 15 per bottle in developed markets.

-

Mid to Long-term (3–5 years): Price stability is anticipated unless new patents or formulations modify dynamics. In emerging markets, increased adoption may provide some pricing support, but overall prices will tend to stay within current low-cost ranges.

Market Challenges and Opportunities

Challenges

- Price Erosion: Ubiquity of generics hampers premium pricing.

- Market Share Competition: Alternatives like combination therapies reduce betaxolol’s relative appeal.

- Regulatory Hurdles: Stringent approval requirements for new formulations limit differentiation.

Opportunities

- Developing Biosimilars & Fixed-Dose Combinations: These could command higher prices and capture unmet needs.

- Expanding in Emerging Markets: Growing hypertensive and glaucoma patient bases present volume-driven growth.

- Clinical Trials for New Uses: Investigating betaxolol’s utility in other indications could unlock new markets.

Key Takeaways

- High Generics Presence Limits Price Growth: Patent expirations have significantly driven down betaxolol prices, especially in oral formulations.

- Market Stability, Not Expansion: Demand for betaxolol remains steady primarily due to existing therapeutic indications; significant market growth or price escalation is unlikely without formulation innovation.

- Emerging Markets Offer Volume Opportunities: While prices stagnate in mature markets, increasing access in emerging economies can yield incremental revenue.

- Competitive Landscape Is Intense: Dominance of well-known beta-blockers and glaucoma agents limits differentiation opportunities.

- Innovation and Differentiation Are Critical: New delivery methods, combination therapies, or new indications could sustain or enhance pricing potential.

FAQs

-

What are the main therapeutic indications for betaxolol?

Betaxolol is primarily used for managing hypertension and glaucoma, with topical ophthalmic formulations preferred for intraocular pressure reduction.

-

How has patent expiration affected betaxolol’s market prices?

Patent expiration has led to a surge in generic manufacturing, which significantly lowered prices—oral formulations now typically cost less than USD 1 per tablet in many markets.

-

Are there any new formulations or formulations in development for betaxolol?

Currently, most formulations are established, with limited innovation. Future growth may depend on new combination therapies or advanced delivery systems.

-

Which regions present the most growth opportunities for betaxolol?

Emerging markets such as India, China, and Latin America offer growth potential due to increasing prevalence of hypertension and glaucoma, driven by expanding healthcare access.

-

What factors could drive betaxolol prices upward in the future?

Introduction of proprietary formulations, combination products, or licensure for new indications could create pricing premiums and expand market share.

References

[1] Global Hypertension Market Analysis, 2022. MarketWatch.

[2] Glaucoma Therapeutics Market, 2022-2030. Grand View Research.

[3] Patent status and generic competition dynamics in cardiovascular drugs. WHO Report.

[4] Price trends of beta-blockers globally. IMS Health Data.

[5] Regional healthcare access and emerging market growth projections. World Bank Reports.