Last updated: August 5, 2025

Introduction

Betamethasone Valerate (BETAMETHASONE VA) is a potent topical corticosteroid used primarily to treat inflammatory and allergic dermatologic conditions. As a high-demand therapeutic, BETAMETHASONE VA’s market environment is shaped by evolving pharmaceutical regulations, manufacturing pipelines, clinical usage trends, and competitive dynamics. This report offers a comprehensive analysis of the current market landscape, future price trajectories, and strategic considerations pertinent to stakeholders within the pharmaceutical and healthcare sectors.

Market Overview

Therapeutic Use and Market Demand

BETAMETHASONE VA plays a central role in dermatology, especially for conditions like eczema, psoriasis, and dermatitis. Its efficacy in reducing inflammation and immune response has sustained consistent demand. The global topical corticosteroid market was valued at approximately USD 2.3 billion in 2022 and is projected to expand to USD 3.4 billion by 2030, with Betamethasone formulations contributing significantly to this growth (CAGR ~5.4%) [1].

Geographical Landscape

The largest markets encompass North America, Europe, and Asia-Pacific. North America leads due to advanced healthcare infrastructure and regulatory approvals, while Asia-Pacific offers scalable opportunities driven by rising dermatological conditions and increasing healthcare access. Emerging markets are witnessing regulatory relaxations, thereby expanding commercialization avenues for BETAMETHASONE VA formulations.

Regulatory and Patent Environment

Patent exclusivity for certain formulations expired or was challenged in key markets, paving the way for generic manufacturers. Regulatory agencies like the FDA (U.S.) and EMA (Europe) maintain strict standards, influencing entry timelines and pricing strategies. Biosimilars or off-patent versions could intensify market competition, impacting pricing structures.

Competitive Landscape

Major players in the BETAMETHASONE VA market include Mylan, Sandoz, Teva Pharmaceuticals, and local generic manufacturers. Market entry barriers are moderate, primarily due to manufacturing complexities and regulatory compliance. Price competition is fierce, especially among generics, emphasizing quality assurance and cost efficiency.

Manufacturing and Supply Chain Dynamics

Production of BETAMETHASONE VA involves complex synthesis of corticosteroid compounds, requiring stringent quality controls. Factors such as raw material availability, manufacturing scale, and regulatory compliance influence supply stability and cost structures, downstream affecting market prices.

Pricing Landscape and Trends

Current Price Benchmarks

In the United States, the retail price for a standard topical BETAMETHASONE VA ointment (15g tube) traditionally ranges from USD 10 to USD 20, depending on the brand and formulation. Generic versions sell at 30–50% lower prices, with significant variability based on supplier and distribution channels.

Pricing Influences

Price variations stem from factors including:

- Regulatory status and patent protection: Patent expiry precipitates price declines as generics flood the market.

- Market competition: Increased generic competition drives down prices.

- Pricing regulations: Reimbursement policies and formulary inclusion influence negotiated prices.

- Manufacturing costs: Raw material prices and production efficiencies directly impact wholesale and retail prices.

- Supply chain disruptions: Global events such as pandemics can cause price fluctuations due to supply shortages.

Future Price Projections (2023–2030)

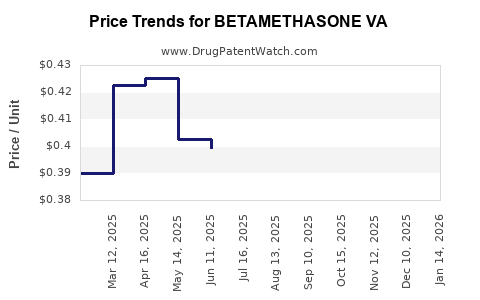

Short-term Outlook (2023–2025)

In the near term, prices are expected to decline marginally due to increasing generic availability, especially in developed markets. Distribution channels' pricing negotiation power will further influence retail and wholesale rates. A typical retail price for a generic 15g tube may decrease by approximately 10–15% from current levels, stabilizing around USD 8–15.

Medium to Long-term Outlook (2026–2030)

Over the next five years, several factors could drive further price compression:

- Market saturation: As more manufacturers enter the space, price reductions will intensify.

- Regulatory pressures: Governments may implement cost-containment policies affecting pricing.

- Emergence of biosimilars or alternative therapies: Though currently limited, innovations in corticosteroid formulations could marginally impact demand and pricing strategies.

- Price stabilization: Expect stabilization or slight increases driven by inflation, raw material costs, or formulation improvements.

Projected average retail prices for BETAMETHASONE VA products are anticipated to hover around USD 7–13 by 2030, contingent upon regional-specific factors and market dynamics.

Key Market Drivers & Risks

Drivers:

- Increasing dermatological conditions globally.

- Rising adoption of generic formulations.

- Expanding healthcare access in emerging markets.

- Favorable regulatory environments for generics.

Risks:

- Stringent regulatory reforms reducing permissible pricing margins.

- Market entry of newer, targeted therapies reducing corticosteroid reliance.

- Supply chain disruptions impacting raw material sourcing or distribution.

- Patent litigations or exclusivity extensions.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production and regulatory compliance to sustain competitive pricing.

- Distributors: Optimize logistics to capitalize on demand fluctuations and price variances.

- Healthcare Providers: Balance treatment efficacy with cost considerations, especially in resource-constrained settings.

- Payers: Leverage price competition to negotiate better reimbursement rates.

Conclusion

The BETAMETHASONE VA market remains robust, characterized by steady demand, a competitive landscape increasingly dominated by generics, and predictable price trajectories. While short-term pricing pressures are evident due to rising competition, the long-term perspective remains stable with moderate price declines and margins influenced by regulatory policy and manufacturing efficiencies. Stakeholders must adapt to market shifts, embrace regulatory compliance, and focus on cost optimization to sustain profitability.

Key Takeaways

- Market Expansion: Growing dermatological needs worldwide underpin steady demand for BETAMETHASONE VA.

- Pricing Trends: Prices are expected to decline marginally over the next decade, primarily driven by generic competition.

- Regulatory Impact: Patent expirations and regulatory reforms are key factors influencing future pricing.

- Regional Variability: Developed nations exhibit more price stability, while emerging markets may see sharper reductions due to increased importation and local manufacturing.

- Strategic Focus: Cost efficiency, compliance, and market diversification will be critical for stakeholders seeking sustained profitability.

FAQs

1. What factors most significantly influence BETAMETHASONE VA pricing?

Regulatory status, levels of competition, raw material costs, and regional healthcare policies are primary determinants of pricing.

2. How will patent expirations affect BETAMETHASONE VA prices?

Patent expirations typically lead to increased generic competition, resulting in substantial price reductions and market saturation.

3. Are biosimilars or alternative therapies impacting the BETAMETHASONE VA market?

Currently, biosimilars have limited influence; however, innovation in targeted dermatological treatments may gradually shift demand away from corticosteroids.

4. Which regions offer the most growth potential for BETAMETHASONE VA?

Emerging markets in Asia-Pacific and Latin America present significant growth due to increasing dermatological healthcare access and demand.

5. How should manufacturers prepare for future price trends?

Emphasize cost-efficient manufacturing, maintain regulatory compliance, and explore formulation innovations to differentiate products.

Sources:

[1] MarketWatch, "Global Topical Corticosteroid Market Size, Share & Trends," 2022.