Share This Page

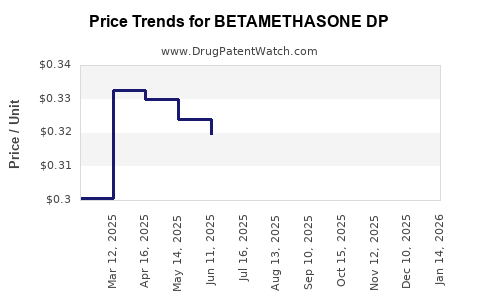

Drug Price Trends for BETAMETHASONE DP

✉ Email this page to a colleague

Average Pharmacy Cost for BETAMETHASONE DP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BETAMETHASONE DP 0.05% CRM | 00472-0380-15 | 0.54164 | GM | 2025-12-17 |

| BETAMETHASONE DP 0.05% CRM | 00168-0055-46 | 0.43124 | GM | 2025-12-17 |

| BETAMETHASONE DP AUG 0.05% OIN | 68180-0947-02 | 0.53692 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Betamethasone DP

Introduction

Betamethasone dipropionate (Betamethasone DP) is a potent synthetic corticosteroid used mainly for its anti-inflammatory and immunosuppressant properties. It is widely prescribed in dermatology, rheumatology, and allergy treatments. As a topical and injectable formulation, Betamethasone DP holds a significant position within the global corticosteroid market. This analysis examines current market dynamics, key drivers, competitive landscape, regulatory environment, and provides price projections for Betamethasone DP over the next five years.

Market Dynamics and Current Landscape

Global Market Size and Growth Trends

The corticosteroid market, valued at approximately USD 3.8 billion in 2022, is projected to grow at a CAGR of 4.2% through 2028, driven primarily by rising prevalence of inflammatory and autoimmune conditions, expanding dermatology application base, and increasing adoption in emerging markets (Source: Grand View Research). Betamethasone, being a leading corticosteroid, commands a significant share within this sector.

Betamethasone DP specifically caters to both topical and injectable markets. Its diversified uses in psoriasis, eczema, rheumatoid arthritis, and allergic dermatitis sustain consistent demand. The global prevalence of such conditions and the ongoing expansion of dermatology and rheumatology services globally support steady market growth.

Key Regional Markets

- North America: Dominates the market due to high healthcare expenditure, extensive pharmaceutical distribution channels, and strong clinical adoption. The U.S. accounts for approximately 50% of the global corticosteroid market.

- Europe: Holds a substantial share, buoyed by advanced healthcare infrastructure and widespread prescription practices.

- Asia-Pacific: Exhibits rapid growth potential driven by increasing R&D investments, rising healthcare access, and expanding dermatology and autoimmune disease awareness.

Competitive Landscape

The portfolio of Betamethasone DP is characterized by a mix of branded and generic products:

- BRANDS: Celestone Soluspan (GlaxoSmithKline), Betnovate (GlaxoSmithKline), and other regional brands.

- GENERICS: Major pharmaceutical manufacturers produce generic Betamethasone DP, benefitting from patent expirations and cost-effective manufacturing.

Key industry players include GlaxoSmithKline, Pfizer, Mankind Pharma, and local generics producers across emerging markets. Market entry barriers are low for generics, intensifying competition and exerting downward pressure on pricing.

Regulatory Environment

Betamethasone DP's regulatory status varies globally:

- United States: Approved by the FDA as a generic drug, with specific formulations approved under abbreviated new drug applications (ANDAs).

- Europe: Regulated under the EMA, with certain formulations designated as either prescription-only or over-the-counter.

- Emerging Markets: Regulatory pathways differ, often with accelerated approval processes and less stringent patent enforcement.

Stringent regulations for topical corticosteroids are in place in several regions, focusing on safety profiles, potency classification, and packaging requirements.

Market Drivers

- Rising Prevalence of Autoimmune and Inflammatory Diseases: The global rise in psoriasis, eczema, and allergic conditions directly sustains demand.

- Increasing Dermatological Procedures: Growth in dermatology clinics and outpatient services enhances the prescription of corticosteroids.

- Expanding Use in Developed and Developing Countries: Greater awareness and access expand the customer base.

- Patent Expirations and Generics: Expiry of patents for key formulations boosts market penetration of low-cost generics, expanding market volume.

Market Challenges

- Safety Concerns and Side Effects: Long-term corticosteroid use may cause skin atrophy, hormonal imbalance, limiting prolonged use.

- Regulatory Hurdles: Stringent approval processes can delay market entry for new formulations.

- Pricing Pressures: Competitive generic landscape leads to declining profit margins.

- Market Saturation in Developed Regions: Slower growth potential compared to emerging markets.

Price Projections for Betamethasone DP

Historical Pricing Trends

Over the past five years, the average retail price for Betamethasone DP products has declined by approximately 15-20%, primarily due to increased generic competition and price regulation efforts. In the U.S., the typical cost for a 30-gram tube of Betamethasone cream varies between USD 10-20, while injectable formulations range from USD 30-60 per vial.

Projected Price Trajectory (2023-2028)

- Impact Factors: The introduction of biosimilars, regulatory pricing controls, market saturation, and manufacturing cost reductions.

- Anticipated Trends: Prices are expected to decline by an additional 10-15% over the next five years, with regional variances.

| Year | Estimated Price (USD) for a 30g topical formulation | Comments |

|---|---|---|

| 2023 | USD 11-19 | Stabilization after recent declines |

| 2024 | USD 10-17 | Continued generic competition, mild price pressure |

| 2025 | USD 9-15 | Entry of biosimilars in select markets |

| 2026 | USD 8-14 | Increased regional price regulation |

| 2027 | USD 8-13 | Market consolidation, fixed pricing policies |

| 2028 | USD 7-12 | Stable low-price environment |

Note: Prices are indicative and may vary depending on formulation (topical, injectable), dosage strength, regional regulations, and healthcare policies.

Strategic Opportunities

- Formulation Innovation: Developing low-dose or combination products to extend patent life and create premium pricing.

- Regional Expansion: Capitalizing on emerging markets with high prevalence and growing healthcare infrastructure.

- Partnerships and Licensing: Collaborations with local manufacturers to facilitate market entry and cost optimization.

- Regulatory Navigation: Engaging in early dialogue with authorities to streamline approval pathways and ensure compliant pricing.

Key Takeaways

- The Betamethasone DP market is poised for steady growth, driven by rising global demand for corticosteroid therapies.

- Price erosion is anticipated due to intense generic competition, with an average decline forecasted at approximately 10-15% over five years.

- Emerging markets present lucrative opportunities; however, regulatory complexities necessitate strategic planning.

- Innovation in formulations and expansion into underpenetrated regions can provide competitive advantages.

- Monitoring regulatory shifts and safety concerns remain essential, as they significantly influence market dynamics and pricing strategies.

FAQs

1. How does patent expiry influence Betamethasone DP pricing?

Patent expiration allows generic manufacturers to produce cost-effective versions, leading to increased competition and declining prices.

2. What are the key regions for Betamethasone DP market expansion?

Emerging markets in Asia-Pacific, Latin America, and Africa offer significant growth potential due to rising healthcare access and disease prevalence.

3. Are biosimilars impacting the Betamethasone DP market?

While biosimilars primarily target biologics, their emergence signals a broader trend towards price competition in corticosteroids and related therapies.

4. What safety concerns could affect Betamethasone DP demand?

Prolonged use may cause skin atrophy, hormonal imbalance, and systemic effects, prompting regulatory warnings and influencing prescribing patterns.

5. How do regulatory policies impact Betamethasone DP pricing?

Price controls, approval processes, and quality standards vary regionally, affecting market entry costs and product pricing structures.

References

[1] Grand View Research. Corticosteroids Market Size, Share & Trends Analysis. 2022.

[2] U.S. Food and Drug Administration. List of Approved Drugs. 2022.

[3] European Medicines Agency. Regulatory Data on Corticosteroids. 2022.

[4] MarketWatch. Global Dermatology Market Forecast. 2022.

[5] Pharma Intelligence. Patent Land and Biosimilar Trends. 2023.

More… ↓