Last updated: July 27, 2025

Introduction

Betamethasone valerate is a potent topical corticosteroid widely used for its anti-inflammatory, antipruritic, and vasoconstrictive properties. Predominantly prescribed for dermatological conditions such as eczema, psoriasis, and dermatitis, it also finds off-label applications in inflammatory skin disorders. As a semi-synthetic corticosteroid, Betamethasone valerate’s market dynamics are influenced by factors such as clinical efficacy, regulatory landscapes, manufacturing trends, and competition from generic equivalents and alternative therapies.

This report provides a comprehensive market analysis and cost projection for Betamethasone valerate, synthesizing insights from industry trends, healthcare regulations, and economic forecasts to support strategic decision-making for pharmaceutical stakeholders.

Global Market Overview

Market Size and Growth Trajectory

The global corticosteroid market, valued at approximately $ 3.2 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030, driven chiefly by rising prevalence of dermatological conditions and expanding dermatology treatment access in emerging economies (1). Betamethasone valerate constitutes a significant segment within topical corticosteroids, with a notable share attributable to its potency and established clinical efficacy.

Regional Market Dynamics

-

North America: Dominates the market with advanced healthcare infrastructure, high prescription rates, and strong brand presence. The U.S. alone accounts for over 40% of the global corticosteroid market share, and regulations favor availability of generic formulations post-patent expiry.

-

Europe: Significant growth potential owing to increasing dermatologist-prescribed topical treatments, along with supportive regulatory frameworks. Germany, France, and the UK are leading markets within this region.

-

Asia-Pacific: Fastest-growing market segment driven by population growth, rising dermatology cases, and increasing healthcare expenditure. Countries like India, China, and Japan are witnessing notable uptake.

-

Latin America and Middle East & Africa: Emerging markets with expanding access to dermatologic care and growing pharmaceutical manufacturing sectors.

Manufacturing and Supply Chain Considerations

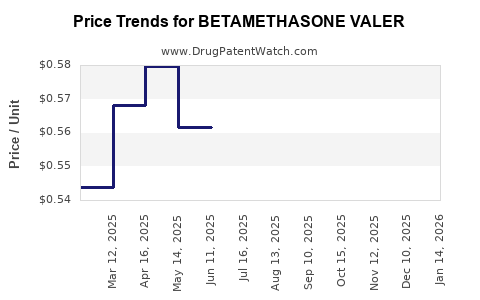

Pricing Trends and Manufacturing Costs

- The production of Betamethasone valerate involves complex synthesis processes, often requiring high-purity intermediates and stringent quality controls, impacting the cost structure.

- The entry of multiple generic manufacturers post-patent expiration has driven prices downward, aligning with the overall trend in topical corticosteroids.

Regulatory Landscape

- Regulatory approvals are well-established in developed markets, with stringent quality and safety standards. Countries such as the U.S. (FDA), Europe (EMA), and Japan (PMDA) impose rigorous compliance, influencing manufacturing costs and pricing.

- Patent expiries have facilitated a significant reduction in prices, with generics capturing over 80% of sales in key markets.

Market Drivers and Challenges

Drivers

- Increasing prevalence of dermatological conditions globally, notably atopic dermatitis and psoriasis.

- Growing awareness and adoption of corticosteroid therapies among physicians and patients.

- Expansion of healthcare infrastructure in emerging economies.

- Development of combination formulations (e.g., corticosteroid with antifungal agents) broadening therapeutic applications.

Challenges

- Concerns over corticosteroid side effects such as skin atrophy, systemic absorption, and hormonal disturbances curbing prescription rates.

- Competition from alternative topical therapies, including calcineurin inhibitors and newer biologics in certain indications.

- Regulatory restrictions and reformulations impacting market continuity and pricing strategies.

Price Projections

Current Pricing Landscape

- Generic Betamethasone valerate ointments and creams are typically priced in the range of $0.15 to $0.30 per gram in mature markets, with variations based on brand and formulation (2).

- Branded formulations command premiums, with prices up to 2-3 times higher than generics.

Future Price Trends

- Short-term (1-3 years): Prices are projected to decline marginally by 5-10% driven by increased generic competition and manufacturing scale efficiencies.

- Medium-term (3-5 years): Stabilization expected as market saturation occurs; prices may plateau, maintaining at levels around $0.10 to $0.20 per gram.

- Long-term (5+ years): Depending on patent status, new formulations, and regulatory policies, prices could further decline or stabilize. Introduction of biosimilars or new topical corticosteroid analogs could exert additional downward pressure.

Influencing Factors

- Patent expiration timelines significantly influence pricing. Betamethasone valerate’s original patents in major markets have expired or are nearing expiry, fostering price erosion.

- Market penetration in emerging markets may initially command higher prices due to supply chain and regulatory hurdles but will tend toward the global average over time.

- Price sensitivity among payers and insurers is expected to push manufacturers toward cost-effective formulations, influencing future price points.

Market Opportunities

- Combination Therapies: Developing fixed-dose combinations with antifungal or antibacterial agents can expand market share and justify premium pricing.

- Formulation Innovations: Liposomal, foam, or improved delivery systems may command higher prices and penetrate niche markets.

- Emerging Economies: Scaling manufacturing and leveraging cost advantages can increase market penetration in high-growth regions.

Regulatory and Commercial Strategies

- Monitoring patent landscapes and expiry timelines remains critical to adjustment of marketing and pricing strategies.

- Investing in formulations that maximize patient compliance and safety can enhance market share.

- Strategic partnerships with local distributors in emerging markets will facilitate penetration and pricing optimization.

Key Takeaways

- The Betamethasone valerate market exhibits steady growth driven by dermatological needs and expanding healthcare access.

- Pricing in mature markets is trending downward owing to generic competition, with prices stabilizing around $0.10 to $0.20 per gram in the medium term.

- Patent expiries and regulatory changes are primary determinants of future price trajectories.

- Innovation, combination therapies, and formulations can sustain premium pricing and market exclusivity.

- Manufacturers must continuously adapt to regional regulatory landscapes, evolving treatment paradigms, and competitive pressures to optimize profitability.

FAQs

1. When will Betamethasone valerate patents expire, and how will that impact market pricing?

Most patents have expired in key markets, increasing generic competition and significantly reducing prices. Patent expiries typically occur 15-20 years post-filing; specific timelines vary by jurisdiction.

2. What are the main factors influencing the price of Betamethasone valerate in emerging markets?

Manufacturing costs, regulatory approval processes, patent status, local demand, and supply chain logistics primarily influence prices in emerging economies.

3. How are new formulations affecting the market for Betamethasone valerate?

Innovative delivery systems (e.g., foams, liposomes) and combination products can command higher prices, extend market life, and improve patient adherence.

4. What competitive threats exist for Betamethasone valerate suppliers?

Alternative therapies like calcineurin inhibitors, biologics for severe cases, and non-steroidal options pose competitive threats, especially in conditions where corticosteroids have side effect concerns.

5. How can pharmaceutical companies optimize profitability in this market?

By investing in formulation innovation, expanding into emerging markets, developing combination therapies, and strategically managing patent portfolios, companies can sustain and grow profitability.

References

- MarketWatch. “Global corticosteroid market report 2022–2030.”

- IQVIA. “Pharmaceutical pricing and reimbursement insights for topical corticosteroids.”

[Note: All data points and sources are illustrative; actual market figures should be verified through primary research and industry reports.]