Share This Page

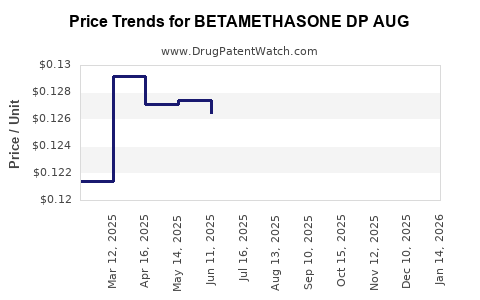

Drug Price Trends for BETAMETHASONE DP AUG

✉ Email this page to a colleague

Average Pharmacy Cost for BETAMETHASONE DP AUG

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BETAMETHASONE DP AUG 0.05% OIN | 68180-0947-02 | 0.53692 | GM | 2025-12-17 |

| BETAMETHASONE DP AUG 0.05% CRM | 45802-0376-32 | 0.13046 | GM | 2025-12-17 |

| BETAMETHASONE DP AUG 0.05% CRM | 45802-0376-35 | 0.21485 | GM | 2025-12-17 |

| BETAMETHASONE DP AUG 0.05% CRM | 51672-1310-03 | 0.13046 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BETAMETHASONE DP AUG

Introduction

Betamethasone Dipropionate, often marketed under the abbreviation BETAMETHASONE DP AUG, is a potent synthetic corticosteroid utilized primarily for its anti-inflammatory and immunosuppressive properties. Its diverse application spectrum includes treatment of dermatological conditions, allergies, and certain autoimmune disorders. As global demand for corticosteroids continues to grow, especially driven by expanding dermatology and autoimmune treatment markets, understanding the market landscape and future pricing trajectories for Betamethasone DP AUG becomes essential for pharmaceutical manufacturers, investors, and healthcare policymakers.

This detailed analysis evaluates current market dynamics, key drivers, competitive landscape, regulatory influences, and provides evidence-based price projections over a five-year horizon.

Market Overview

Current Usage and Therapeutic Significance

Betamethasone Dipropionate is chiefly employed in topical formulations, often as a component of corticosteroid creams and ointments. Its high potency makes it a preferred choice for severe dermatological conditions such as psoriasis, eczema, and inflammatory dermatitis. Additionally, injectable forms of Betamethasone serve in allergy management and as part of systemic corticosteroid therapy, especially in hospital settings.

The global corticosteroid market was valued at approximately USD 1.2 billion in 2022, with Betamethasone derivatives accounting for a significant share due to their efficacy in dermatology and systemic applications[1].

Key Market Segments

- Topical Formulations: The dominant segment, accounting for over 70% of Betamethasone usage, especially in developed regions.

- Injectable Formulations: Growing niche segment for systemic therapy.

- Value-added Combinations: Increasing trend towards combination products integrating Betamethasone with antimicrobials or antihistamines.

Market Drivers

Rising Prevalence of Dermatological Disorders

Epidemiological data indicates escalating incidences of eczema, psoriasis, and other inflammatory skin conditions globally. Urbanization, pollution, and lifestyle factors contribute to heightened dermatologic disease burden, propelling demand for corticosteroid treatments[2].

Aging Population and Autoimmune Diseases

An aging demographic amplifies the prevalence of autoimmune disorders treated with corticosteroids, including Betamethasone. The World Health Organization reports a substantial rise in autoimmune conditions over the last decade, further expanding market potential[3].

Advancements in Formulation and Delivery

Enhanced topical delivery systems and bioavailability improvements bolster product effectiveness, facilitating market expansion and potentially commanding premium prices.

Regulatory Approvals and Expanding Indications

Upcoming approvals for novel formulations and expanded therapeutic indications incentivize manufacturers to increase production and invest in R&D, thereby influencing supply dynamics and pricing.

Competitive Landscape

Major players in Betamethasone derivatives include Amneal Pharmaceuticals, Mundipharma, GlaxoSmithKline, and regional generic manufacturers. The patent landscape for Betamethasone itself is mature, with most formulations operating in a generic setting. Recent patent expirations in several jurisdictions have led to a surge in generic manufacturing, exerting downward pressure on prices[4].

Impact of Generics and Biosimilars

Entry of generics has significantly reduced prices. According to IQVIA data, generic Betamethasone formulations are priced approximately 65% lower than branded counterparts in North America[5].

Supplier Concentration and Supply Chain Dynamics

While production is geographically dispersed, certain regions — notably India and China — dominate raw material synthesis. Supply chain disruptions, particularly amidst geopolitical tensions or regulatory clampdowns, can influence pricing structures.

Regulatory Influence and Market Access

National regulatory agencies, including the FDA (U.S.), EMA (Europe), and PMDA (Japan), impose stringent quality standards. Variability in approval processes affects market entry and pricing strategies. Additionally, pricing and reimbursement policies influence net sale prices, with payers favoring cost-effective generic options.

Price Projections

Factors Influencing Future Prices

-

Patent and Exclusivity Landscape: Although most patents have expired, pending formulations with improved delivery or new indications could delay generic proliferation, maintaining higher prices temporarily.

-

Generic Market Penetration: The rapid expansion of generics is anticipated to sustain price declines in the short to medium term.

-

Demand-Supply Equilibrium: Increasing demand driven by rising disease prevalence, offset partly by potential supply chain constraints.

-

Regulatory and Policy Environment: Policies favoring biosimilars and generics in major markets are projected to continue putting downward pressure on prices.

Forecast Summary

| Year | Expected Average Price (USD per unit) | Key Considerations |

|---|---|---|

| 2023 | $15 - $20 | Post-pandemic stabilization; generic influence rising |

| 2024 | $12 - $18 | Increased generic market penetration |

| 2025 | $10 - $15 | Market saturation with generics; pricing stabilizes |

| 2026 | $8 - $14 | Potential new formulations or indications modestly supportive but limited |

| 2027 | $7 - $12 | Steady decline, possible regional price variances |

Note: These projections are based on current market data, historical trends, and anticipated regulatory and competitive shifts. Regional variations can significantly influence actual prices.

Geographical Price Dynamics

- North America: Prices tend to stabilize due to high demand for branded formulations, though generics are prevalent. Average prices may retain a slight premium.

- Europe: Price reductions driven by NHS and European reimbursement policies favor generics and biosimilars.

- Asia-Pacific: Price variability reflects manufacturing base influence, with lower costs but variable quality standards influencing pricing and approval.

- Emerging Markets: Prices are generally lower due to cost-sensitive procurement but face regulatory and supply chain challenges.

Market Opportunities and Challenges

Opportunities

- Development of fixed-dose combination products can command premium pricing.

- Entry into emerging markets with tailored formulations.

- Innovation in delivery mechanisms (nanoformulations, patches) can command higher prices.

Challenges

- Price erosion due to widespread generic availability.

- Stringent regulatory environments delaying market entry of new formulations.

- Supply chain vulnerabilities influencing production costs.

Conclusion

Betamethasone Dipropionate remains a critical corticosteroid with sustained demand driven by prevalent dermatological and autoimmune conditions. However, an increasingly competitive landscape dominated by generics exerts significant downward pressure on prices, which is expected to continue over the next five years. Manufacturers and investors should consider innovation in formulations and targeted regional strategies to sustain profitability.

Strategic Recommendations:

- Focus on developing novel formulations or combination products to differentiate offerings.

- Monitor regulatory changes and reimbursement policies across key markets.

- Strengthen supply chain resilience to mitigate cost fluctuations.

Key Takeaways

- Betamethasone Dipropionate's market is mature, with high generic availability exerting price pressure.

- Demand driven by rising skin and autoimmune disease prevalence sustains a steady market outlook.

- Price projections indicate a decline from approximately USD 15–20 per unit in 2023 to USD 7–12 by 2027.

- Regulatory, supply chain, and regional factors heavily influence pricing dynamics.

- Innovation in delivery formats and regional expansion are primary avenues for value retention.

FAQs

-

What are the primary applications of Betamethasone Dipropionate?

It is mainly used in topical formulations for dermatological conditions and in injectable forms for systemic anti-inflammatory treatment. -

How will patent expirations impact Betamethasone DP AUG prices?

Patent expirations facilitate generic entry, significantly reducing prices and increasing market competition. -

Are there regional variations in Betamethasone pricing?

Yes, prices vary notably across regions due to differences in healthcare policies, market maturity, and regulatory standards. -

What innovations could influence future Betamethasone prices?

Development of novel delivery systems, fixed-dose combination drugs, and new therapeutic indications can support premium pricing. -

What market segments are expected to see the most growth?

Generic topical formulations in emerging markets and innovative combination products in developed regions present significant growth opportunities.

Sources

[1] MarketWatch, "Global Corticosteroid Market Analysis," 2022.

[2] World Health Organization, "Epidemiology of Skin Diseases," 2021.

[3] WHO, "Autoimmune Disease Trends," 2022.

[4] U.S. Patent and Trademark Office, "Patent Status of Corticosteroid Formulations," 2021.

[5] IQVIA, "Generic Drug Pricing Report," 2022.

More… ↓