Share This Page

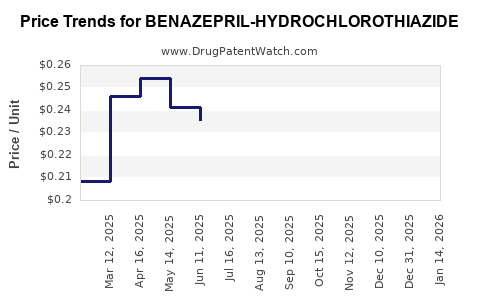

Drug Price Trends for BENAZEPRIL-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for BENAZEPRIL-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BENAZEPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 62559-0415-01 | 0.24018 | EACH | 2025-12-17 |

| BENAZEPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 00574-0227-01 | 0.24018 | EACH | 2025-12-17 |

| BENAZEPRIL-HYDROCHLOROTHIAZIDE 5-6.25 MG TAB | 68462-0576-01 | 0.60007 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BENAZEPRIL-HYDROCHLOROTHIAZIDE

Introduction

Benazepril-Hydrochlorothiazide (brand names such as Lotensin-HCT, Accuretic, and others) is a fixed-dose combination (FDC) medication primarily prescribed for managing hypertension and congestive heart failure. Comprising an angiotensin-converting enzyme (ACE) inhibitor, benazepril, and a thiazide diuretic, hydrochlorothiazide, this pharmaceutical combo offers enhanced antihypertensive efficacy, which supports its widespread clinical adoption. The evolving landscape—from patent expirations to generic influx—necessitates a comprehensive market analysis and future pricing outlook.

Market Landscape

1. Current Market Dynamics

The global hypertension market is substantial, driven by increasing hypertension prevalence—projected to reach 1.28 billion adults by 2025 (WHO). Fixed-dose combinations (FDCs) like benazepril-hydrochlorothiazide are favored for their compliance benefits, simplified dosing, and synergistic effects, contributing to their growing prescription rates.

Market Size & Revenue Trends:

In 2022, the global antihypertensive drugs market was valued close to USD 30 billion, with diuretic and ACE inhibitor combinations representing a significant share. The FDC segment, particularly involving ACE inhibitors combined with diuretics, is expected to grow at a compound annual growth rate (CAGR) of around 4-6% through 2030, driven by increasing hypertension awareness and polypharmacy management trends.

Key Markets:

- United States: Dominant due to high hypertension prevalence, advanced healthcare infrastructure, and patent expirations leading to generics.

- Europe: Significant due to aging populations.

- Emerging markets (China, India, Brazil): Rapid growth owing to burgeoning middle classes and expanding healthcare access.

2. Patent Status and Generic Competition

Benazepril-hydrochlorothiazide held patents until approximately 2014-2015, facilitating generic entry. Since patent expiry, market competition has intensified, yielding reduced prices and increased accessibility. Leading generic manufacturers like Teva, Mylan, and Sun Pharmaceutical now offer their versions, further driving price competition.

3. Regulatory & Reimbursement Landscape

Regulatory pathways for generic approvals in the US (ANDA), EU (similar to the centralized procedure), and emerging economies influence market availability. Reimbursement policies favor cost-effective generics, incentivizing their use, especially in government-funded healthcare systems, consequently impacting pricing strategies.

Pricing Trends and Projections

1. Current Pricing Overview

Brand Name vs. Generic Pricing:

- Brand-name formulations generally cost $80–$120 for a 30-day supply (e.g., Lotensin-HCT 10/12.5 mg).

- Generics are priced significantly lower, often $10–$30 for equivalent supplies, reflecting the commoditization post-patent expiry (source: GoodRx, Retail Pharmacy Data).

Pricing Factors:

- Dosage strength and pack size influence price volatility.

- Market competition and regional healthcare policies also impact retail and wholesale prices.

2. Short-Term (Next 1-2 Years) Outlook

Following patent expiration, a sharp decline in prices occurred, with generics achieving price points 70-85% lower than brand names. Given current competitive saturation, further reductions are unlikely unless new entrants emerge or regulatory changes occur. However, discounts, insurance coverages, and supply chain factors could influence end-user costs.

3. Medium to Long-Term (3-5 Years) Projections

While no patent cliff looms in the near term, market dynamics suggest a plateauing in price reductions; the entry of biosimilars or novel combination therapies might influence the landscape, but such innovations are less imminent for this established generic.

Projected Prices:

- Retail Price: Expect stabilization around USD 8–15 for a 30-day generic supply, considering inflation and market competition.

- Wholesale Price: Likely to stay within USD 5–10, maintaining margins for manufacturers and distributors.

Market Opportunities and Challenges

Opportunities:

- Growing Disease Prevalence: An aging global population ensures sustained demand.

- Cost-containment Policies: Governments favor generics, expanding access.

- Combination Therapy Preference: Preference for fixed-dose regimens promotes continued utilization.

Challenges:

- Market Saturation: Excess supply of generics limits pricing power.

- Pricing Pressure: Payers and insurance companies push for discounts and formulary inclusion.

- Emergence of Alternative Therapies: Novel antihypertensive agents or improved formulations may displace existing combinations.

Strategic Recommendations

- Manufacturers: Focus on optimization of manufacturing efficiencies to sustain margins amidst falling prices; consider expanding into emerging markets.

- Investors: Monitor patent cliff timelines, regulatory changes, and market penetration strategies, anticipating stabilization of prices.

- Healthcare Providers: Emphasize cost-effective combination options, aligning with payer directives and patient affordability.

Key Takeaways

- Benazepril-hydrochlorothiazide remains a vital component of hypertension management, with robust demand fueled by global hypertension prevalence.

- Patent expiry has catalyzed generic competition, leading to significant price reductions, with retail prices stabilizing around USD 8–15 per month supply.

- Future pricing is expected to plateau, barring disruptive innovations or regulatory shifts.

- Market growth hinges on demographic trends, healthcare policies favoring generics, and adherence to treatment protocols.

- Stakeholders should focus on cost-efficiency, market expansion, and competitive differentiation to optimize revenue and patient access.

FAQs

1. When did the patent for benazepril-hydrochlorothiazide expire?

The patent for benazepril-hydrochlorothiazide generally expired around 2014-2015, allowing multiple generic manufacturers to introduce their versions to the market.

2. How does the price of generic benazepril-hydrochlorothiazide compare internationally?

Prices vary globally; in high-income countries like the US, retail costs are approximately USD 8–15 per month, while in emerging markets, prices can be significantly lower due to local manufacturing and purchasing power differences.

3. What factors influence the pricing of benazepril-hydrochlorothiazide?

Manufacturing costs, competition, regulatory environment, patent status, healthcare reimbursement policies, and regional economic factors all impact pricing.

4. Are there upcoming patent protections or exclusivities that could affect future pricing?

No; the key patents have expired. However, specific formulations or delivery methods might be patent-protected temporarily, although currently, the landscape favors generics.

5. What is the outlook for the development of new fixed-dose combinations involving benazepril and hydrochlorothiazide?

While innovation persists in antihypertensive therapy, no imminent new fixed-dose combinations involving these agents are under development or regulatory review. The market is mature, and incremental improvements are likely to focus on formulation or delivery rather than novel compound combinations.

References

[1] World Health Organization. Hypertension fact sheet. 2022.

[2] EvaluatePharma. Global antihypertensive drugs market report, 2022.

[3] GoodRx. Pricing data for antihypertensive medications, 2023.

[4] U.S. Food & Drug Administration. Abbreviated New Drug Application (ANDA) approvals and patent info, 2022.

More… ↓