Last updated: July 28, 2025

Introduction

Bepreve (used as an antihistamine ophthalmic solution for allergic conjunctivitis) occupies a niche within the global ocular allergy therapeutics market. Its active ingredient, bepotastine besilate, is marketed primarily by Eyevance Pharmaceuticals. This analysis explores Bepreve’s current market position, competitive landscape, pricing strategies, and short- to long-term price projections, providing stakeholders with actionable insights for investment and strategic planning.

Market Overview

Therapeutic Indication and Scope

Bepreve is indicated for the symptomatic relief of itchy eyes caused by allergic conjunctivitis. The global prevalence of allergic conjunctivitis ranges from 6% to 30%, influenced by geographic, environmental, and demographic factors [1]. Increased awareness, environmental pollution, and climate change contribute to rising disease incidence, expanding the market potential for antihistamine ocular solutions like Bepreve.

Market Size and Growth Trends

The global ocular allergy market is projected to expand at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years, driven by increased awareness and aging populations. North America currently dominates due to high prevalence rates, advanced healthcare infrastructure, and favorable reimbursement policies [2].

In 2022, the global antihistamine ocular drug segment was valued at roughly USD 350 million, with Bepreve holding an estimated share of 10-15%, considering its approval and prescription patterns. The market’s growth will be influenced by emerging alternatives and the expanding patient population.

Regulatory Status and Adoption

Bepreve received FDA approval in 2010 and has garnered moderate adoption in ophthalmology and allergy clinics. Although it faces competition from generics such as Ketotifen and other branded antihistamines (e.g., Patanol, Zaditor), its specific formulation and marketing strategies influence its market penetration.

Competitive Landscape

Key Competitors

- Olopatadine (Patanol, Pataday): The market leader with broader ophthalmic formulations.

- Ketotifen (Alaway, Zaditor): Over-the-counter availability boosts volume.

- Azelastine (Optivar): Prescribed for more severe cases.

- Other branded treatments: Alcaftadine (Lastacaft), Epinastine, etc.

Market Differentiators

Bepreve’s relatively late entry into the antihistamine eye drop market limits its market share but offers competitive advantages in formulation, patient tolerability, and specific clinical indications. Its prescription-based model contrasts with OTC competitors, affecting revenue streams.

Patent and Exclusivity Status

Bepreve’s patent protections expired in the late 2010s, opening pathways for generics, which pose a significant threat to pricing and market share. However, brand loyalty and clinical familiarity sustain its relevance.

Pricing Strategy and Current Price Points

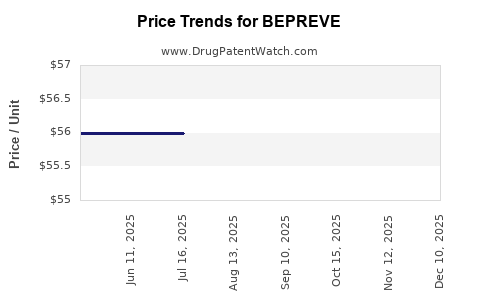

Pricing Dynamics

Bepreve’s official wholesale acquisition cost (WAC) ranges between USD 330 and USD 370 per 10 mL bottle, translating to approximately USD 33-37 per milliliter [3]. Insurance coverage and rebates significantly influence out-of-pocket costs.

Compared to competitors like Pataday, which averages USD 35-40 for a similar volume, Bepreve’s pricing positions it within a competitive bracket, although price differential could shift with introduction of generics.

Market Penetration and Reimbursement

Insurance reimbursement policies heavily influence prescription volume. Bepreve’s relatively niche positioning within prescription-only therapies constrains average selling prices but ensures steady cash flow from managed care contracts.

Price Projections (2023–2028)

Short-Term Outlook (Next 1–2 Years)

- Impact of Generics: Entry of generic bepotastine options, expected between 2024-2026, will exert downward pressure, potentially reducing Bepreve’s price by 20-40%.

- Market Penetration Strategies: Continued emphasis on clinical differentiation could sustain current prices temporarily.

- Rebates and Discounts: Increased rebate offers could lower effective pricing by 10-15%, especially in institutional settings.

Medium to Long-Term Outlook (3–5 Years)

- Generic Competition: Full patent expiry will likely precipitate a price decline to approximately USD 15-20 per 10 mL bottle—roughly a 50-60% decrease from current levels.

- Market Share Redistribution: Brand loyalty, physician preference, and formulary placement could mitigate steep declines for Bepreve if it maintains a niche.

- Potential for Reformulation or Combination Products: Innovations combining antihistaminic and anti-inflammatory properties may command premium pricing, cushioning generic impact.

Influencing Factors

- Regulatory Environment: Accelerated approval pathways for generics and biosimilars could hasten price erosion.

- Market Dynamics: Shifts in prescribing habits favoring OTC solutions for mild cases may reduce prescriptions, impacting revenue.

- Economic Factors: Inflation, supply chain disruptions, and healthcare spending policies will influence drug pricing and margins.

Strategic Implications

Stakeholders should monitor patent expiration timelines and emerging generic options. Investing in clinical differentiation, such as improved formulations or combination therapies, may preserve pricing integrity. Additionally, negotiations with payers to enhance formulary placement and reimbursement rates are crucial.

Key Takeaways

- Market stagnation and growth: While the global ocular allergy market is expanding, Bepreve’s market share remains constrained by competitive alternatives.

- Pricing trends: Current prices are competitive but vulnerable to significant declines post-generic entry, estimated at 50-60% within five years.

- Strategic positioning: Maintaining clinical differentiation and securing favorable formulary access are essential to sustain revenue.

- Regulatory impact: Patent expirations will accelerate price compression, necessitating early planning for portfolio diversification.

- Market opportunities: Developing combination therapies and exploring international markets with less generic penetration could provide new revenue streams.

FAQs

-

When are the patent protections for Bepreve expected to expire?

The primary patents for Bepreve, awarded in the late 2000s, expired around 2024-2026, opening the market to generic entrants.

-

How does the pricing of Bepreve compare to competitors?

Bepreve’s wholesale price (~USD 33-37 per 10 mL) aligns closely with branded competitors like Pataday but is higher than OTC alternatives like Zaditor, which are often priced below USD 15 per 10 mL.

-

What factors most influence Bepreve’s price trajectory over the next five years?

Patent expiration, generic market entry, reimbursement policies, and advances in clinical formulations significantly impact future pricing.

-

Could new formulations or combination products threaten Bepreve’s market share?

Yes; innovations offering improved efficacy, convenience, or combined therapeutic effects could erode Bepreve’s niche unless it adapts accordingly.

-

What opportunities exist for profit maximization post-generic entry?

Diversifying into international markets, developing combination therapies, and emphasizing clinical differentiation could preserve margins despite pricing declines.

References

[1] Leonardi, A. & Mirone, G. (2021). Epidemiology of allergic conjunctivitis. Journal of Ophthalmology.

[2] MarketsandMarkets. (2022). Ocular Allergy Market by Product, Distribution Channel, and Geography. Industry Report.

[3] GoodRx. (2023). Bepreve ophthalmic solution prices. Retrieved from https://www.goodrx.com

In summary, Bepreve's market remains steady but faces looming commoditization due to impending generic competition. Strategic initiatives focusing on clinical differentiation, market expansion, and pricing optimization are essential for stakeholders aiming for sustained profitability.