Last updated: July 28, 2025

Introduction

BESIVANCE (besifloxacin ophthalmic suspension) is a broad-spectrum fluoroquinolone antibiotic developed by Bausch + Lomb, primarily indicated for bacterial conjunctivitis. Approved by the U.S. Food and Drug Administration (FDA) in 2011, it has established itself as a key player within the ophthalmic antimicrobial sector. This analysis explores its current market landscape, competitive positioning, demand drivers, regulatory environment, and future price trajectories.

Market Overview

Global Ophthalmic Antibiotic Market

The global ophthalmic antibiotic market is expanding driven by increasing prevalence of ocular infections, rising intraocular surgeries, and advancements in diagnostic technologies. The market was valued at approximately USD 1.2 billion in 2022 and is projected to reach USD 1.45 billion by 2028, growing at a compound annual growth rate (CAGR) of roughly 3.2% (Source: MarketResearch.com).

Bacterial conjunctivitis, the primary indication for BESIVANCE, accounts for a significant portion of ocular infections, prompting steady demand in outpatient ophthalmology clinics, hospitals, and retail pharmacies.

Competitive Landscape

BESIVANCE's main competitors include:

- Moxeza (moxifloxacin 0.5%) by Novartis

- Vigamox (moxifloxacin 0.5%) by Alcon

- Ocuflox (ofloxacin 0.3%), generic formulations

- Azasite (azithromycin ophthalmic solution) for conjunctivitis

While generics dominate sales volume due to lower pricing, BESIVANCE maintains a solid market share attributed to its efficacy, formulary positioning, and patent exclusivities.

Patent and Exclusivity Status

BESIVANCE’s patent protection, primarily covering formulation and delivery system, was extended through orphan drug designation and specific formulation patents until approximately 2025. Patent expiries influence pricing strategies and market penetration by generics.

Market Dynamics

Demand Drivers

- Incidence of bacterial conjunctivitis: A leading cause of eye emergency visits, with an annual incidence in the U.S. estimated at approximately 24 million cases (Source: CDC).

- Growth of ophthalmic surgeries: Increased intraocular procedures escalate infection risk, amplifying demand for effective antibiotics.

- Patient compliance: The relatively short duration and once- or twice-daily dosing of BESIVANCE may favor adherence, influencing prescribing patterns.

- Clinician preference for broad-spectrum agents: BESIVANCE’s broad coverage and safety profile make it a preferred choice in certain cases.

Pricing Framework

In the U.S., BESIVANCE’s list price is approximately USD 320–350 per 5 mL bottle, reflecting brand premium amid insurance coverage dynamics. Paid pricing varies based on pharmacy benefits, PBM negotiations, and patient assistance programs.

Post-patent expiration, generics are expected to reduce prices by 50% or more, lowering barriers for broader access but impacting brand revenue.

Regulatory and Reimbursement Environment

Reimbursement policies strongly influence market penetration. Insurers, PBMs, and pharmacy networks impact formulary placements. BESIVANCE’s relatively higher price is offset by favorable insurance coverage, but price erosion from generics remains a key concern.

In some markets, reimbursement disparities and formulary exclusions could constrain sales growth, affecting long-term price stability.

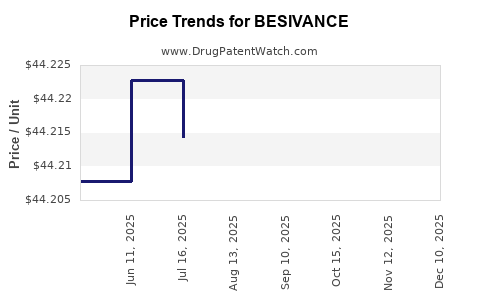

Price Projections (2023-2030)

Short-term (2023–2025)

- Brand Price Stability: With patent exclusivity, prices are expected to remain stable or slightly increase due to inflation, marketing, and inflationary costs.

- Patent expiration impact: Initiation of generic entries anticipated around 2025, leading to immediate price erosion of approximately 30–50%.

Medium to Long-term (2026–2030)

- Generic competition: Rapid price reductions expected post-generic entry, with prices potentially falling to USD 150–200 per bottle.

- Market share shift: Generic providers may capture significant volume share, slightly depressing overall market pricing.

- Innovation and differentiation: To sustain higher margins, Bausch + Lomb may introduce formulary innovations or combination formulations.

Forecast Summary

| Year |

Brand Price (USD) |

Estimated Market Price (USD) post-generic entry |

Price Change |

| 2023 |

340 |

340 |

N/A |

| 2024 |

340 |

330–340 |

Stable/slight increase |

| 2025 |

340 |

250–300 (as patent invalidates) |

20–30% decline |

| 2026 |

200–250 |

150–200 |

Further decline |

| 2030 |

150–200 |

150–200 |

Stable at lower levels |

Future Market Trends and Considerations

Emerging Competitors and Pipeline Drugs

Pipeline candidates with enhanced penetration, such as combination therapies or sustained-release delivery systems, could challenge BESIVANCE's market position and influence pricing strategies.

Regional Market Dynamics

In emerging markets, smaller price reductions are typical due to less aggressive patent enforcement, but lower affordability may limit volume growth.

Regulatory and Reimbursement Evolution

Shifts towards value-based care and personalized medicine could impact formulary decisions and favor newer agents or generics based on cost-effectiveness analysis.

Key Takeaways

- BESIVANCE holds a strong position in the ophthalmic antibiotic market, supported by its broad-spectrum activity and marketed exclusivity.

- Patent expiration around 2025 will significantly lead to price reductions; companies should prepare for commoditization.

- Market growth sustained by rising ocular infection incidence and surgical procedures; however, competition from generics will intensify.

- Strategic pricing, differentiation, and pipeline development are critical for maintaining revenue streams.

- Price erosion is substantial post-patent expiry, underscoring the importance of lifecycle management.

FAQs

1. When is BESIVANCE expected to face generic competition?

Patent protections are projected to expire around 2025, after which generic besifloxacin formulations should enter the market, significantly impacting pricing and sales volumes.

2. How does BESIVANCE price compare to its competitors?

The current list price for BESIVANCE hovers around USD 340 per 5 mL, higher than generics such as Ocuflox, which can be priced below USD 50, but competitive with other branded agents like Vigamox.

3. What factors influence future BESIVANCE pricing strategies?

Patent status, regulatory approvals of generics, reimbursement policies, market demand, and competitive innovations will shape pricing trajectories.

4. Will BESIVANCE maintain market share after patent expiry?

While brand loyalty and clinical efficacy support continued sales, generic price advantages threaten to reduce market share unless the brand offers meaningful differentiation or value-added features.

5. Are there any developments that could prolong BESIVANCE’s exclusivity?

Possible regulatory extensions through new formulations, orphan drug status, or combination therapies could delay generic entry or justify premium pricing.

References

- MarketResearch.com, "Global Ophthalmic Antibiotic Market Outlook," 2022.

- CDC, "Bacterial Conjunctivitis Epidemiology," 2021.

- Bausch + Lomb, "BESIVANCE Prescribing Information," 2011.

- IQVIA, "Pharmaceutical Market Data," 2022.

- FDA FDA, "BESIVANCE New Drug Application," 2011.