Last updated: July 27, 2025

Introduction

BETADINE, a widely recognized antiseptic solution primarily containing povidone-iodine, is utilized globally in medical, dental, and household settings for its broad-spectrum antimicrobial properties. Given a growing demand for effective disinfectants amid global health concerns, a detailed market analysis coupled with price projections is instrumental for stakeholders. This report synthesizes current market dynamics, competitive landscape, regulatory influences, and future pricing trends to inform strategic decision-making.

Market Overview

Global Market Size and Growth Trajectory

The global antiseptic market, to which BETADINE belongs, was valued at approximately USD 3.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of around 6% through 2030 [1]. This growth is driven by increasing healthcare awareness, rising incidences of infections, and heightened focus on infection control measures, particularly in hospital, community, and home care settings.

Segmental Deployment

BETADINE's primary segments include:

- Healthcare settings: Use in surgical prep, wound care, and disinfection.

- Dental applications: Oral rinse and antiseptic solutions.

- Household use: Disinfectants for food prep and general sanitation.

- Veterinary applications: Animal wound care and disinfectants.

Regional Market Distribution

North America dominates due to advanced healthcare infrastructure and stringent infection control standards, accounting for roughly 40% of the global antiseptic market. Asia-Pacific is also ascending rapidly, fueled by expanding healthcare infrastructure, urbanization, and rising disease prevalence [2].

Competitive Landscape

Major competitors encompass:

- Hibiclens (3M): Noted for chlorhexidine-based antiseptic solutions.

- Chlorhexidine and alcohol-based disinfectants: Offering alternatives with comparable efficacy.

- Local and regional brands: Often priced competitively, especially in developing markets.

While BETADINE holds a strong global presence, particularly in emerging markets where povidone-iodine products are preferred due to affordability and proven efficacy, competition is intensifying with new formulations and alternative disinfectants.

Regulatory and Market Influences

Regulatory Approvals and Labeling

Stringent regulations worldwide influence product formulations, labeling, and marketing. US FDA classifications as a skin disinfectant and the European CE marking ensure access, but compliance may necessitate ongoing modifications. Regulatory shifts towards antimicrobial stewardship could impact over-the-counter availability, impacting sales volume and pricing strategies.

Impact of COVID-19 Pandemic

The COVID-19 pandemic heightened demand for antiseptics, including BETADINE, due to its proven efficacy against viruses and bacteria. This surge temporarily boosted prices and supply, but post-pandemic stabilization has prompted reevaluation of pricing structures and supply chain resilience.

Supply Chain and Raw Material Factors

Raw material costs, notably iodine and povidone, influence manufacturing expenses. Global iodine markets, affected by geopolitical factors and mineral resource availability, directly impact pricing. Supply chain disruptions, as seen during recent crises, further pressure prices and supply stability.

Price Trends and Projections

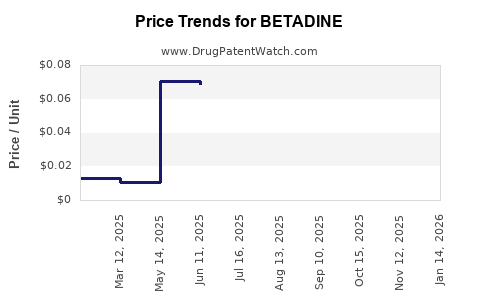

Historical Price Movements

Over the past five years, BETADINE's retail prices have shown modest volatility, with a slight upward trend attributed to raw material cost increases and regulatory costs. In developing regions, prices remain highly competitive to ensure widespread accessibility.

Forecasted Price Trends (2023-2030)

- Short-term (2023-2025): Prices are expected to stabilize or experience slight increases (~2-4%), driven by inflation, raw material costs, and regulatory compliance expenses.

- Long-term (2026-2030): Prices may escalate more significantly (~5-8%) if iodine shortages persist or if regulatory restrictions tighten. Conversely, technological improvements and manufacturing efficiencies could moderate inflation.

Market-driven Pricing Strategies

Manufacturers are increasingly adopting tiered pricing models, offering lower-cost formulations for emerging markets while maintaining premium pricing in developed areas. The expansion of generic products further intensifies price competition, potentially capping price inflation.

Factors Impacting Future Pricing

- Regulatory Environment: Stricter standards may elevate compliance costs, affecting retail prices.

- Raw Material Availability: Fluctuations in iodine supply, driven by geopolitical or environmental factors, could cause prices to spike.

- Market Demand Dynamics: Post-pandemic normalization may temper demand surges, stabilizing prices.

- Innovations and Patents: Introduction of new formulations or alternative antiseptics could impact BETADINE's market share and pricing power.

Conclusion

BETADINE remains a dominant antiseptic in the global market, underpinned by its proven broad-spectrum antimicrobial activity and versatility. The market outlook indicates steady growth, with modest price increases driven by raw material costs, regulatory factors, and competitive strategies. Stakeholders should monitor raw material markets and regulatory developments closely, as these elements are central to pricing and supply stability.

Key Takeaways

- Market Growth: The global antiseptic market, including BETADINE, is expected to grow at a CAGR of 6%, driven by increased infection control awareness worldwide.

- Competitive Dynamics: Price competition intensifies with generic entrants and alternative antiseptics; brands must innovate to maintain margins.

- Pricing Trends: Short-term stability with potential for moderate increases (~2-4%), and longer-term rises (~5-8%) contingent on raw material prices and regulatory changes.

- Strategic Focus: Diversification across regions and formulations, along with supply chain resilience, are critical to mitigate pricing pressures.

- Regulatory Impact: Evolving standards could influence availability and cost, warranting proactive compliance strategies.

FAQs

1. What are the main factors influencing BETADINE's market price?

Raw material costs (iodine and povidone), regulatory compliance expenses, competitive pressures, and supply chain stability primarily influence BETADINE's pricing.

2. How has the COVID-19 pandemic affected BETADINE's market?

The pandemic temporarily boosted demand and prices due to increased awareness of infection control, but market stabilization has resumed post-pandemic, with competitive pricing resuming.

3. Are there regional differences in BETADINE pricing?

Yes, prices are typically lower in emerging markets due to local competition and affordability concerns, whereas developed regions maintain premium pricing driven by regulatory standards and brand positioning.

4. What are future price projections for BETADINE?

Prices are expected to increase modestly (~2-4% annually) in the short term, with potential increments of 5-8% over the next decade, contingent upon raw material trends and regulatory landscape.

5. Will innovations impact BETADINE's pricing power?

Yes, adoption of new formulations or emergence of alternative antiseptics could challenge BETADINE’s market share, impacting its pricing strategies.

References

[1] Market Research Future. "Antiseptic Market Analysis." 2022.

[2] Global Industry Analysts. "Antiseptics & Disinfectants: Market Outlook." 2022.